How to have a good investment experience (tip: it's all about control)

As investors, we all want a good investment experience.

The key to this is controlling what we can…

And accepting what we can’t.

I briefly touched on this last week.

Now for a more detailed look…

When it comes to investing, there are some things we can control and some we can’t.

The good news is that we will reap the rewards if we stay invested for the long run despite short-term fluctuations in the market.

I’ve witnessed that a good investment management experience is a combination of control and interestingly, a lack of it.

What can’t you control?

#1 The random performance of active fund managers

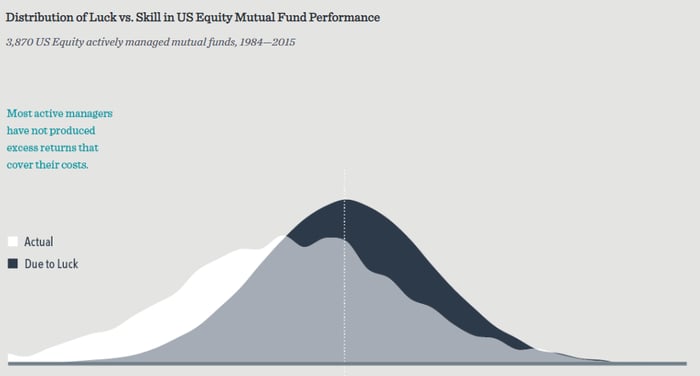

The performance of professionally managed funds has been studied extensively.

While some managers have good track records…

It’s difficult to separate the skilled ones from the lucky.

Based on all the overwhelming evidence, it’s safe to say that their success often boils down to chance.

Dimensional Fund Advisors illustrates this in their graph below.

A 50:50 flip of a coin has produced better results…

Than the managers of 3,870 US equity funds between 1984 and 2015.

#2 The uncertainty of the markets

We are always faced with uncertainty.

That’s a fact of life.

We often have to make decisions without knowing the outcomes.

So, we weigh the pros and cons.

Look at the various possibilities.

And then decide.

However, investing is a little different.

We can’t possibly know or predict what may happen.

The best approach is to make informed choices.

And be comfortable with the range of possible outcomes.

Then adjust as our circumstances change.

What can you control?

#1 Understanding who you’re working with and their fees

Choosing the right financial planner is one of the most important things you can do as an investor.

Opt for a fee-based planner instead of commission-based.

It’s also important to avoid high-cost, complex products.

The charges of these convoluted schemes can be detrimental to your investment and negate years of hard work, dedication and focus.

#2 Establishing an investment plan you believe in

A plan acts as a compass guiding you along your investment journey.

It sees you through turbulent times.

And helps you stay the course.

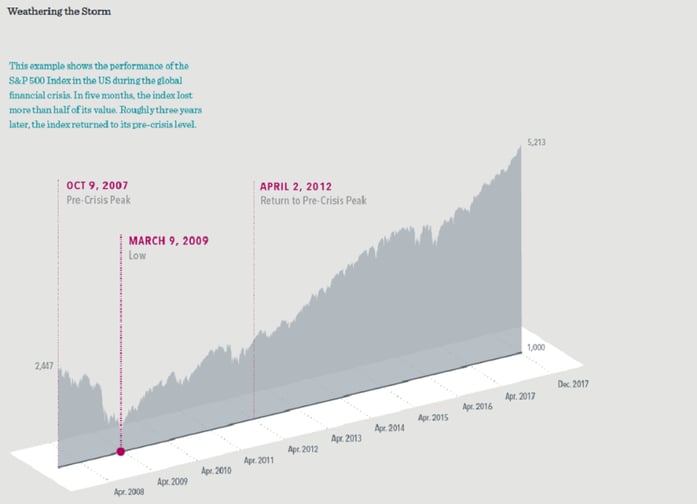

When the financial crisis happened in 2008…

People panicked and cashed out.

But the market turned and those who got out, lived to regret it, spending years trying to make up their losses.

If these investors persevered, they’d have pulled through and their investments would be looking hugely rewarding today.

Here’s a quick look at the S&P 500’s comeback after the crisis.

I’ve said this before – the market is remarkably resilient.

#3 Trusting your strategy and being patient

Trust involves understanding.

Understanding requires knowledge.

To trust the markets, you need to understand how they work…

Which means learning about them as much as possible.

The best information comes from scientific research and not opinions or hunches.

Trusting your financial planner means understanding their services and expertise and letting them help you decide on your goals.

They should present you with tailored options to help you reach them and ensure you understand the risk of each and are comfortable with it.

With all the options at hand, and all the knowledge you require, you’ll be able to make an informed decision.

And remain committed for the long run.

You’re also likely to feel more secure knowing your financial planner stands between you and regret, whether that is money-related or simply not living the best version of your life.

Investing is about discipline, long-term goals and having a plan you firmly believe in.

It’s a lifelong journey that, like everything else in life, comes with bouts of uncertainty.

But when you trust your strategy, your portfolio and your financial planner – you’ll be able to weather the storms.