[Estimated time to read: 2 minutes]

![]() Research into the power of peer pressure reveals we are influenced by the emotions of others around us.

Research into the power of peer pressure reveals we are influenced by the emotions of others around us.

It’s because we are hardwired to care what other people think.

Apparently this gives us morality…but sometimes, being easily influenced by emotions can be costly.

Shared emotions worsen stock market movements

Stock markets move for many different reasons, but investor fear worsens volatility.

Investors focused on short-term gains react immediately and emotionally to bad news.

Their reactions are kneejerk and create market stress, because they impact on their peers, causing them to react in the same way.

The media’s reporting of the market’s subsequent fall often reinforces all these negative emotions…and an over-reaction spirals until corrected.

To go against the emotional flow is difficult – but it is possible.

(click image to view our Investment Code)

Why go against the flow of fear?

Loss aversion is understandable - everyone fears loss because it results in grief and stress.

And loss aversion is why investors sell when a market is falling.

They want to get out before they lose out.

This behaviour causes short-term market over-reactions time and time again.

But because stock prices are driven by solid fundamentals like corporate earnings rather than intangible investor sentiment, they even out again over time.

And this is why you have to fight your own fear of loss.

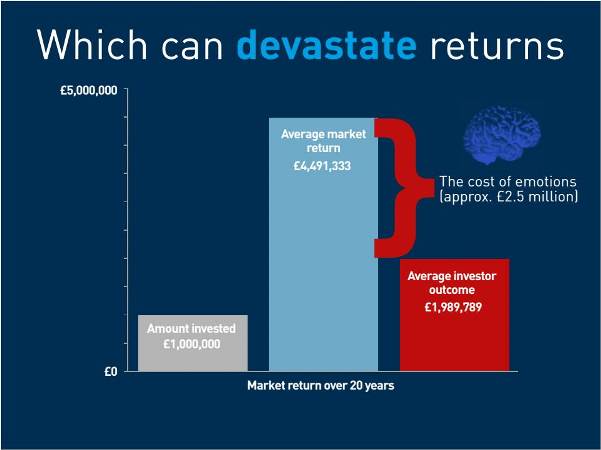

If you react emotionally to short-term volatility you will disrupt your long-term investment success.

Stock markets reward long term investors – but if you sell and get out every time the market falls because of fear, you will lose out.

3 steps to successfully fighting fear

As a Chartered Financial Planner I protect my clients from fear, and from following the emotions of the crowd.

(click image to view our Investment Code)

Here’s what I tell many of my clients: -

1. Work with a Chartered Financial Planner to create a plan for the long-term that details the path you need to take to reach your own financial ambitions.

2. Then, choose a low-cost passive investment approach so you don’t even need to listen to the market noise, let alone react to it.

Your investment portfolio will passively track the market with no need for you to do anything. This means that rather than trying to escape the market when it’s falling or buy back in when it’s climbing, you can sit back and relax while others stress.

3. Finally, trust your plan to work.

Remain committed to the long-term, and allow your Chartered Financial Planner to keep you on track by protecting you from making any investment management decisions based on emotional reactions that will scupper your financial outcome.

To misquote Kipling:

If you’d like my help with any element of your wealth management, I’d be very pleased to assist.