When your working years come to an end and your employer’s no longer subsidising things like healthcare, phone bills and wellness memberships…

How much will you really need to cover everything in retirement?

Conventional wisdom says you’ll need roughly 70-80% of your current income in retirement.

These rules of thumb are always situation-dependent.

And rely heavily on several assumptions.

But this is the foundation most people aim for.

However, many say this number because it’s conventional wisdom.

Dig a little deeper, you’ll find most people have much higher expectations, which tend to be completely unrealistic.

A report in the Wall Street Journal researched people’s retirement needs.

They set out to see what they will actually need as opposed to what they think they will need.

A group of participants were asked questions about how they wanted to spend their time in retirement.

Based on this information, the researchers calculated what percentage of their salary they would actually need to support this kind of lifestyle.

The results were shocking - 130%.

They’d have to save nearly double what they originally thought.

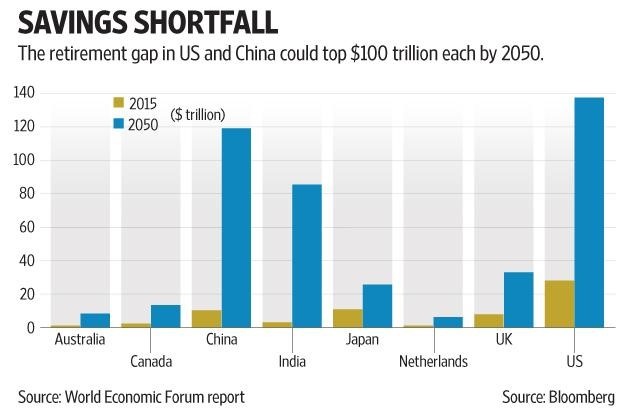

Retirement statistics are becoming increasingly woeful.

We keep reading about how unprepared we are for retirement.

It’s easy to feel despair.

But truth is many people will need 130% of their current income during retirement...

In order to live out their ideal future.

But how many will actually do all this?

And, if they do, how long will it last?

It begs the question…

Are we truly facing a retirement crisis?

Or are our expectations far too extreme to ever live up to?

In reality, almost all our costs decrease with age except for healthcare.

And the biggest drain of our income regardless of age always remains housing.

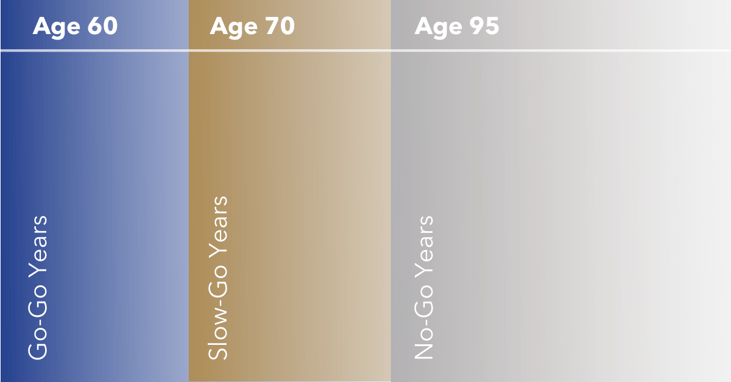

Michael Kitces, one of my favourite financial bloggers reiterates the three phases of retirement from the book: The Prosperous Retirement: Guide to New Reality.

It’s the idea that spending behaviour is not consistent throughout retirement.

It declines over time.

The first phase is basically a continuation of the pre-retirement lifestyle.

The second is a little slower as health and energy begin to decline, along with discretionary spending.

The third phase is where most of our spending comes to an almost halt.

Except for healthcare costs.

So if most of our retirement spending happens within the first 10 years of retirement and gradually decreases…

Is it really prudent to say we need 130% of our current income to retire comfortably?

I think not.

Where to from here?

There’s no one-size-fits-all approach to retirement savings.

The media does a good job of instilling fear in us all making us dread our retirement years.

Which should, ultimately, be our most carefree days.

A wise approach is to speak to a financial planner who can provide unbiased advice regarding your retirement goals.

Chat to us if you want peace of mind.

Book your FREE Discovery Call to find out more.