Short-term pain versus long-term gain: Can fixed income now deliver stock-like returns?

Fixed income investments are generally considered a safe-haven in times of economic uncertainty.

Yet in the first half of 2022, fixed income markets posted some of their worst returns in history.

However, at times like this, risk-reward calculations shift, and investment opportunities may arise.

Could the current environment allow for equity-like returns in a fixed income portfolio?

One factor could make it possible to achieve equity-like returns in fixed income: higher yields.

Price and yield are inversely related: As the price of a bond goes up, its yield goes down, and vice versa.

The asset class may now be offering compelling income returns whatever the economic environment, as well as the potential for capital appreciation if the economy goes into a recession.

And yet some investors may be hesitant to take advantage of higher yields because of concerns about future increases (effectively devaluing any bonds bought now).

Some may even be considering reducing their bond exposure after this year’s negative returns for fixed income.

The good news?

If yields do keep rising, investors seeking higher expected returns may still be better off maintaining the duration of their fixed income allocation.

Rising yields impact fixed income portfolios in several ways.

Firstly, longer-duration portfolios (as is our preference) may experience larger immediate losses from increased yields compared to shorter-duration portfolios.

Secondly, higher yields may lead to higher expected returns.

Investors can think of this tradeoff as a pit stop in a Formula 1 race.

The pit stop immediately causes the driver to fall back.

However, fresh tires may help the driver win the race if there are enough laps left to catch the leader.

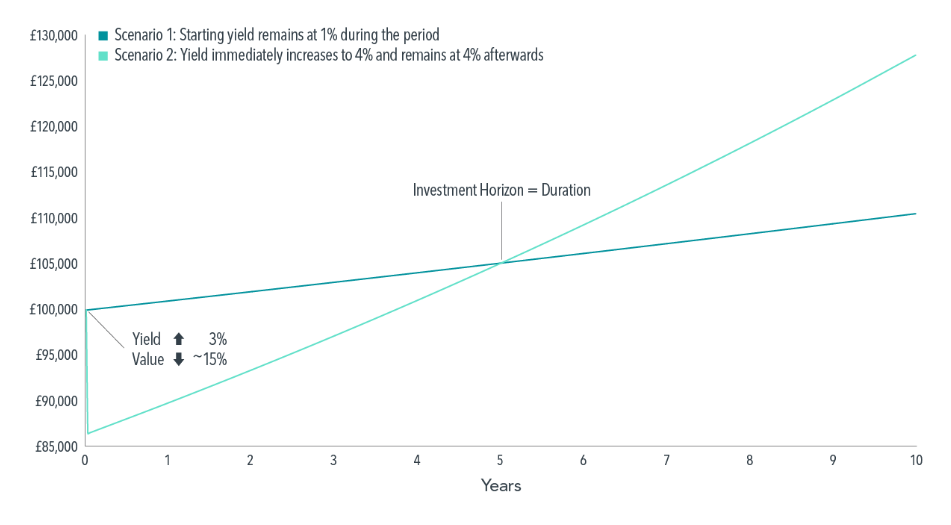

The chart below from Dimensional shows this, using two scenarios for a £100,000 fixed income allocation with a five-year duration.

Scenario 1 experiences a constant yield of 1% during the period.

Scenario 2 is faced with a sudden spike in yield from 1% to 4% on Day 1 and sees its value immediately drop to a little over £86,000.

However, the higher-yield environment accelerates Scenario 2's recovery: With a 4% yield rather than the previous rate of 1%, Scenario 2’s portfolio value overtakes Scenario 1's within five years—the time horizon determined by the duration of Scenario 2.

When faced with uncertainty, investors should focus on the things they can control.

Research tells us that trying to outguess the market by holding on to cash, or shortening duration, with the expectation of future yield increases may not help you achieve your long-term goals.

Markets quickly incorporate new information about higher interest rates and inflation.

The market is an effective information-processing machine. Each day, the world equity markets process billions of pounds in trades between buyers and sellers and the real-time information they bring helps set prices.

Accept the markets for what they are, avoid reacting and focus on your long-term goals.

Investors who maintain appropriate asset allocations, even after increases in bond yields, may have a more rewarding investment experience in the long run.