![[2022 outlook] Plus 3 things to remember](https://www.aesinternational.com/hubfs/%5B2022%20outlook%5D%20Plus%203%20things%20to%20remember%20%282%29.jpg)

![[2022 outlook] Plus 3 things to remember](https://www.aesinternational.com/hubfs/%5B2022%20outlook%5D%20Plus%203%20things%20to%20remember%20%282%29.jpg)

I generally take the annual forecasting published by all the major firms and their strategists with a pinch of salt.

Why?

My opinion is that it’s nothing more than guessing.

But that doesn’t mean it’s not fun to review or think about....

You may remember this time last year I published a 2021 forecast.

In it, I covered how the markets always recover.

And gave the example of the Great Financial Crisis in 2008.

The world was thrown in turmoil and there seemed no end in sight.

Yet, those who rode out the financial storm, were rewarded handsomely.

It’s kind of unfair of me to pick on these forecasts.

It's what these firms and experts do, and all of their research reports are grounded in rigorous research and analysis.

I read what they write, and I deeply appreciate their reasoning for these annual forecasts.

However, I don’t believe it should be used as “actionable advice”.

Let’s review them.

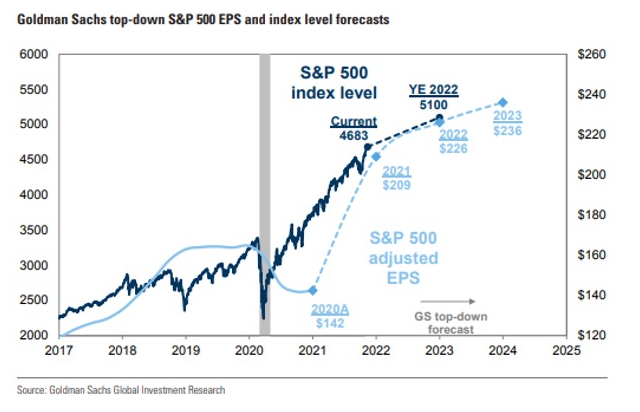

Goldman Sachs

Goldman publishes from two different groups: their Investment Services Group (ISG) and Global Investment Research (GIR).

The team there have forecasted the S&P 500 index will climb by 9% to 5100 at 2022 year-end.

That’s a prospective total return of 10% when you include dividends.

They predict that S&P 500 earnings per share (EPS) will grow by 8% to $226 in 2022 and 4% to $236 in 2023.

Not bad. (See below for the chart from the report.)

JP Morgan

Published earlier this month, this report has the S&P 500 finishing up 2022 at 5050 and EPS coming in at $240.

So their index level forecast is close to Goldman’s, but they are forecasting a much higher EPS.

Their estimate for the 2021 S&P 500 index level was the highest on the street at 4700.

So as JPM looks ahead, they see moderate market upside on better than expected earnings growth.

LPL Financial

LPL publish their reports to the public.

You can follow it all on Twitter: @LPLResearch, Ryan Detrick @RyanDetrick, and Burt White @_BurtWhite.

LPL is forecasting the S&P 500 to end 2022 between 5000 and 5100…so in line with JPM and Goldman.

Their EPS forecast is coming in a little lower than the others at $220.

So what?

I have no doubt these forecast reports are all based on good solid, intelligent thinking.

But in my view, it’s still all guessing.

Educated guessing, and fun to read, but guessing nonetheless.

So if you use forecasts as an investment decision-making tool to adjust portfolios, be cautious.

Our philosophy?

Determine where the greatest odds are in your favour.

Remember, as Matt Hall says in Odds On:

“Most investors try to pick the right investments and time the market’s moves, but their chances of winning are as slim as their chance of beating the house when they walk into a casino. The deck is stacked against them.”

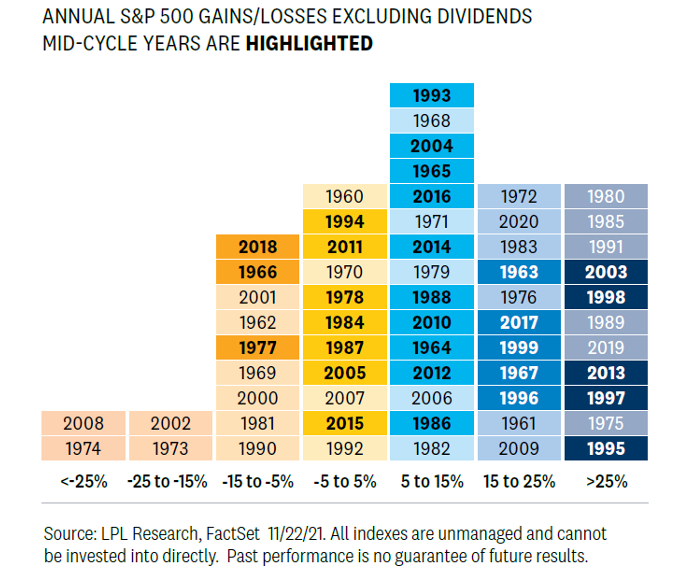

So are the odds favourable for investors?

I think yes.

Take a look at the skew of returns below – it’s showing that the odds are in favor of investors being in the equity markets.

There is no need to guess.

Simply be in the market.

Even if the odds go against you, a solid plan will account for those times.

Remember:

- Have a good plan – don’t risk what you have and need for what you don’t have and don’t need

- Be financially stable – have the resources available to fund your cash needs during market downturns, so you don’t have to sell investments when they are down.

- Markets are efficient – when some news or data comes out that might affect the value of a company's stock or bonds, the market quickly incorporates it into the price of those assets. As a result, the stock's price immediately rises or falls to reflect the market's collective take on its current value. In other words, the price of a stock or bond reflects all of the public information available to investors at any given time. Accept the price.

Our culture and philosophy are not for everyone, and that’s okay.

We know that our value proposition resonates with the people who want to remove a source of anxiety from their life through good advice.

If this sounds like you, we'd love to chat.