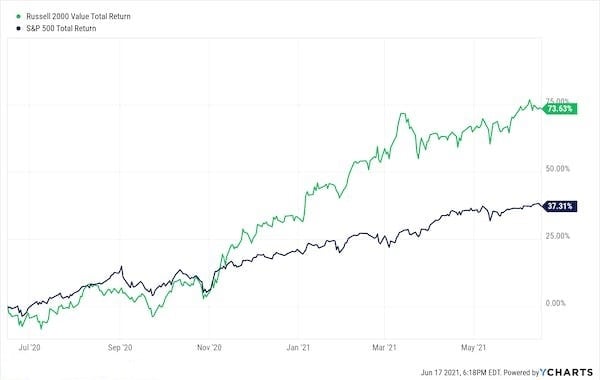

Over the last 12 months, small-cap value stocks are up +73%.

The S&P 500 is up +37% during the same period.

Why have small-cap value stocks been performing so well?

Let's use toothpaste to explain.

When you're shopping for toothpaste, you likely check the price tag before buying.

If you find a 100ml tube of Colgate for £3 and a 100ml tube of Crest for £1, you will likely buy Crest.

It's human nature to look for value for money and pay less if your 'expected return' is the same.

In this example, you're looking after your teeth from either option.

By paying less, the return on your investment is higher.

Price matters

This theory can and should be applied to investment decisions as well, no matter the 'economic environment' we're in.

Analysts will make the case that the recent outperformance of small cap stocks is being driven by factors like:

- Inflation

- Rising interest rates

- Economic recovery

While these factors may contribute, the real reason goes back to basic economic theory.

We know that not all stocks have the same expected return.

Through academic research, we can identify which stocks have higher expected returns over longer periods of time...

A stock's current price reflects information about expected future cash flows discounted by the expected return.

All else equal, companies with lower relative prices (value stocks) and lower market capitalisation (small-cap stocks) should have higher expected returns, as they did in 2020.

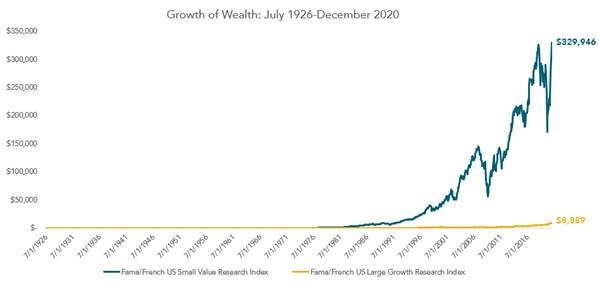

Since 1926, small company (aka “small-cap”) US stocks have outperformed large-cap stocks by 1.6% per year, while high book-to-price (aka “value”) stocks have outperformed low book-to-price (“growth”) stocks by 3.0% per year.

If you invested £1 in the Small Cap Value index in 1926, it would have grown to £330,000 by the end of 2020.

The same £1 invested in the Large Growth index would have only grown to £8,890.

Over the last 10 years however, small-cap investors have seen disappointing returns.

In fact, the 10-year periods ending each month of 2020 were the 12 worst periods in history for small-cap value when compared to large growth stocks.

Like any asset class, there will always be periods of underperformance for small cap value investors. Sometimes safer assets like bonds perform better than riskier stocks for extended periods of time.

These periods can be frustrating, but you will have a better investment outcome by staying the course over the long-term.

So, what can we expect from small-cap value stocks going forward?

We certainly don’t expect them to underperform growth like we did in the 2020. (The 39% differential was the greatest calendar year underperformance ever!)

We also don't think the recent eye-popping returns in value stocks are sustainable.

That said, we do expect small/value stocks, on average, to outperform large/growth.

There is empirical evidence that supports this.

Price matters. And paying a lower price implies a higher expected future return.

We believe investors are best served by making decisions based on proven, academic research.

While markets and economies are constantly evolving, the theory that supports small-cap value stocks is evergreen.

We choose to “tilt” our clients’ portfolios – and our own, of course – towards small-cap and value stocks.

This means that while we still “own the market” by holding essentially every public stock in the world (via mutual funds), we modestly overweight small-cap and value stocks and underweight large-cap and growth stocks.

It’s a big part of the reason we prefer Dimensional to traditional index funds.

The evidence in peer-reviewed academic literature strongly favours tilting portfolios towards small-cap and value stocks.

If the supporting evidence ever changes, we would be forced to reevaluate.

Until then, we'll continue to follow the data.