Revealed: 3 shocking reasons investors lose money (and why you're at risk)

Fully updated January 2018

[Estimated reading time: 5 minutes - read while you eat something green and healthy.]

Offshore bonds and their hidden secrets

A new year.

A new opportunity to keep a closer eye on your portfolio, so you can stop the performance problems that have plagued it in the past.

But we all know how it goes, don’t we?

Fast forward a few months, and staying on top of market movements and financial news gets harder and harder.

Before you know it, there's an email from your financial adviser rattling on about ‘the current investment landscape’ … ‘market volatility' ... ‘a new fund for you to switch your money into.’

You skim down until your eyes focus on the only piece of information you're interested in: your offshore investment bond's valuation.

Your heart sinks.

Performance has slipped again.

And just like last time, it's worse than the ups and downs you might expect when investing.

Appalling performance seems to be endemic to your portfolio.

What the hell's going on?

Get a portfolio X-Ray Review™ today and discover the truth about your investments »

Well, there are three reasons why your offshore bond is losing you money.

Before we dive into the reasons there's one thing I need you to keep in mind...

Offshore bonds aren't necessarily the problem, but the way they're sold and the investments they contain can easily add up to create serious issues for your financial well-being.

Reason #1: High charges are swallowing up growth

Imagine trying to swim with weights tied to your ankles.

It would take massive effort just to stay afloat – never mind to swim.

Well, offshore investment bonds charges have a similar effect on your portfolio.

They weigh it down, preventing any positive movement whatsoever.

Based on what we see every day at AES, when we unravel these often ruinously expensive structures for people, typically offshore investment bond investors are paying:

-

1.5% - 5% annual charge to the pension or bond provider

-

£400 fixed annual fee to the bond provider

-

1.5% - 5% a year establishment charge for the first 5-10 years

-

4% - 8% initial commission on the investments held in the bond

-

1% - 3% annual charge on investments (this is often much more, and more opaquely hidden from you if you're invested in structured products)

This can add up to annual charges of 6% or more AND initial charges of 8% or more.

What’s worse, all these fees and charges are entirely hidden from you - so only someone with a PhD in maths can work out their total costs in real terms.

How these charges affect your money

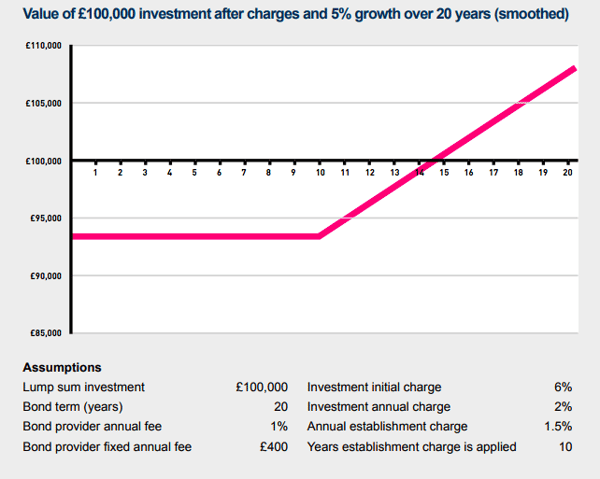

Imagine a portfolio of £100,000 growing at a reasonable rate of 5% a year.

Once you take the above listed charges into account, the growth over 20 years would only be equivalent to 0.08% (with charges of £88,698).

That's less than what you’d have received if you’d left the money in a bank account!

Also, as you can see from the above graph, you’d have to wait 15 years before seeing any growth at all.

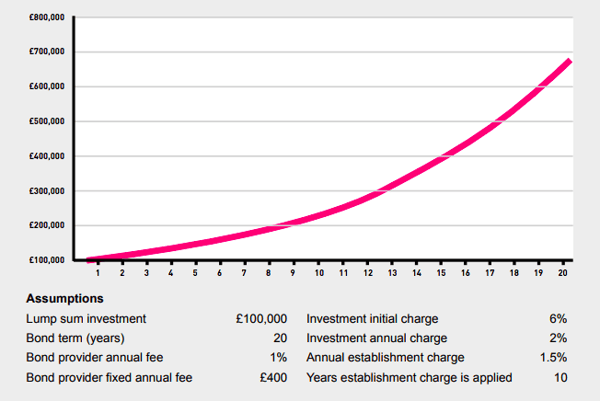

But what if you experienced fantastic growth of 15% a year instead?

Charges would still eat up nearly two thirds of that, leaving you with an effective growth of just 5.95% a year...see: -

Your final fund value is £695,318, but the total charges paid are an astonishing £226,259.

Reason #2: A toxic investment mix

Offshore bonds are an investment wrapper.

That means they are a container you can fill with pretty much any investment you like, with the exception of physical property.

So, if a bond is the most appropriate vehicle for your investments, your adviser should recommend you fill it up with a well-diversified, risk appropriate portfolio of investments, suitable for your personal circumstances.

They should ensure your portfolio is structured so it has the best potential for delivering you healthy returns.

So, how likely is that to happen?

So, how likely is that to happen?

Sadly, the odds are stacked heavily against it!

Here's why: -

Firstly, because some advisers receive more commission on the investments they recommend you wrap up in your bond.

And, the more alternative and opaque the investment (e.g. hedge funds and structured products), the higher the charges you will pay, and the higher the commission your adviser will take.

Secondly, because advisers tend to recommend racy investments that look like they could deliver exceptional performance.

However, the racier an investment, the higher the risk it will suffer an horrific fall. And, once a fall has happened, the way back up is much harder than the way down...

Look: -

So, if you're an expat with an offshore investment bond, your portfolio is potentially an elaborate gamble, in which the only guaranteed winner is your so-called financial adviser.

Reason #3: Sold and forgotten

A portfolio loaded with racy, alternative investments needs in-depth research at the outset, and continuous monitoring thereafter.

Sadly, that’s unlikely to happen.

Get a portfolio X-Ray Review™ today and discover the truth about your investments »

Very few financial salespeople have the time, resources and expertise to conduct quantitative and qualitative analysis on the investments they recommend.

What's more, there’s no incentive for them to do so!

They receive their commission upfront – so what happens next, whether you make or lose money, has no direct impact on them.

So, once the policy has been sold, they have no incentive to look after you and your portfolio at all...

Unless of course, you allow them to regularly switch your investments...because then they generate more fund commission at your expense.

Or, if you give them more money to invest...for more commission...

Or, if you refer them to your friends who they can also swindle!

Think of it like this...if an employer pays a new employee their salary for the next 10 years in one lump sum on their first day, what are the chances of that employee working hard, or even coming back to work?

Slim!

So, regardless of what that silky-tongued salesman tells you about his ‘free’ or ‘cost-effective’ services, there is absolutely no alignment between your interests and his.

This is why countries like the UK and Australia have banned commission only advice models.

Follow your curiosity

If any of what you've read here strikes a chord and you want to know more: -

1) Read our reviews of many of the most commonly sold offshore investment bonds

AND

As you'll see from the reviews, bonds aren't all bad, and you could be one of the few investors whose bond has been responsibly set up, and who's consequently not crippled by exorbitant charges.

If so, your X-Ray Review™ will confirm that, and help you put any niggling concerns to one side.

If, however, your offshore bond was set up less than responsibly, as is sadly all too often the case, getting the truth and your options with an X-Ray Review™ will be the beginning of a recovery.

It will help you stop building someone else’s wealth, and enable you to build your own.