Excited to become an expat? Are your finances in order?

Finally, after what was likely a long and arduous decision-making process, you are moving abroad and are so excited to experience life as an expat. You have made your list and carefully planned out your move.

House hunting? Check.

Job applications? Check.

Farewell parties? Check.

![]()

You have done all the exciting parts of the planning. Now you need to do the important bit – your finances. It is not as easy as simply packing up all your belongings and shipping them to your new home. Expat financial planning requires a lot of time and effort, and to help you get started, we have compiled an Expat Financial Checklist that you can use – wherever you are planning to move.

Simply tick them off as you go and you will be all set for your new adventure. (You can download a copy of this checklist here.)

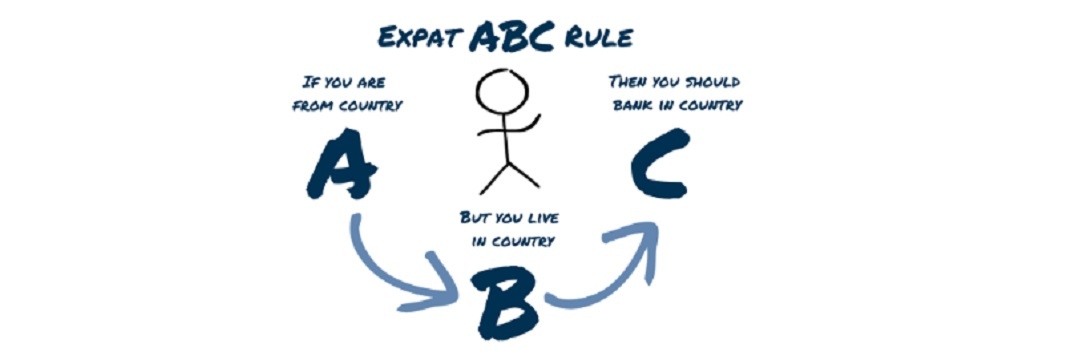

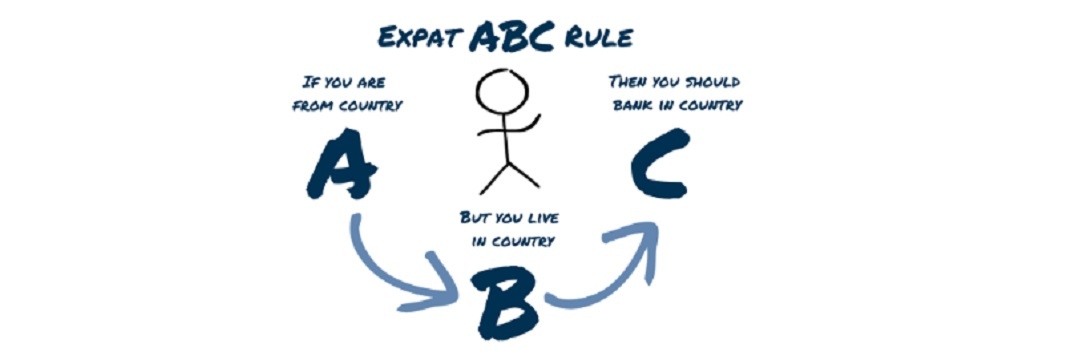

1. Banking

Before I move

![]() Inform bank of my intention to move abroad

Inform bank of my intention to move abroad

![]() Update contact details with my bank

Update contact details with my bank

![]() Enquire about fees and accessibility whilst I’m away

Enquire about fees and accessibility whilst I’m away

![]() Cancel any direct debits or standing orders which are unnecessary

Cancel any direct debits or standing orders which are unnecessary

![]() Pay any outstanding debt (credit cards, store cards etc.)

Pay any outstanding debt (credit cards, store cards etc.)

![]() Remember to open an offshore bank account (with multi-currency options) to keep my money safe and secure

Remember to open an offshore bank account (with multi-currency options) to keep my money safe and secure

After I move

![]() Open a local bank account for day-to-day finances

Open a local bank account for day-to-day finances

2. Pension

![]() Find out how I can continue making contributions to myh pension while I'm away, if I want to

Find out how I can continue making contributions to myh pension while I'm away, if I want to

![]() If I am retiring abroad, find out how I can access my pension

If I am retiring abroad, find out how I can access my pension

![]() Find out how the tax system in my new country will impact my pension

Find out how the tax system in my new country will impact my pension

3. Investments and estate planning

![]() Research how my existing investments will be affected by my move abroad and where I should hold my investments

Research how my existing investments will be affected by my move abroad and where I should hold my investments

![]() If I want to invest, research what offshore investments will work for me

If I want to invest, research what offshore investments will work for me

![]() Research how my estate will be affected by my move abroad

Research how my estate will be affected by my move abroad

![]() If I have an ISA, make necessary contributions before I leave

If I have an ISA, make necessary contributions before I leave

![]() Contact a qualified investment specialist to help me organise my investment portfolio

Contact a qualified investment specialist to help me organise my investment portfolio

4. Tax

![]() Inform tax agency (HMRC in the UK) of my intention to move

Inform tax agency (HMRC in the UK) of my intention to move

![]() Research tax system of new country, including if a double tax agreement exists between my home country and destination country, and what applies to me

Research tax system of new country, including if a double tax agreement exists between my home country and destination country, and what applies to me

![]() Find out if I will pay Capital Gains Tax on any existing properties or assets in my home country

Find out if I will pay Capital Gains Tax on any existing properties or assets in my home country

![]() Find out if I will pay Capital Gains Tax on any properties or assets in my new country

Find out if I will pay Capital Gains Tax on any properties or assets in my new country

![]() Contact a qualified tax planning expert to help me if I need advice

Contact a qualified tax planning expert to help me if I need advice

5. Property

![]() If selling existing property - hire an agent and solicitor

If selling existing property - hire an agent and solicitor

![]() If planning to rent out existing property - arrange management (such as finding tenants, collection of rent, repair) and relevant insurance

If planning to rent out existing property - arrange management (such as finding tenants, collection of rent, repair) and relevant insurance

![]() If I have an existing mortgage, request permission from my mortgage provider to rent out my property and organise suitable insurance

If I have an existing mortgage, request permission from my mortgage provider to rent out my property and organise suitable insurance

![]() If I have an existing mortgage, reset (increase) it so that interest payments on mortgage offset as much of the rent as possible.

If I have an existing mortgage, reset (increase) it so that interest payments on mortgage offset as much of the rent as possible.

Organising your finances before and after you move abroad can be quite tedious and well, boring. You might find yourself steering your mind away from the stressful parts of the planning, in favour of the more fun bits of moving abroad. In some cases, even the well-organised find that their own research is still lacking enough to require the expertise of a financial planner. Of course, there is nothing like speaking to a professional to get advice that is specific to your needs, but you have to make sure that the adviser you are speaking to is regulated in the country of your destination. If you are considering moving abroad, click below and speak to a regulated financial planner.

To download a copy of this checklist, click here.