Investment mistakes you don’t even realise you’re making [case study]

![Investment mistakes you don’t even realise you’re making [case study]](https://www.aesinternational.com/hubfs/Investment%20mistakes%20you%20don%E2%80%99t%20even%20realise%20you%E2%80%99re%20making%20%5Bcase%20study%5D.jpg)

![Investment mistakes you don’t even realise you’re making [case study]](https://www.aesinternational.com/hubfs/Investment%20mistakes%20you%20don%E2%80%99t%20even%20realise%20you%E2%80%99re%20making%20%5Bcase%20study%5D.jpg)

Have you ever buried your head in the sand when it comes to getting your financial house in order, only to find delaying your decisions ended up costing you far more than anticipated?

This week, a real couple's story.

Time is indeed money, especially when it comes to investing in the great companies of the world.

And making investment decisions/taking action is hard.

I spoke recently about our human, inbuilt, common fears around investing.

Inertia, procrastination, bias towards the status quo and gremlins in the mind, are all BIG obstacles.

But, one critical factor most individuals don’t understand is the compounded cost of delay.

This hidden cost is often far more carcinogenic to your future purchasing power (and thus your future life opportunity) than the unaided human mind can typically calculate (the complexities of compounding).

Meet Eric and Anna

This is the real story of Eric and Anna (names changed).

Eric had been digesting our content for some time, and raised his hand to speak to us just last October.

The family had been fortunate and had a large lump sum of capital sitting in cash.

First, let me summarise their profile, which is typical of who I speak to day in, day out:

- British

- Late 40s, hoping to retire in their 50s

- Eric is a partner in professional services firm

- Married, with two young children

- Dual annual household income of £1,000,000

- Around £5m of investable assets in cash at bank

- Neither individual had come from a wealthy background, and were used to making well-informed money/capital allocation decisions with an awareness of their subconscious money scripts.

We had a great initial conversation talking about their current situation, concerns and broad goals.

He wanted to make the most of his unique wealth accumulation window (his first 'mountain') before moving onto his second life mountain post 50/55.

The tip of the iceberg

Our second conversation went deeper, looking at what it really means to have a flourishing future.

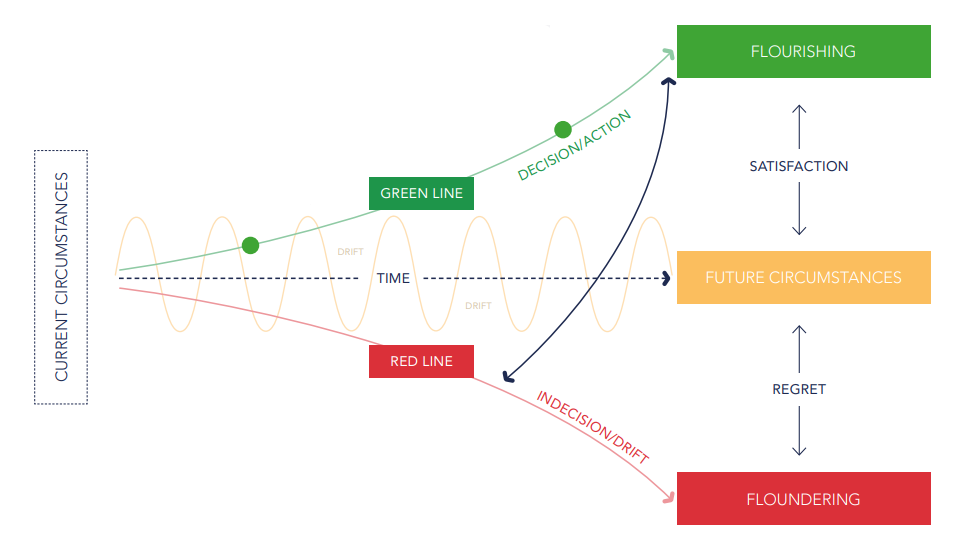

I showed them the possible routes their future can take, and explained the insidious danger of inaction, or drift.

The red line shows what happens when you allow one of the fears of investing to take over.

This typically manifests itself as the aforementioned indecision, inaction, resistance, apathy, inertia, procrastination, wrong action, status quo bias and ultimately, in downward drift.

I explained how time ALWAYS WINS.

It compounds.

But that decision/action plus time, discipline and patience, ALWAYS yield results.

What I didn't cover, was the actual cost.

A strategy for life

Eric and Anna took some time to consider their current financial situation in greater detail.

I've lost count of how many times I've been told how worthwhile this exercise can be, whether you later choose to work with a financial life manager, or not.

They shared a lot of detail with us.

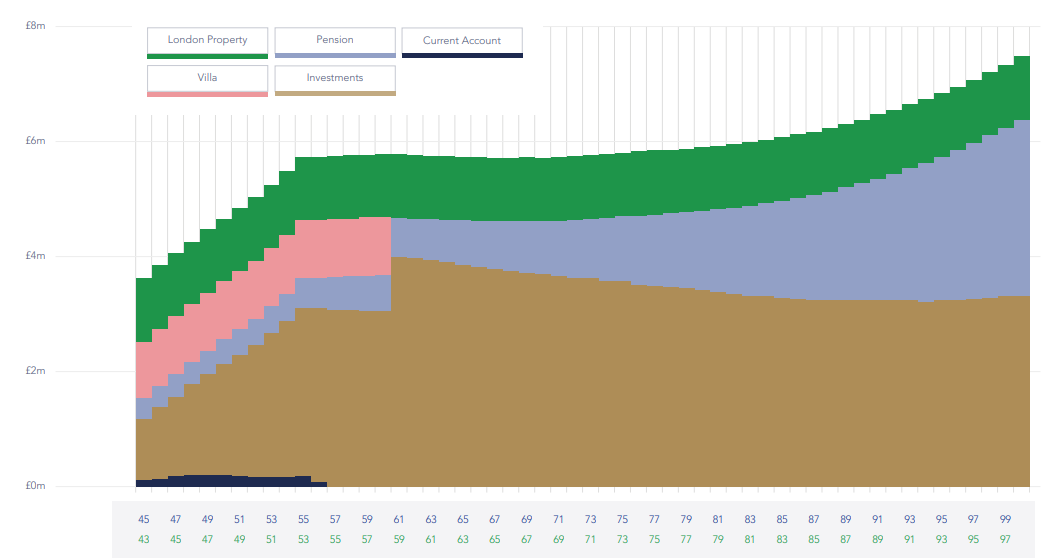

Enabling us to put together their life strategy, including cash flow models of how their financial lives would pan out if they didn't invest their cash, versus how it would if they did.

This is like having a set of company accounts for your family's entire life.

So you can model various scenarios to enable you to make great decisions.

These scenarios included different retirement ages and property purchases, while factoring in inflation, university fees, gifting and caring for elderly parents - always ensuring we run out of life before we run out of money. It took into account savings, pensions, investments and other assets.

Here's an example cash flow model (not theirs):

But, in this case, fear overcame them.

Eric and Anna decided to WAIT.

Fearful that markets were too high and that TIMING the market was a better strategy, than TIME IN the market.

Even though their pathway and trajectory was clear.

And so, we left it there.

Of course, these are exactly the kinds of people I've been helping for decades so I know it's best to leave things until they're ready and committed.

I'm not in the convincing business.

I'm in the evidence, data, and uncomfortable truth business.

Because when it comes to investing, the data speaks for itself...

At least 90% of an investor’s personal lifetime return will be driven by:

- the primacy of a robust plan,

- how much of the portfolio is allotted to equities as opposed to bonds, and

- whether or not, in response to some extreme market fad or fear, you break faith with the plan.

And the fact that...

- All successful investing is goal-focussed and planning driven.

- All failed investing is market-focussed and current outlook driven.

- Successful investors act continuously on their plan.

- Failed investors continually react to the markets, and always in the wrong way.

The cost of delay revealed

And so what are the life-changing costs of inaction and delay?

Fast forward to just a few weeks ago, and the costs of delay became apparent.

Their recommended portfolio is up around 12% since October.

This represents missing out on £600,000 of growth for Eric and Anna.

BUT – here's the real kicker...

It’s not the short-term loss people need to be aware of, but the long-term opportunity cost.

Put this £600,000 into their life strategy up to the age of 100, and compound it at a prudent 6.5% per annum (based on the models we ran through with them), and this is already a compounded lifetime loss of more than £21million.

That's an eye-watering amount of money, as well as lost purchasing power and lost future life opportunity/optionality.

But the decision NOT TO ACT is not just about numbers.

In reality, it has a much more profound impact – it's about unlived lives.

In our experience, the total, long-term cost of inaction and delay is typically both invisible and unimaginable to the unaided human mind.

No one models it.

What feels safe in the short-term, is always the most dangerous in the long-term.

This is extremely hard to understand as it runs entirely counter to the mental programming that evolution has wired us with.

This isn't wrong. It’s entirely human.

The consequence of such drift and inaction is typically not measured in monetary terms, but in units of future life regret.

Hindsight is a powerful thing, but with sensible investing, you don't need it.

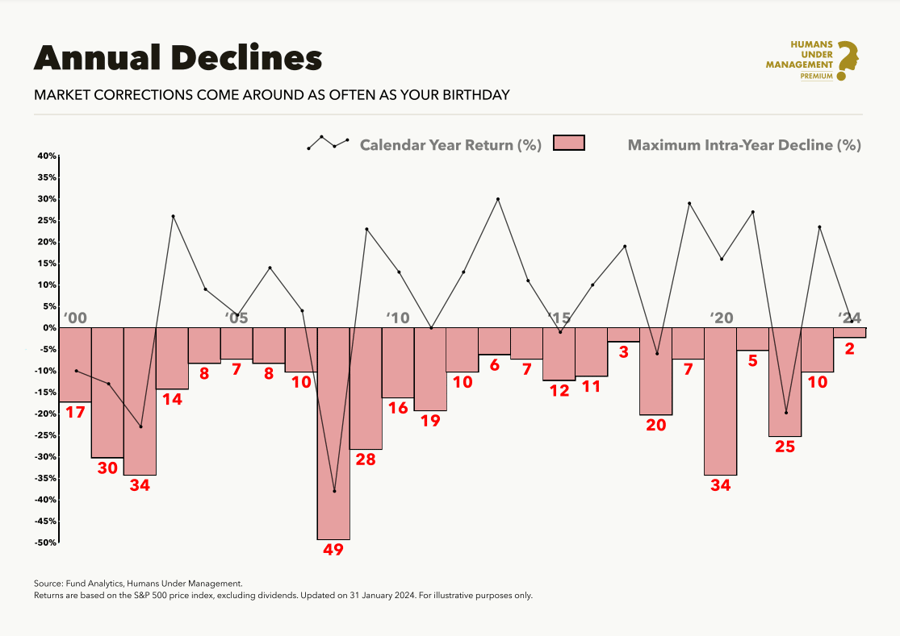

We KNOW that about three out of every four years will provide positive returns (history being our only guide), and every single year will provide an intra-year decline that has the potential to sabotage an investor's best-laid plans.

But this is the price of admission for life-changing returns.

When they're ready, my team and I will be here to provide sage guidance and fight to ensure we keep Eric, Anna, and their family on the right pathway as they journey upwards through life.

But starting yesterday would've always been better.

As Warren Buffet once said,

“Someone's sitting in the shade today because someone planted a tree a long time ago.”

And working with the right financial life manager can have profoundly life-transforming results.