The pros & cons of owning a rental property vs. stock market investing

People love talking about property.

Should you rent?

Should you buy?

Should you invest?

After all, a house is the largest asset many families will ever own.

It's also the most emotionally meaningful.

Over the past two decades, housing values have increased significantly, even doubling or tripling in some global cities.

The conventional wisdom is that renting is “throwing money away”, while buying “builds equity”.

I recently shared a post on LinkedIn examining the arguments for renting vs. buying, giving you a simple calculation to help you decide.

This week, I wanted to look at another side of the debate - rental properties as an investment vs. investing in the stock market.

Recent stock market volatility has perhaps led investors to feel more confident in bricks and mortar.

But I want to be clear - there are no right or wrong answers here. I'm personally invested in both asset classes.

There are people who've built wealth investing in property.

There are people who've built wealth investing in the stock market.

There are people who've lost wealth investing in property.

There are people who've lost wealth investing in the stock market.

We all have our own personal preferences that have been shaped throughout our lives and experiences.

Pros and cons

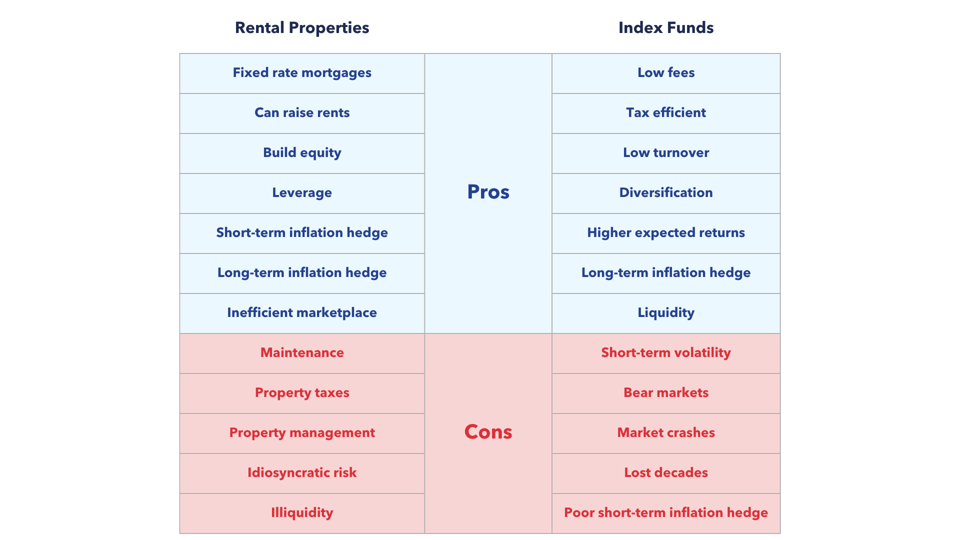

To start to break this argument down, let's look at the pros and cons for both renting and investing in index funds:

Rental properties vs Index funds

Why is property such a popular investment?

It turns out that different cultures have different psychographic profiles and feelings towards property.

Many continental Europeans are often happier renting, but the British and Irish love ownership.

Perhaps it isn't surprising, as kids we love playing Monopoly, I was told 'an Englishman's home is his castle' and learned nothing is as 'safe as houses'. These scripts are easily absorbed and contribute to what becomes our 'Money Personality'.

The website Property Hub covered this very topic in one of their recent newsletters.

They believe if you approached 100 Brits and asked how they'd invest £1m, the vast majority would say “property”.

But what makes people love it so much as an asset class?

Maybe because property is a simple investment for the average person.

"It’s obvious why it has value, clear how you make money from it, and everyone feels like they have some degree of familiarity with it – even if just from buying their own home, or knowing what they look for as a renter." - Property Hub

It's also physical, you can see it.

This is, I’m sure, a part of it.

And in most people’s minds this is enough - even with drawbacks like the lack of liquidity and diversification.

But Property Hub also list three intrinsic characteristics that also make it the perfect psychological investment for the everyday investor:

1. You can't panic sell

An online stock brokerage studied the performance of their most successful clients, trying to identify what they had in common.

It turned out it was… they were dead.

You see, when it comes to investing, we tend to do and precisely the wrong thing and at the wrong time.

Human emotion (the neurotransmitters in our head) typically leads us to buy high, then sell low – and now we can do this from our phones in seconds, we’re even more likely to fall victim to ourselves.

"Yet if you’re feeling nervy about property, you need to be sufficiently scared to call an estate agent, instruct a solicitor, fill in lots of forms… then maintain that level of fear for the months it will take to complete a sale."

2. You can’t obsessively check the price

It's simply silly to wonder if the value of your property has gone up or down within the last day or hour.

Yet this is what some stock market investors compulsively check. Again and again.

Again, this plays to the worst of our psychology and potentially creates a behavioral flaw known as 'myopic loss aversion'.

As well as leading you to act at the wrong time, it can affect your mood. If you weren’t planning to sell, the price makes no difference – "but many people who invest in stocks will tell you that they feel better or worse about their life based on whether an arrow is green or red."

"We complain about how we rely on the subjective views of valuers to know how much our property is worth, but the difficulty of understanding its true value until the day you sell it, is - again - a huge mental benefit."

3. You're forced to take a long-term view

In property, the stock market and most asset classes, you should always take the long view.

The trend is usually up.

But the temptation is always to take the short-term view: dip in and out, try to be smart and beat the market. This is gambling, not investing.

Meanwhile property has such hefty financial and practical trading costs/duties, you can’t help but take a long-term view.

Unpopular opinion: property returns are not always as they seem

Investing in the stock market has historically offered better returns than property over the long term. In fact, the data tells us the stock market, over the long term, remains undefeated.

Simply put, an investment in property earns just three to four percent per year, historically.

Investments in global equities post annuallised returns of 10+ percent.

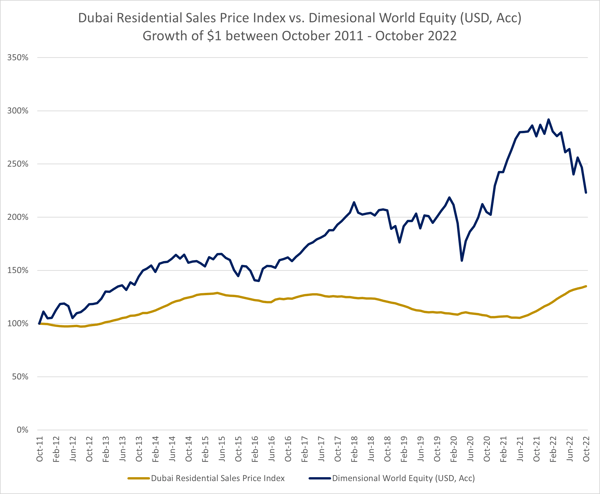

Let's take one of the world's favourite property investment markets over the last decade, Dubai. Post COVID, all I hear about is how much money can be made in Dubai property.

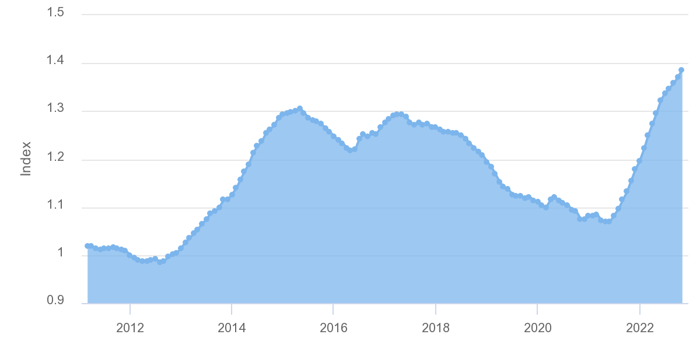

This chart below shows the Residential Sales Price Index for the Dubai property market:

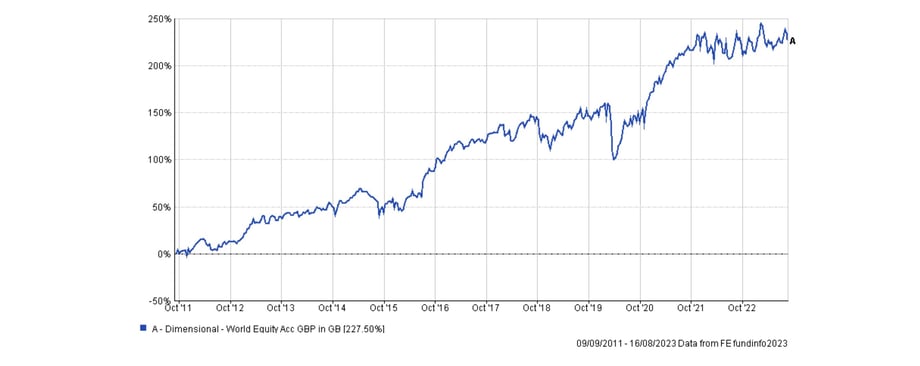

And this, the annual returns of the Dimensional World Equity Acc (GBP) for the same period.

£1 invested in the Dubai property market in October 2011 would have been worth £1.39 in November 2022.

When you compare that to £1 invested in Dimension World Equity Acc (GBP), the same pound would have been worth £2.27 - a 61% greater return on investment.

Now compare the investment returns against one another.

When extrapolated out over the course of an investor's lifetime, the difference in returns would potentially be worth millions.

The hassle spectrum

Directly owning a rental property is no free lunch.

First of all, you have to find tenants. If they leave you may have time in-between finding new ones, where you aren’t receiving any income but still have costs to pay.

Obviously, you can build things like taxes, insurance, maintenance and repairs into rent but there are likely going to be one-off costs you don’t plan for (a new roof or broken air conditioner could eat up months of profits in an instant).

Some people are more equipped than others to deal with this.

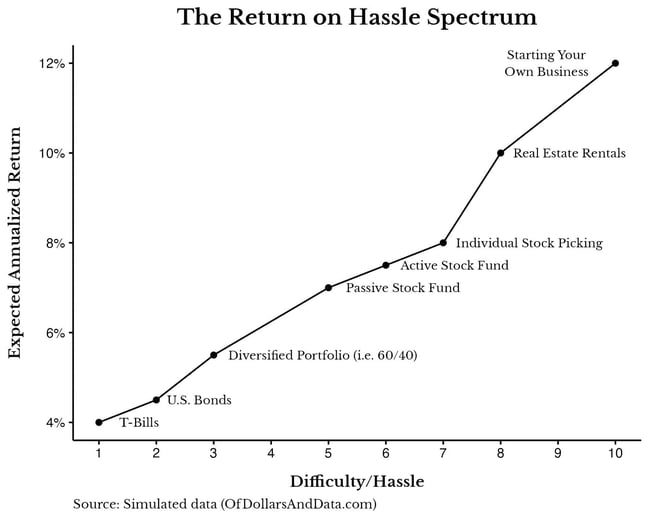

Nick Maggiuli talks about 'the return on hassle spectrum'.

This is the idea that you need to consider the time and work associated with an investment in addition to its expected return.

In the case of property, you have to factor in the mental and physical work associated with managing the ins and outs of your properties.

These are all “hassles” that most traditional investments (i.e. stocks, bonds, etc.) don’t require.

You can access property without this 'hassle factor' by buying REITS (Real Estate Investment Trusts). These give many of the benefits of equities (diversity, liquidity and typically the good returns of professional property management) without much of the hassle and risk of director property ownership.

This is the type of decision that I would make completely outside of the spreadsheet.

So, property or the stock market?

For me, property should be something to enhance your lifestyle and not your finances.

I am looking forward to finishing renovations and enjoying family life in mine.

But I believe the statistics show capital markets (if you understand them, can efficiently access them and stomach the journey) are a better alternative to building my family's wealth in the long run, than property.

But many retail equity investors fail to invest well so I appreciate property may seem safer to some.

Being British, I also have a fascination with property.

And don't get me wrong, investing in property ISN'T a bad idea.

As part of a good life plan and a balanced portfolio, it makes perfect sense.

I wrote more about property vs the stock market here and you can read more in this free guide.

You can also watch this video on the pros and cons of investing vs property:

I feel like I've somewhat successfully ridden “the ladder” myself, but my words of wisdom on the topic are that you always need to think about it very carefully and resist becoming too emotional about it, or listening to the current noise around it.

Many of us simply don't fully appreciate the numbers and risks.

Property isn’t a good alternative to a well-invested pension or retirement fund considering all data.

Remember, property doesn't necessarily produce anything, while the best companies in the world (represented in the Indexes) do.

Businesses exist to maximise earnings and the growth of those earnings.

In contrast, the value of a house is based more upon supply/demand and the local economy.

Buy or rent a property you can comfortably afford, you’ll enjoy living in, or one that forms part of a balanced portfolio of equities, property, bonds and cash.