As we grow older and navigate through life, we quickly realise the more we delve into a subject, the more complex it becomes. Take supply and demand.

It's a concept most of us can wrap our heads around, but truly understanding how these variables dance with changes in interest rates, inflation, and trade relations demands a deeper dive.

Or the idea of "opportunity cost."

At first glance, the idea of opportunity cost seems straightforward— it's the value of the next best alternative forgone when a decision is made. However, as we delve deeper into various scenarios, we uncover layers of complexity.

Imagine you're deciding between starting in a new senior position at a well-known firm and starting a business.

You weigh things like salary, benefits, and job security. But, once you dig a bit deeper, you realise it's not that simple.

Opting for the senior position means benefiting from a stable income, corporate resources, and an established career path. Yet, it also entails foregoing the autonomy and potential financial gains that come with entrepreneurship.

On the one hand, starting your own business promises independence, the thrill of building something from the ground up, and the prospect of substantial returns.

However, the risks are palpable — financial instability, statistically slim chances of success, and the absence of the security and certainty provided by a corporate position.

Surprisingly, greater wealth is typically obtained via the corporate career rather than the uncertainty of business start-ups. But it's not just about money. It's about personal growth and a sense of accomplishment. Choosing between a senior role and entrepreneurship is more than just a trade-off; it's a multi-faceted decision that needs a good, hard look from all angles.

But, oddly enough, as we push past a certain point in any field, things tend to simplify again.

Details and unnecessary complexities seem to fade, and we distill the subject into the few key points that truly matter.

Real simplicity emerges from a profound understanding and appreciation for the subject. When shared, this simplicity acts as a beacon, helping the rest of us make sense of the world without earning a PhD in every discipline.

Think of the great teachers or writers who have this magical quality.

Richard Feynman can make physics lessons not only digestible but funny.

Who would've thought that was possible?

The curse of unnecessary complexity

Leonardo da Vinci said "Simplicity is the ultimate sophistication."

Unfortunately, we often find ourselves drowning in complexity when simplicity is what we crave.

It's wielded like a weapon to baffle, leaving us with little understanding and making us dependent on the so-called experts.

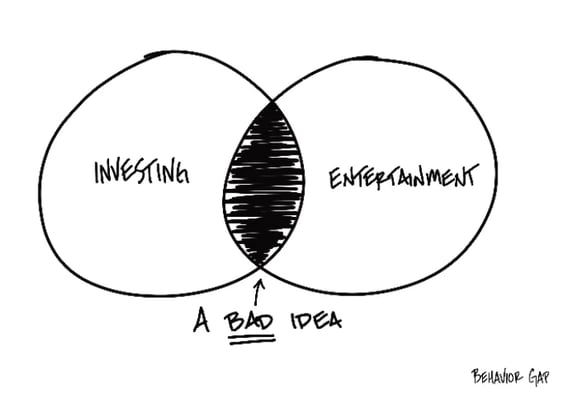

The financial world is no stranger to this.

Despite calls for improved financial literacy, few actually contribute to the needed changes. Many in the industry use complexity to spread fear and are happy to sell a product without having the buyer understand what they're getting themselves into.

Media sensationalism adds fuel to the fire, and the financial machine stands at the ready with a solution that might have worked for the last crisis but is questionable for the current one.

Lessons from financial history

The history of financial markets teaches us a few timeless lessons.

Armed with this knowledge, every new crisis seems less daunting, and the world becomes a tad simpler.

Money, too, can be straightforward if you choose to see it that way.

Sure, financial product providers will gladly serve you complexity on a silver platter, with a product designed for every financial fear imaginable.

But starting there might lead you astray.

You need to decode what these mean for your life and the lifestyle you desire.

Otherwise, each new crisis may force you to reassess your strategy, sending you back to square one.

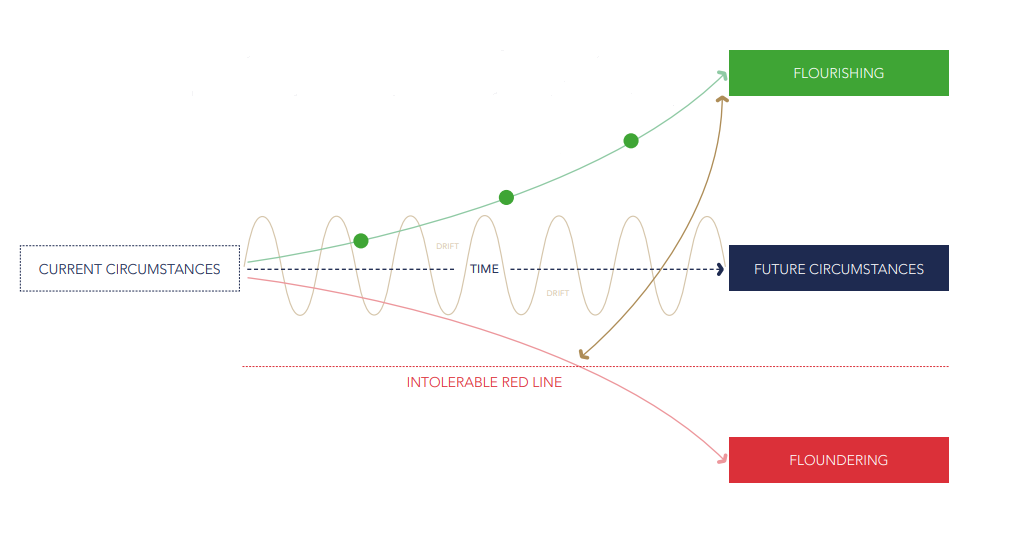

A genuine understanding of money empowers you to build a strategy based on spending less than you earn, investing wisely, handling short-term expenses, leveraging compound interest, and appreciating historical market returns—all blended with good old discipline and patience.

This is how you stay on the green line towards a flourishing future, instead of drifting or ending up on a downward path.

While products may still have a role, they should occupy their proper place.

In life, we often face the choice between simplicity and complexity.

Unfortunately, complexity is often mistaken for intelligence and sophistication.

In financial matters, however, nothing could be further from the truth.

The real tragedy is that many aren't aware that simplicity with money is a viable option.

They buy into the complexity sold to them, leading to overwhelm, confusion, and disengagement—ultimately resulting in long-term consequences.

Our experience tells us that 'simple and done' is often better than 'complex and perfect'.

Taking action and engaging in your financial affairs lead to a profound understanding of how your decisions shape your future.

So, how can your plan be simplified to eliminate the unnecessary?