This UAE-based lawyer lost 11% of his £600,000 investment to hidden commissions – here’s how

Ever heard of an investing black hole?

Essentially, your money is sucked in and never seen again.

Don’t believe me?

Read this.

Hawking, Einstein and Newton dedicated their lives to studying and understanding black holes.

This natural phenomenon has such a strong gravitational pull that it sucks up everything in its path.

But these don’t just exist in science.

They’re in financial services too.

Our client, Andrew, is all too familiar with them.

He moved to Dubai from London in 2016.

His company set him, his wife and children up handsomely with relocation, housing, schooling and healthcare costs all paid for.

With more disposable income, he hoped to invest more and possibly retire early to spend time with his family.

Unfortunately, as a busy, high-earner in Dubai, he became an easy target for unsolicited sales calls.

A financial salesperson contacted him, offering to meet at a nearby coffee shop to chat about his investment management options.

“You need to take full advantage of your tax-free salary and cash in on the current Brexit situation. Transferring your life savings into an offshore bond is the best decision for your future.”

Andrew was won over.

He withdrew his £600,000 pension and invested all of it into the offshore bond he was recommended.

However, his investment hadn’t grown in two years – despite a raging bull market.

Those inflation-beating returns he was promised were nowhere in sight.

With his retirement and family’s financial future on the line, he desperately sought a second opinion.

After scrutinising his investment, the results were shocking.

Andrew is a clever man.

A senior international professional.

But he unknowingly agreed to a 10-year lock-in period, paid his ‘adviser’ an initial 7% product commission and 4% on the underlying investments…

An eye-watering 11% (£66,000) disappeared into the abyss on the day he transferred his money.

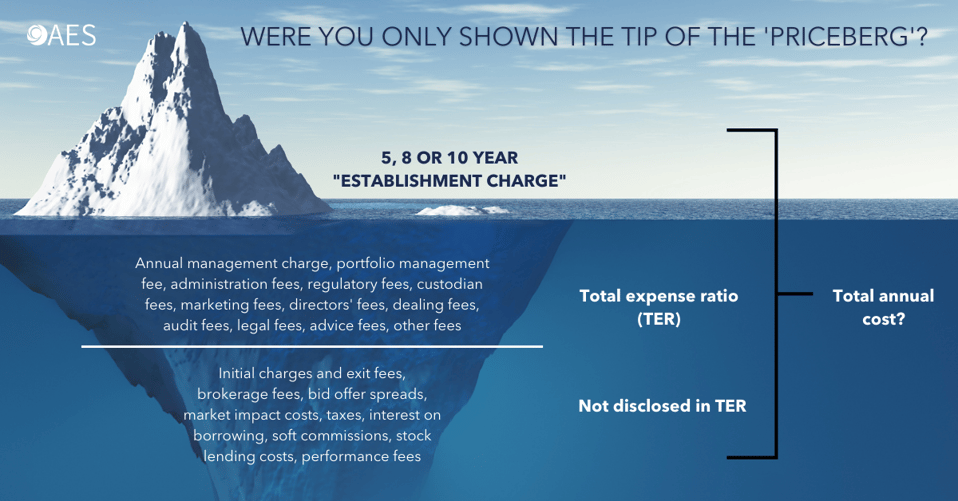

But this was only the tip of the priceberg for him.

He was charged:

- Establishment fee 1.83% pa for five years

- OCF of funds 2.32% (AMC 1.75%)

- Portfolio management/advice fee 1% pa

- Admin charge £428 per annum (0.07% on £600,000)

- Transaction charge £25 x 10

- Total = circa 5.2%+ pa

It gets worse.

If Andrew withdrew his funds within the initial charging period of 10 years, exit penalties would apply.

It was clear, the damage was done.

The 5 stages of grief followed.

Denial.

Anger.

Depression.

Bargaining.

And eventually acceptance.

But, truth be told, the damage wasn’t irreparable.

The Middle East is littered with similar stories caused by a financial services industry that’s systemically broken.

While he couldn’t make up contractual losses, he could move on.

The journey would be difficult.

It would begin with a simple chat about him and his life, not about money…

Black holes are everywhere in financial services

Cases like Andrew’s often start with an unsolicited phone call from a ‘financial expert’.

They lure you in with lofty promises of free advice or high growth.

But like doctors, lawyers, accountants, etc.; professional financial advisers (fiduciaries) never cold call.

They’ll wait to hear from you first, because everything should begin and end with you.

They’ll listen intently to your goals, recommend a strategy you’re comfortable with, provide clarity on why it works for you and give you the confidence to believe in it and leave it alone.

This is the secret formula to a successful investment experience.

Shining a light on the dark side of financial services

Andrew is one of many international professionals who moved to a new country with hopes of making the most of a foreign salary and low tax.

However, international financial services are often not what they are ‘back home’.

Hidden fees and commissions can devastate returns, leaving investors with far less saved than they’d hoped for.

A black hole in their financial futures.

You need to be made aware of this, so you can make smarter, more informed decisions.

AES Education is a rich source of information for anyone wanting clarity, confidence and control over their ideal futures.

Subscribe today for resources that can help you become personally and financially awake, aware and empowered.