How to avoid these common investment mistakes and become a better investor

Last week's blog was about the uncertainty of investing.

About the many aspects that are out of our control.

Yet, adversely, there are so many things you can control...

And they all begin and end with you.

You've heard the saying: "You are your own worst enemy".

Self-doubt.

Indecision.

Lack of confidence.

Fear.

Investing is emotional.

When the markets go up, you're happy.

You have confidence in your portfolio.

When the markets go down, you're anxious.

You feel you are losing control.

The fear of losing money drives your need to react.

To regain clarity.

But like life in general...

You shouldn't judge your success when things are going well...

You should be doing so when things are bad.

When the markets are volatile.

When there's a bear market.

When political or economic events threaten your returns.

Many investors would rather sell than deal with the fear of uncertainty.

It's simply one of the fascinating biases and mental errors seen in investing.

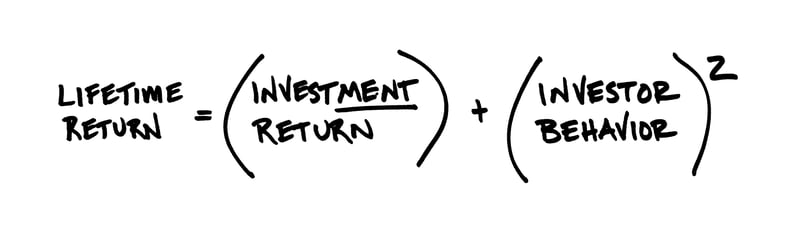

Behaviour Gap

Investor psychology explained

Understanding how human minds work when it comes to investing is a part of behavioural finance.

It's a field studying the human impact on markets.

Getting to grips with our minds is the first step towards helping us understand and potentially alleviate the psychological pain of a market downturn when it eventually comes.

Because we know from experience - downturns always come.

If you're interested in knowing more on this topic, this blog will enlighten you.

It lists the five most common mental errors in investing.

I can guarantee you'll learn something new about yourself after reading it.

The risk of taking on no risk

Let’s think about risk tolerance, which is the ability to absorb pain when it comes to investing.

Most people are not comfortable at the edge of their tolerance to pain.

So why would you be comfortable with an investment portfolio which pushes your tolerance for risk?

Everyone prefers to celebrate success not failure, another human response.

But you may not have suffered pain in recent years.

After all, we're in the longest bull run in history.

The returns you've been enjoying in the last 11 years have made you feel confident in your portfolio.

You have faith that it will continue to work for you in the years to come.

In fact, you may be tempted to take on even more risk...

Hoping it will bring better returns and possibly get you to your goals faster.

It is highly likely that some investors are currently in a period of over-confidence with their investments, believing their investment decisions are superior to those of others.

As a result, they may be more inclined to make risky investments, encouraged by the long period of the bull-markets.

However, simply taking on more and more investment risk does not guarantee more return.

It does guarantee more pain.

Yes, holding a well-managed invested for more than 20 years should bring lucrative returns.

But ask yourself...

Would you be able to ride out the years of fear, desperation, panic and anxiety?

Would you constantly be battling with your instincts telling you to sell when the markets are down?

It's far more important to have risk you're comfortable with and that you can stick to for years to come...

Than have a high-risk portfolio that makes your entire investment experience stressful.

How to ease investment pain

Remember at the beginning of this blog, I spoke about the things you can control?

Well here they are.

As an investor, there are 3 things you can do to ensure your investment journey is always comfortable...

1. A strategic asset allocation that's globally diversified

This weighting of different assets in your portfolio will make a big difference to returns, and must be within your tolerance to risk.

The right asset mix will spread your wealth and risk, offering a cushion against market downs.

When one asset class underperforms, another outperforms.

2. Consistent, systematic investing

Choose to use low cost investments instead of trying to outguess the market, blot out all the market noise and become a couch potato investor.

As Matt Hall says in his book:

"Trying to find undervalued investments is like trying to find a needle in a haystack. Instead of wasting your time and money, buy the whole haystack."

3. Work with a regulated financial planner

A financial planner has many roles.

Not only do they help you decide on the right portfolio for your ideal future...

They also help you stay on track when the markets test you...

Manage your emotions when you're unable to...

And save you from making any decisions that may eat away at your returns.

A financial planner will be as invested in your future as you are.

If you're looking for one to work with you along your investment management journey...

Get in touch.

The first call is on us and gives you the opportunity to see if we're the right fit for you.

Without any obligation.