The most powerful tool EVER for your finances (and how you can use it today)

Did you know...

If you fold a piece of paper 103 times, it will be larger than the observable universe?

That's 93 billion light years...

It's difficult to get our heads around, isn't it?

How can a 0.0039-inch-thich piece of paper get to be as thick as the universe?

The answer is simple.

Compound growth.

It's like a supernatural force.

And it can produce remarkable results on your money if you let it run its course...

When I was in my 20s, a BBC interviewer asked me whether students think about pensions.

“Pensions?” I laughed.

“We have more pressing things to think about than retiring.”

In my mind...

Tuition fees, rent, student loans, studying and career prospects all ranked higher than a pension I wouldn’t need for decades.

Retirement seemed a long way off.

Yet...

If I could go back in time and tell myself anything, I would use the words of Tony Robbins, from his great book Unshakeable: Your Guide to Financial Freedom:

“You’re never going to earn your way to financial freedom."

"The real route to riches is to set aside a portion of your money and invest it, so that it compounds over many years. That’s how you will become wealthy while you sleep. That’s how you will make money your slave instead of being a slave to money.”

Some people try to shortcut this process.

They don’t invest – they speculate.

In effect, they gamble their money in emotionally-driven investments like houses, active funds, shares, and products sold to them by banks and brokers.

Other people just procrastinate and drift.

Even into their 40s and 50s, they think retirement is a distance away.

People in both these camps have one thing in common.

They hope things will work out for them.

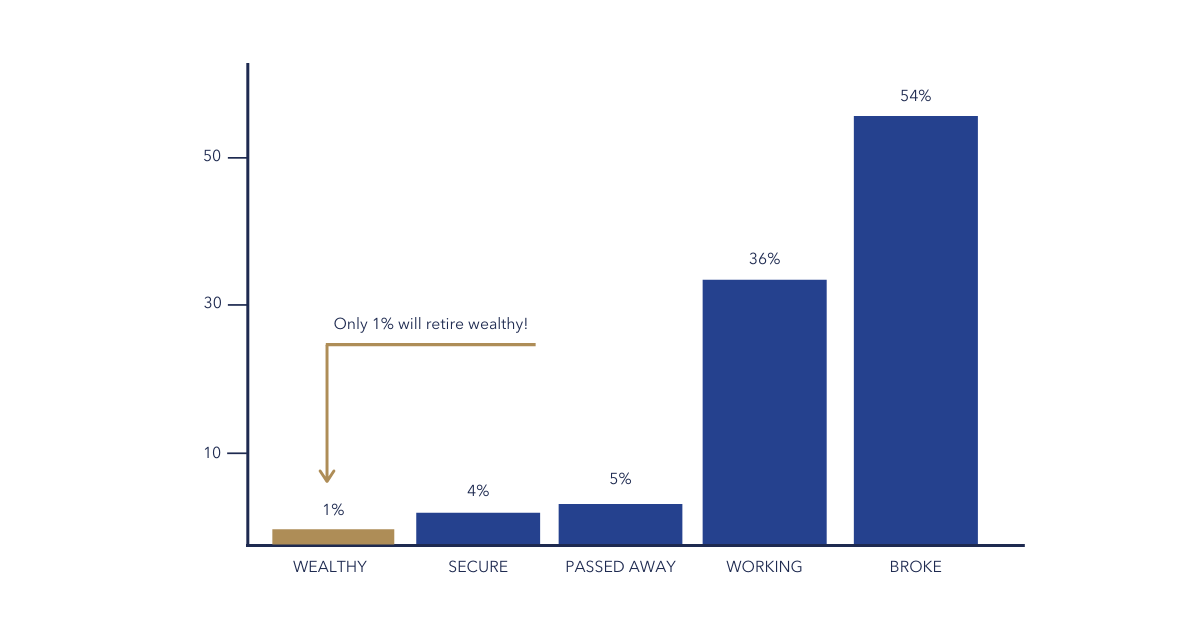

Hoping is why 95% of people live below their preferred standard in retirement.

How to ensure you're in the wealthy 1%

Back to the paper analogy.

The average paper thickness is 1/10th of a millimetre.

If you perfectly fold the paper in half, you will double its thickness.

Folding the paper in half a third time will get you about the thickness of a nail.

Seven folds will be about the thickness of a 128-page notebook.

Things get interesting very quickly.

10 folds and the paper will be about the width of a hand.

23 folds will get you to one kilometer—3,280 feet.

30 folds will get you to space. Your paper will be now 100 kilometers high.

42 folds will get you to the Moon. With 51 you'll reach the Sun.

Now fast forward to 81 folds and your paper will be 127,786 light-years, almost as thick as the Andromeda Galaxy, estimated at 141,000 light-years across.

Ninety folds will make your paper 130.8 million light-years across, bigger than the Virgo Supercluster, estimated at 110 million light-years.

And finally, at 103 folds, you will get outside of the observable Universe, which is estimated at 93 billion light-years in diameter.

So, no matter how old or young you are…

Used right, the power of compounding can be your greatest route to wealth.

However, as the American economist Burton Malkiel said:

“The majority of investors fail to take full advantage of the incredible power of compounding – the multiplying power of growth times growth.”

He's right. Most people don't know how amazing compounding truly is and the impact it can have on your future wealth.

This is why getting you on the right pathway and keeping you on it is so critical to your financial future.

The story of rice on a chessboard

Let's take another example - this time using a love of mine, chess.

You may have heard the tale of the king, the traveller, the chessboard and the rice.

There are a few versions of the story, but the essence remains the same.

The traveller beats the king at a game of chess, and chooses rice as his prize.

One grain on the first square, two grains on the second, four grains on the third and so on, until all the squares on the board have rice on them.

Each square has double the amount of the previous.

Sounding like a great deal, the king agrees to pay up.

The king gets his officials to collect the rice and starts placing it on the chessboard.

By the time he's reached the last square on first row, square 8, he's placed 128 grains of rice.

But, by the end of the second row, the king needed 32,768 grains of rice.

By the end of the third row, he needed 8,388,608 grains of rice.

The 4th? 2.1 billion grains of rice.

By the time he reached the final square on the board, square 64, he needed 9,223,372,036,854,775,808 grains of rice.

You get the idea - so let's look an example with investors.

A shocking example of the power of compound interest

Let’s take two teenage friends, Will and Mike.

They each decide to invest £500 a month.

Will is resourceful, and starts investing at 19.

However, he only saves for eight years, then stops, when he's 27 years old.

He invests his £48,000 and leaves it alone.

His money starts compounding.

After eight years, his investment is worth approximately £72,277.89 – assuming it compounds at 10% a year, which is the historic rate of the US stock market over the last century.

Will's account then lies dormant, not being added to for 39 years, until he turns 66.

The compounding continues…

Mike is slower off the mark.

He doesn’t start investing his £500 a month until he’s 27, the time when Will stopped.

But, unlike Will, he’s consistent and disciplined.

He invests every single month until he’s 66.

He manages to invest £234,000 in those 39 years – and of course, every penny compounds at our example rate of 10% a year.

At 66, whose account is worth more?

Will and Mike meet up for a reunion at 66.

Will, who started earlier but stopped after 8 years, has approximately £2,901,579.42 in his account.

Mike, who started later but was consistent, has less, with £2,537,257.67.

Will ends up with more money in his account at age 66 due to the compounding effect, even though Mike invested for 31 years longer.

£364,321.75 more.

By starting earlier, the compound interest Will earns on his investment adds more value to his account than he probably could have added on his own.

But what if Will hadn’t stopped investing at 27, and had carried on adding £500 a month until he was 66 too?

At 66, he’d have walked away with £5,511,115.02.

How can you best manage your complex financial affairs?

Even the small, seemingly inconsequential decisions we make every day can have a big impact over time. Whether we’re trying to run a faster mile or master a foreign language, the best way to stay motivated is to keep reminding ourselves of the rewards that come from patience and commitment.

Just a little bit of time every day can add up to a lot of progress.

The same is true of investing. A 10% return on your investment each year—similar to the stock market’s historical annualised average—would double your money every seven years.

Having a lot of time can help an investor make up for not having a lot of money.

In both life and investing, compounding is a powerful force. You might say that the life equivalent of compound interest is wisdom. Learning from the past can help us make better decisions in the future, and those lessons build on one another over time.

The truth is, those I speak to are much older than their 20s.

And as successful families, come with complex financial affairs.

So, how can you achieve similar success?

The answer is simple, but not easy:

-

Find clarity around your “why” and your current financial situation.

-

Be confident about what you want your future to look like.

-

Take control over your ideal future and be accountable for its progress.

And quite often needs guidance from someone who has a deep understanding of your situation and objectives.