Many people still feel property is a better alternative to capital markets despite the evidence showing otherwise.

Here’s why.

Being British, I was born with a property-fetish gene.

People love the idea that property is a tangible asset, something we can see and touch.

A property has real worth and value that is apparent while many investments, on the other hand, are invisible.

I live in Dubai – an equally ‘bricks and mortar’ obsessed market where fortunes are made and lost within ‘real estate’.

Almost every day, new resort-style residences and country-like estates are built in Dubai - unlike any we've seen back home.

I can understand the temptation.

One investor I know, bought a few off-plan properties three years ago.

He planned to live in one (the penthouse), rent out another and keep the cosy studio for his 16-year-old daughter to set her up nicely when she is ready to leave the nest.

The handover of the properties were scheduled for Q2 of 2020 but the pandemic derailed those plans.

To date, his properties are still standing as empty shells as the construction company faces financial problems.

This investor is leaking money every day on properties he can neither live in nor sell.

Another investor, a business owner, also lost a lot of money from his property.

He bought a gorgeous villa which he was forced to sell for £1 million less than its original price.

It was a harsh pill to swallow as he repatriated to the UK during a declining property market.

Don't get me wrong, investing in property ISN'T a bad idea.

As part of a good life plan and a balanced portfolio, it makes perfect sense.

You may find yourself gravitating toward property investment as it's something you're comfortable with and understand more about.

You may have even invested significant time, effort and capital to build or renovate properties that are not where you call "home".

But are these behaviours grounded upon numbers or just feelings?

Does our emotional love of property cloud our judgement when we think about it as an investment?

Here are 11 things to consider before buying.

(Hat tip to Jonathan Clements from Humble Dollar for these).

1. Homeownership isn’t as safe as it feels

The old saying “you can’t go wrong with bricks and mortar” has been well hammered home.

But the truth is you can.

A house purchase is a big, highly leveraged, undiversified bet.

It’s arguably substantially riskier than owning a diversified portfolio of index funds.

Comparing the returns of property and the stock market is like comparing apples to oranges. The factors affecting prices, values and returns are very distinct.

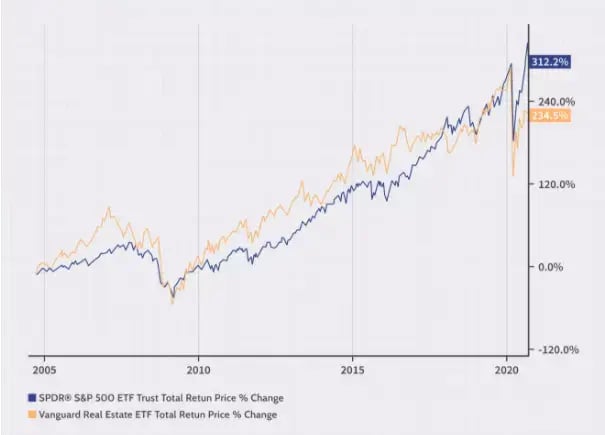

However, we can get a general idea by comparing the total returns of the SPDR S&P 500 ETF (SPY) and the Vanguard Real Estate ETF Total Return (VNQ) for the last 20 years:

The property market is wildly unpredictable, popular locations come and go and you could face unexpected costs along the way.

The most recent period of volatility shows the impact of COVID-19.

In Dubai, we saw villa sale prices record a decline of 3.6% in 2020, with apartment sale prices being even more pronounced, falling 9.5% year-on-year.

Compare that to the S&P 500 that gained a 15.76% return in 2020.

Since 1928, the S&P 500 has generated an annualised total return of roughly 10% versus 5% for Bonds (10-Year Treasury Bonds) and 3% for Cash (3-Month Treasury Bills). In comparison, US house prices have returned a compound annual rate of a little over 1% in the same time frame.

Outliers clearly exist but the evidence clearly shows that world equity is a far better driver of returns, considerably outperforming cash, bonds and fabled property in the long run.

2. Don’t buy unless you plan on staying put for 5-7 years or longer

Buying and selling property involves steep transaction costs.

You need many years of price appreciation to overcome that hit.

A longer time frame also gives you a better idea about how the property market is trending and what your property asset is worth.

3. Home prices generally rise slowly

They climb faster some years and slower in others.

Over the long haul, you should expect an annual increase of around a percentage point more than inflation, roughly 4-5%.

Compare that to investments, the S&P 500 specifically has produced total returns in the 9-10% range.

Now that prices are falling, that tends to feed on itself.

Just as in the stock market, everyone wants to buy at the bottom.

When prices are rocketing, people panic to get in.

4. Annual home maintenance costs

Things can and will go wrong with your property and around the home.

We tend to underestimate the amount of work and expenses associated with maintaining property.

As a rule of thumb – expect to spend around 1-2% of your home’s value on maintenance each year. For a £1 million property, this could be up to £20,000.

Expenses can be managed by doing maintenance yourself, but only if you have the skills to do so properly.

5. The benefits of leverage are often offset by the cost of it

Let’s say you put down £100,000 on a £1,000,000 home.

If the home’s price increases 30% to £1,300,000, your home equity would soar 300%.

But how much did you pay in mortgage interest to get that leveraged gain?

Often the total interest paid rivals the increase in home equity.

Particularly as global interest rates rise.

6. The mortgage tax relief is changing for landlords

Mortgage tax relief was phased out for UK buy-to-let property owners in January 2021.

Landlords will instead receive a reduction on their final tax bill of up to 20% of mortgage interest costs.

The result? Over 400,000 UK resident lower-rate tax payers pushed into a higher bracket with UK higher-rate tax payers most affected.

7. If you have a fixed-rate mortgage, you want inflation

Inflation will likely drive up both your home’s price and your salary.

While leaving your mortgage payment unchanged.

That means you can repay the mortgage lender with depreciated pounds while having more disposable income for everything else.

8. Potential to lose money

Home improvements and remodelling will increase the value of your home.

But they are expensive.

Not to mention time consuming.

Any increase in your home’s value could be offset by transaction costs, maintenance, property taxes and homeowner’s insurance.

And as an international executive, it's likely your properties may be spread across various countries where there are additional tax implications to consider.

Time is money.

The opportunity cost on something that needs your active participation needs to be weighed up.

9. An estate agent wants you to act quickly

If you spend an extra month looking for a home or wait for a buyer to offer you a higher price, the agent might make little to no additional commission.

But don’t allow yourself to be rushed.

Property is a major financial commitment.

10. The benefit of investing in property

You get to live in the place yourself.

A home provides stability for your family and all the social benefits that come with that.

Buying a primary residence is one of the best decisions someone can make for their financial futures.

Despite potential depreciation of the home’s value, you’re effectively renting the home to yourself.

11. A paid-off home is the cornerstone of a comfortable retirement

Paying off your mortgage eliminates a major monthly expense – making retirement more affordable.

This can finance retirement by downgrading to a smaller place or releasing equity.

The bottom line

Investing in property is not all doom and gloom.

I feel like I've successfully ridden “the ladder” myself (having also not compared the numbers) but my words of wisdom on the topic are that you need to think about it very carefully and resist becoming embroiled in the emotions or hype around it.

“...beliefs are hypotheses to be tested, not treasures to be guarded.”

Many of us don't understand the numbers and risks so we use flawed decision-making skills, probabilistic thinking and black-and white-thinking impaired by innumerable cognitive biases to frame and justify our decisions.

Property isn’t a good alternative to a well-invested pension or retirement fund considering all data.

The reason for this is the critical distinction that property doesn't necessarily produce anything, while the best companies in the world (represented in the Indexes) do.

Businesses exist to maximise earnings and the growth of those earnings.

In contrast, the value of a house is based more upon supply/demand and the local economy.

It's generally better to focus on evidence not emotions.

Buy property you can comfortably afford, you’ll enjoy living in, or forms part of a balanced portfolio of equities, property, bonds and cash.

Strike the right balance and resist the urge to go overweight and under-diversify your overall assets to the detriment of your long-term plan and potential returns.

Wise decisions made now could make all the difference when compounded and factored in to your later life.

To quote Robert J. Shiller (a US economist who holds a Nobel prize in economics and the highest academic rank at Yale University):

“If you look at the history of the housing market, it hasn’t been a good provider of capital gains. It is a provider of housing services… to me, the idea that buying a home is such a great idea is just wrong.”

There are no doubt fantastic reasons to own property, but the decision should generally be made because it is life optimising, not returns optimising.