How much money should you leave your children, and when?

There’s the care-free retirement you’re working hard to secure…

And the nest egg to help kickstart your children’s future.

How do you achieve both and manage to enjoy life today?

The question we most often hear from parents and grandparents is,

“What do I need to do to ensure the money I leave behind will amplify the good in my family, not the bad?”

It's amazing the amount of anxiety behind this question.

I’ve yet to meet a parent who wants to support entitlement in their children or grandchildren.

We all want our family members to be self-aware, happy and productive members of society.

We want them to have relationships that flourish and a life of meaning and purpose.

It's at this time of year people reassess their goals or find ways to accelerate them.

Add the pandemic to this, and investors are keen to ensure their financial plans are set up to work for them.

A real-life case study

One such couple was Erica and Derek.

They live in Dubai with their two children, who are both in primary school.

They are both in their 40s.

The couple met with us and together they discussed their future goals.

These included a possible early retirement, saving for their children’s education and having enough left over to distribute to their children later in life.

As for how much to leave their children, perhaps the answer is “As much as they are prepared for.”

Practices around money are left behind

With children, many of us default to how we were raised.

But practices around money are often forgotten.

Yes, some offer allowances, and perhaps some compensation for extra jobs around the house.

But the parental desire often to help gets in the way.

Derek and Erica's children were still a little too young to have received any significant 'gifts' from their parents.

But it was only a matter of time.

Add to this the fact that Derek lost his job during the pandemic.

It caused immense stress as Derek was worried he may not find another job which may delay the couple’s plans for the future.

One salary down, would they need to adjust their standard of living?

Or delay their retirement age?

We set to work to find out whether their current mix of assets would last beyond their lifetime:

- Cash holdings of £750,000

- Regular savings plans valued at £475,000

- SIPP valued at £800,000

- Four properties in Europe valued at £1,110,000

On the surface, the couple seemed to be set up well.

However, after doing a cashflow model, it was discovered they would run out of money in their 80s.

Considering they’re healthy, they’re expected to live longer than ever.

Their money would need to keep up, and more.

After running a few scenarios through with them, a plan was put into place.

The result was a very IHT-efficient plan where the couple would pay little to nothing on IHT (possibly saving around £500,000).

The plan also assured the couple that:

- They can retire when Erica is 55

- Derek doesn’t need to need to return to work meaning the couple can relax and not feel stressed

- They’re able to afford university fees for both children at top institutions in the UK

- They can leave their children a legacy of at least £1.7 million

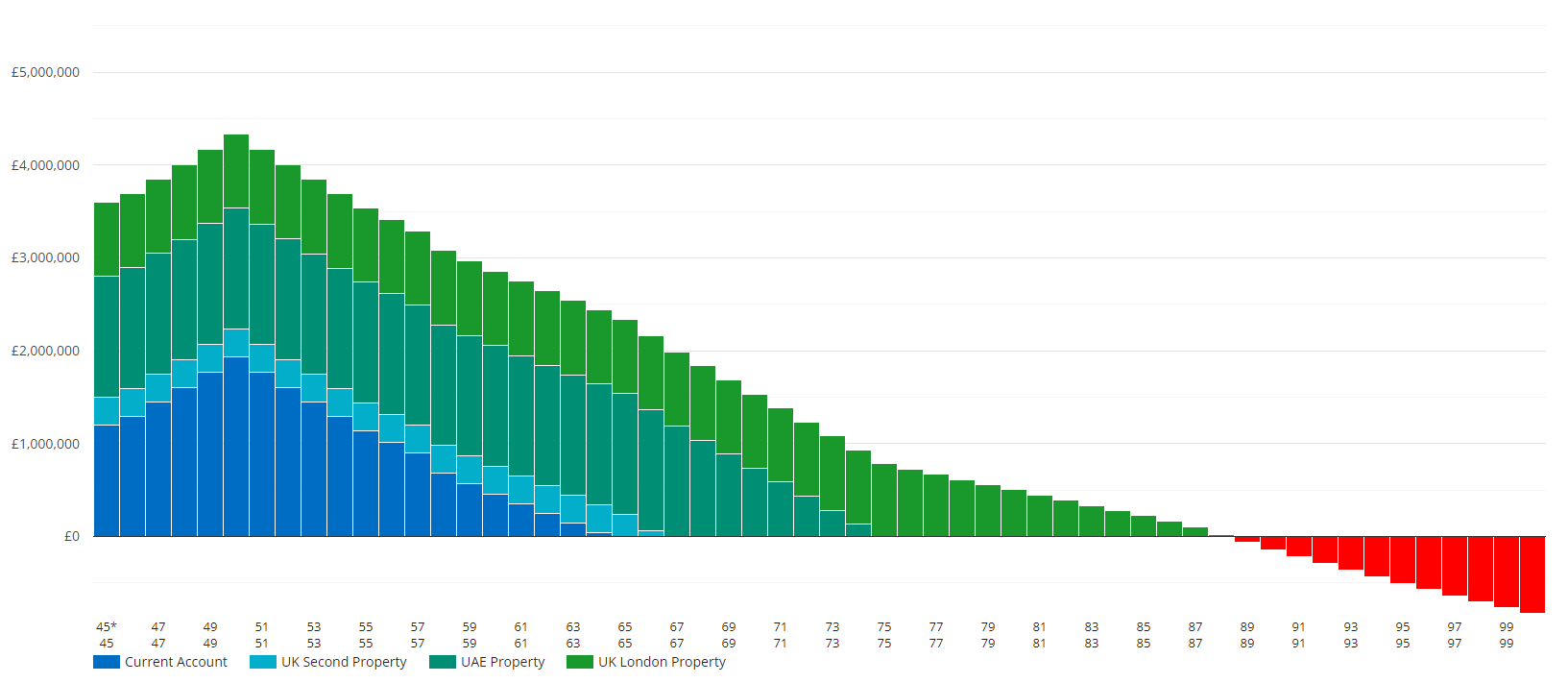

An example cash flow plan

As for how much of this legacy to leave their children, and when...

Their children are still young.

But they are (like all children) already individuals.

They differ in their learning styles, needs, capacities and ambitions, ways of thinking, introverted or extraverted, artist or a math whiz.

Firstly, I’ve come to believe strongly that no significant inheritance (not counting things like contributing to that all-important first car, or help with a down-payment on a house) should be received until 35–40 years of age – after the family member has earned their way into adulthood.

There is nothing like love and work to build healthy self-esteem.

Secondly, whoever is the gatekeeper of the money, whether parents or trustees, they must have enough of a relationship with the emerging adult to understand their motivations, goals, aspirations, and tendencies in order to make sound decisions around finances.

Create plans with your children that takes into account their own goals and strengths.

Hold each other accountable.

Money can amplify good just easily as it can bad.

Parents and children need to be conscious of its power and their relationship to it.

The prepared heir will more often make more informed choices.

As for your goals, getting a second opinion from a fiduciary is the best way to ensure everything’s been considered and you’re properly set up for the future.

And when it’s not just your future, but your family’s future too, you want to avoid any potential disappointments at all cost.

We offer complimentary second opinion reviews on portfolios of £500,000 or more.

Each review comes with absolutely no obligation but could provide greater clarity, confidence and control over your future.

Ready to get started?