Learning from investing mistakes

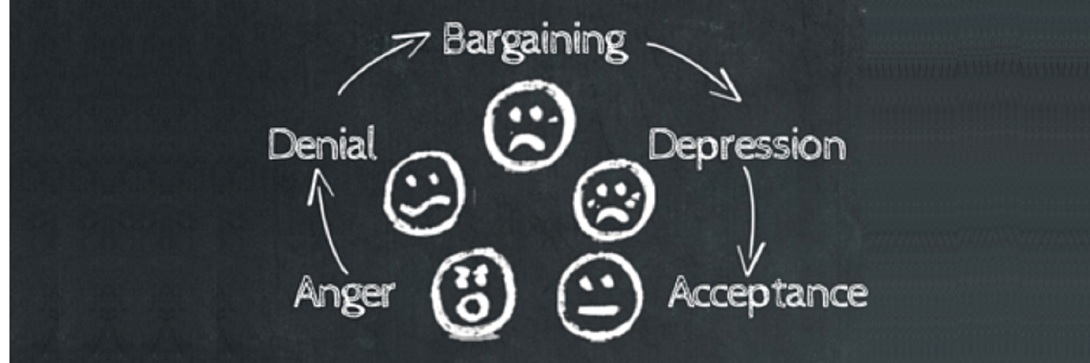

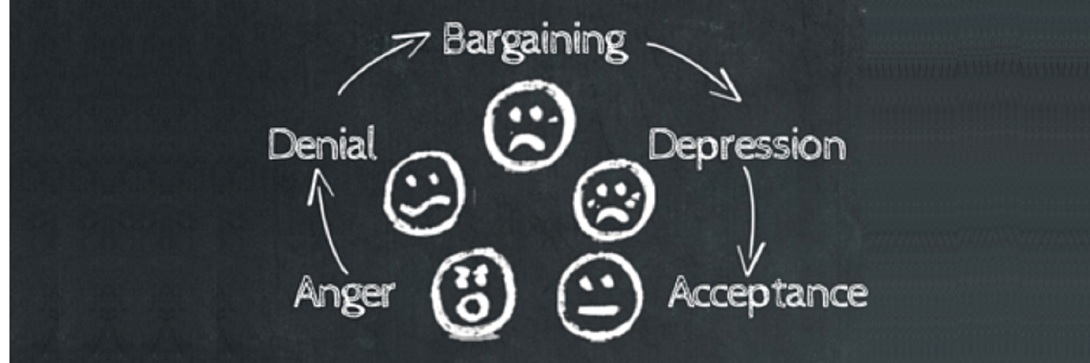

When something bad happens – an accident, death in the family, or unemployment – our emotions launch us into a well-recognised sequence that ends, finally and thankfully, with acceptance. We then ‘move on’ and the great cycle of life continues.

It’s really no different with our investments, but the good news with money is…it’s only money. But money does, of course, matter – it’s what buys the retirement and pays the school fees.

What’s worse is research shows, for most people, the pain of losing money has at least double the impact of the pleasure we get from a profit of exactly the same amount.

Oddly, a disastrous investment often triggers other emotions as well. Instead of simple denial, there is often a sense of shame or embarrassment: not only do we hate the thought that we got it wrong, but we don’t want others to know.

We all know people who’ll tell us about how much money they made developing property, the great deal they got on their car, or how the stock they bought tripled.

What’s strange is, for everyone who made these fabulous bets, there was someone on the other side who lost out. But they tend to keep it to themselves and, perhaps, weigh it up in the small hours of the night.

Why does this matter? Well, one secret of successful investing, or successful anything, is to learn from our mistakes. So we need to acknowledge those mistakes and work out how we made them. And one way to preserve and grow your wealth is to avoid making simple mistakes: don’t buy the wrong stuff, trust the wrong guy, pay the wrong fee.

If your friends won’t tell you how and where they got it wrong, you need to either learn those lessons from somewhere else or risk making the same mistakes… and fall into the same grief cycle as they did.

That’s why we spend so much time trying to expose some of the things that might catch you out. Many of the things investors get wrong are buried or deliberately ignored. We think this needs fixing, and we’re focused on helping investors avoid loss, and keeping them out of the Grief Cycle.