Is there one single way to invest?

I don't think so.

If there was, everyone would be doing it.

Every strategy has pros and cons.

But I do believe a good strategy you can stick with, is much better than a "great" strategy you can’t.

This comes down to who you are as an investor.

There are many factors which will determine this. Some are:

- Experience - this shapes your views of the risk-reward nature of the financial markets. Your early years as an investor and the environments you’ve lived through can impact how you invest.

- Personality - your emotional disposition and therefore behaviour, play a strong role in the type of strategies you’re drawn to as an investor.

- Mentors - having these early on in your investment lifecycle can also determine the path you choose to take as an investor.

Early on in my career the importance of asset allocation, portfolio construction and risk management when implementing investment plans, was hammered into me.

Many of my mentors since have been authors of some of my favourite investment books.

I learned about investing from John Bogle, Charley Ellis, Nick Murray, Warren Buffett and Jeremy Siegel.

The biggest lesson?

The importance of time horizon when investing your money.

The ability to think and act for the long-term is one of the few advantages left in the markets.

One book which really help me, was Siegel’s Stocks For the Long Run.

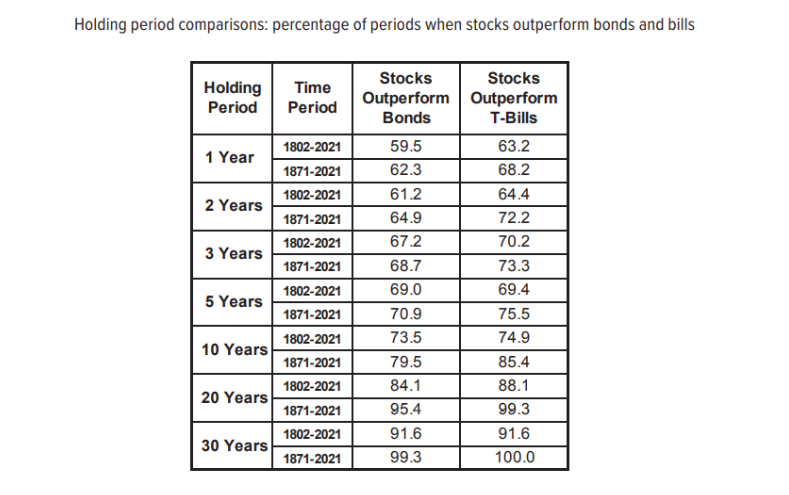

Here is a chart I like:

Of course, there are no guarantees when it comes to investing in the stock market.

But history tells us, the longer you invest in the stock market, the greater your odds of success.

The long-term average return on the stock market would turn $10k into more than $67k over 20 years.

(In contrast, that same $10k in cash turns into just $18k).

Does this mean you should put all your money into the stock market?

No.

But thinking through the historical returns can help you determine how to plan for time horizons and allocate your portfolio accordingly.

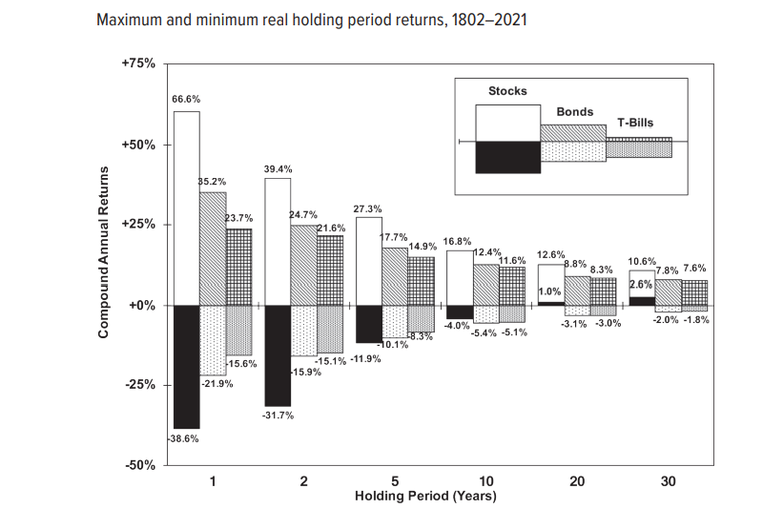

Here’s another way of looking at this from Siegel (and his research partner Jeremy Schwartz):

Here we see the shorter your time frame, the wider your range of returns, especially in the stock market.

The longer you are in, the less volatility there is.

Personally, I don’t invest money in the stock market If l need it back in the next 5 years or less.

It’s just not worth it.

On the other hand, holding cash for 2-3 decades at a time brings its own set of risks in terms of losing purchasing power.

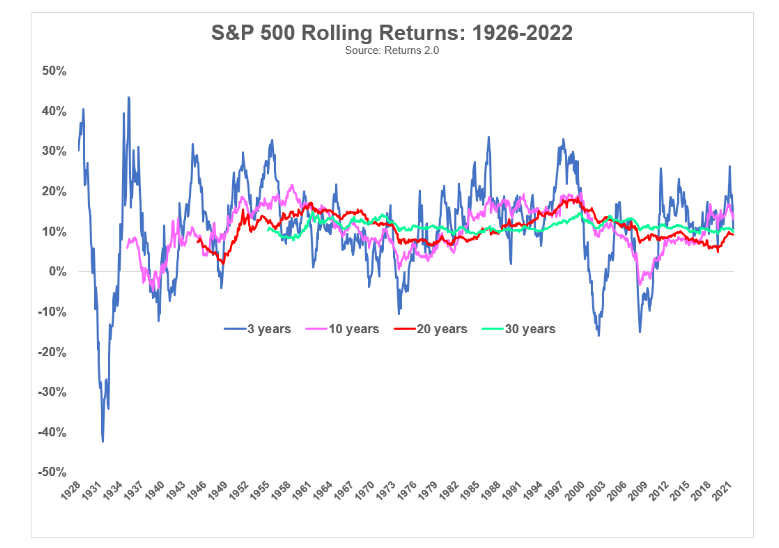

Here’s another way to look at the volatility in stock market returns over time:

I’ve seen studies that suggest investors hold a mutual fund for an average of around 3 years.

After that, they get bored and want something new.

Or want to chase performance.

Three years is nothing in terms of stock market investing.

Wild swings will happen (just look at the last 3!).

Things begin to smooth out (a bit) once you get to 10 years.

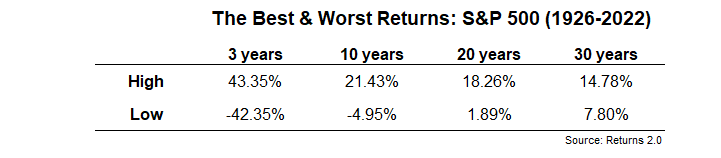

Of course, you could still lose a little money:

The U.S. stock market has never been down over 20 or 30 year time frames.

It could happen, no one knows.

But do you really want to bet against human ingenuity and progress?

I know I don't.

There are lots of ways to succeed as an investor.

Over the long run, the stock market remains the best place to do so, assuming you have the right plan and the patience to make it there.

Thank you to Ben Carlson for sharing the above charts.