If you look beyond the headlines, there's a bigger European story...

The European economy has had a difficult time over the past seven years following the Global Financial Crisis and subsequent “Great Recession”.

However, according to James Sym, a fund manager at Schroder Investment Management who specialises in European equities, things are about to turn a corner, offering the potential for some decent returns.

Specifically, Sym says company earnings, which have lagged behind those in the US (which are now above pre-crisis peaks), have the potential “to stage a strong recovery from their current depressed levels”. He even suggests eurozone-based corporates have the potential to achieve double digit earnings growth this year - a clear reason to consider investing.

How?

Sym outlines three key reasons why he believes a recovery in European earnings is set to take place; namely the low oil price, a weaker euro and lower funding costs.

The fund manager said Schroders calculates that the oil price drop is worth upwards of €1,000 to each European household. Sym says: “A boost of this magnitude has the potential to drive a real uplift in consumer spending. Subdued consumer demand has historically been a problem for the eurozone but there are signs that this may be changing, with Germany publishing stronger retail sales data in recent months.”

Sym did concede that the low oil price is of course a negative for the region’s oil & gas producers, but that the sector makes up a relatively small part of the European stockmarket when compared to the US, for example.

Meanwhile, the weak euro is supportive of Sym’s two other reasons for an earnings turnaround. The European Central Bank’s recently launched quantitative easing (QE) programme will continue to weaken the euro, particularly against the US dollar as the Federal Reserve has already ended its QE programme.

In turn, Sym says just the weak euro alone “has the potential to boost eurozone corporate earnings by 5%-8% this year”, though he adds “some companies will benefit more than others”.

In addition, another effect of the ECB’s QE programme has been to drive government bond yields even lower, thereby reducing borrowing costs for companies.

The simple explanation for this is that if government borrowing costs (bonds) are pushed down, in this case by the printing of more money (QE), then the costs for companies to borrow (issue bonds) is also reduced. If companies are able to borrow cheaply, they can expand and grow earnings.

Sym highlights banking as one sector in particular which he thinks is set for a pick-up in earnings.

“In aggregate, the banks reported earnings of around €40bn in 2014 as they took significant provisions ahead of the ECB’s Asset Quality Review. Lower provisioning this year suggests they should earn around €80bn.”

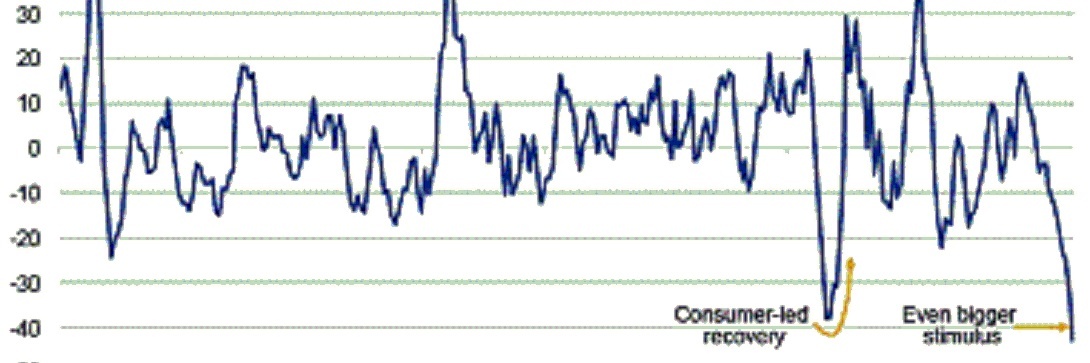

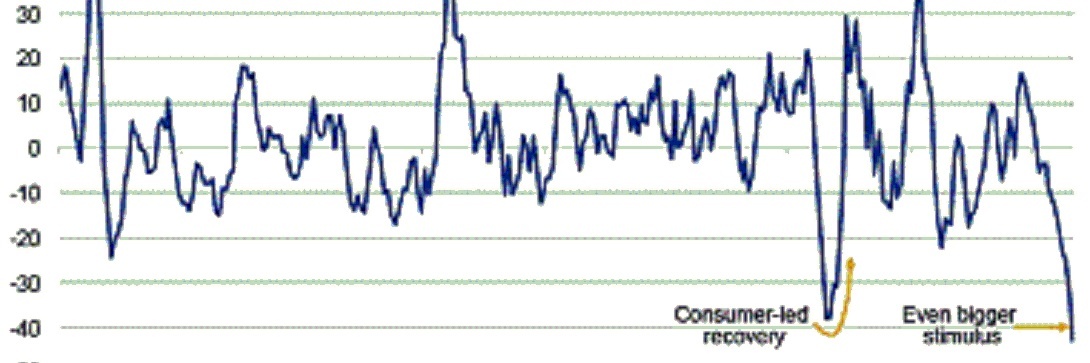

Looking at some of the data behind the predictions, Sym points to the chart above (Source: Morgan Stanley, Jan 2015) which shows the average six-month percentage change in the oil price, the euro-dollar exchange rate and 10-year bond yields.

Looking at some of the data behind the predictions, Sym points to the chart above (Source: Morgan Stanley, Jan 2015) which shows the average six-month percentage change in the oil price, the euro-dollar exchange rate and 10-year bond yields.

The fund manager explains that there has been a significant drop recently in all three factors, exceeding even the fall witnessed at the start of the financial crisis.

“At [the time of the financial crisis], the three factors combined to form a stimulus that resulted in a substantial consumer-led recovery. We think the same can happen this time around, only now the stimulus is bigger so the recovery potential is greater.”

For information about accessing the European equity market, please click the link below to speak with one of our qualified financial advisers.