Gold is an asset class that drives some of the most extreme opinions from investors.

It makes people highly emotional - you either love it or hate it.

It's why I wasn't surprised when I got into a passionate debate around the topic with a reader.

It involved a long email exchange - some of which I'll share with you below.

Gold is dense.

So dense, that a 36cm or 1-ft cube of it weights a ton.

It's also rare.

So rare, that only 187,393 tons of it exist - enough to fill a few Olympic-sized swimming pools or to fit neatly under the first cross-bar of the Eiffel Tower.

That's not a lot of gold.

Especially given you need to drill through 250 tons of rock, then pulverise it and chemically treat it to get enough gold for a single wedding ring.

Some people I know are so convinced about the future value of gold they actually buy gold bars, take them home and store them.

Two days ago, one reader asked me my opinion on gold.

I told him, quite simply, I'm not a fan of precious metals.

I understand that whenever the economy gets turbulent, the goldbugs come out in force to claim the only safe haven is gold.

And I'll admit, their arguments can sound convincing but after being in financial services for close to 20 years and keeping a very close eye on the evidence, I can tell you...

Gold does not make a good long-term investment.

I also shared a quote with him from Warren Buffett, who said:

“It doesn’t do anything but sit there and look at you”.

What transpired was an interesting debate - his reasons for gold being a good investment...

And my responses.

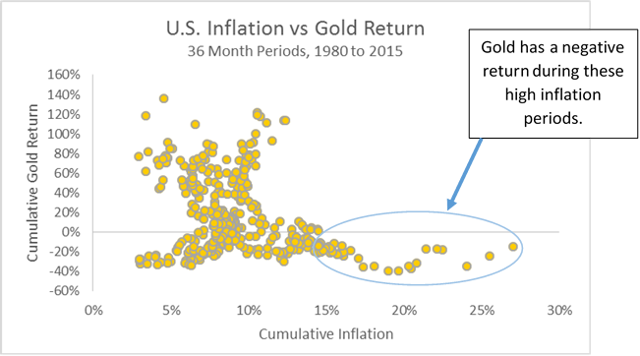

1. “But it’s an inflation hedge!”

No, it’s not.

Gold has failed to track inflation.

Historically, the relationship between gold and inflation has been inconsistent.

It has a negative return during high inflation periods.

In fact, cash (3-month treasury bills) have been a better inflation hedge over the last 35 years.

Gold has underperformed inflation by almost 100% over this period.

2. “But it’s a medium of exchange in a crisis”

Gold is only a medium of exchange if someone is willing to accept it as payment.

It is heavy, cannot be eaten, worn or used as shelter.

In a true crisis, some things will be worth far more than gold.

Frankly, as we saw last year during the pandemic, even toilet paper may hold more value.

3. “It's an important part of a portfolio during a crash”

Really?

In 2008, the great recession, gold’s return was 4.96%.

(Hardly a hedge against a financial crisis).

I found a case study on how two different investors handled it.

They both put $51,000 in the Vanguard Total Stock Market Index Fund in 2008.

As the market dips, investor A decides to ride it out and continue investing $500 every month.

Investor B decides to sell, purchase gold instead and spend $500 each month buying more.

By March 2009, Investor A’s portfolio is worth $29,000.

Investor B’s is $59,000 and he looks like a genius.

In March 2013, investor A is worth $104,000.

And B is still well ahead with $131,000.

But from 2015, the stock market booms and the price of gold plummets.

Today, investor A has $167,000 and B has $109,000.

What’s more, investor A enjoyed 2% dividends every year, earning him an additional $17,968.

Since gold doesn’t earn dividends – investor B earned none.

4. “But gold performed well before the pandemic”

Gold is a great example of recency bias.

(That’s when recent events take precedence over the past).

We project these events indefinitely into the future causing people to make poor decisions about their money.

There’ve been two decades in the past forty years in which gold performed well.

This accounts for the vast majority of gold’s price appreciation over the full four decades.

Yet if we look at gold’s returns between 1983 and 2015; $10,000 grew to $14,460.26 only.

(According to the Central Fund of Canada).

A measly total return of 44.60% over 34 years.

The same $10,000 investment in the S&P 500 between 1983 and 2015 grew to $337,659.68.

A total return of 3,276.59%.

Which would you rather have?

Speculation on future price is different from serious investment.

The price of gold is driven by human emotion.

Ever since the ancient Sumerians of Mesopotamia (around 5000 BC) started using gold for ornaments, it has had emotional and cultural meaning.

But unlike great companies, it gives no dividends and does not improve over time.

Like my advice in this recent property blog, I’m not entirely against emotional assets.

They have their place.

But don’t let the media, its sellers or the less well-informed fool you into thinking it’s a better option than a globally diversified portfolio invested within the world's greatest companies...

Because it’s not.