There have only been a handful of truly monumental “discoveries” in the history of investment theory.

The three-factor model, developed in 1992 by Nobel Laureate Eugene Fama (University of Chicago) and Professor Kenneth French (Tuck School of Business, Dartmouth College), is on that short list.

Prior to the three-factor model, accepted wisdom was that any given stock’s expected return was determined primarily by just one factor, the stock’s “beta,” or its systematic risk as compared to the overall market.

The three-factor model hypothesized that two other factors – a stock’s size and its book-to-price ratio – also meaningfully contribute to its expected return.

To say that those two factors contribute to expected return is an understatement.

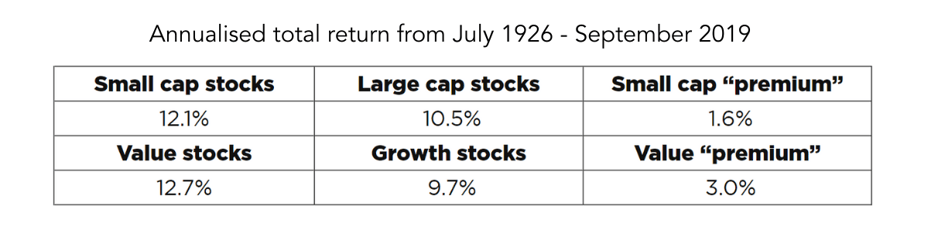

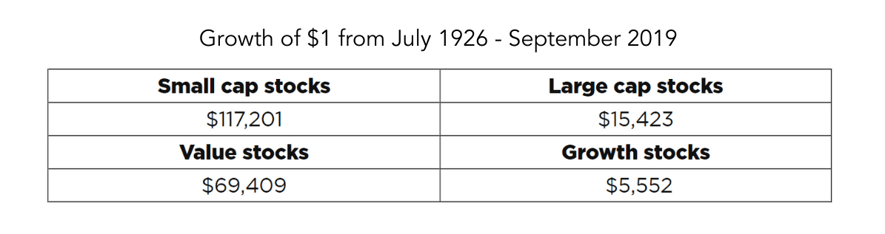

Since 1926, small company (aka “small-cap”) US stocks have outperformed large-cap stocks by 1.6% per year, while high book-to-price (aka “value”) stocks have outperformed low book-to-price (“growth”) stocks by 3.0% per year.

These differences in return are known as the small-cap and value “premiums.”

These premiums are robust across geographies and time periods

Investors disagree as to why these premiums exist:

Investors disagree as to why these premiums exist:

Do they represent a market inefficiency...

Or are they simply reflective of investor risk preference?

This distinction is important.

If it’s an inefficiency (i.e., the stock’s price does not incorporate all publicly-available information), then we should expect the anomaly to disappear as it becomes known.

If instead, it reflects investors’ collective risk preferences (i.e., all else equal, investors prefer to own large-cap stocks to small and prefer growth stocks to value), then the premiums are simply the compensation that investors demand in order to be willing to own riskier (or otherwise less desirable) stocks, in which case we would expect the premiums to persist.

Note - that the difference in risk also explains why stocks would be expected to outperform bonds, a phenomenon known as the “equity risk premium.”

As with most good debates, the truth almost certainly lies somewhere in between.

For what it’s worth, so do Professors Fama and French.

Because we think it’s a good bet that the premiums will persist going forward...

We choose to “tilt” our clients’ portfolios – and our own, of course – towards small-cap and value stocks.

This means that while we still “own the market” by holding essentially every public stock in the world (via mutual funds), we modestly overweight small-cap and value stocks and underweight large-cap and growth stocks.

As an oversimplified example, Microsoft – a large-cap growth company – represents roughly 3.6% of the total US stock market, but only 2.4% of our clients’ US equity portfolios.

The remaining 1.2% is used to overweight the universe of US small-cap and value stocks.

Historically, a portfolio with this degree of tilting would have returned 11.0% per year, as compared to 9.8% for the total US stock market.

The difference between the two (1.2%) represents the portion of the small-cap and value premiums that we hope to capture for our clients.

Dimensional Fund Advisors was founded in part to allow advisors to tilt portfolios – and thereby capture these premiums – as efficiently as possible.

It’s a big part of the reason we prefer Dimensional to traditional index funds.

But while investment theory is clean, the real world is messy.

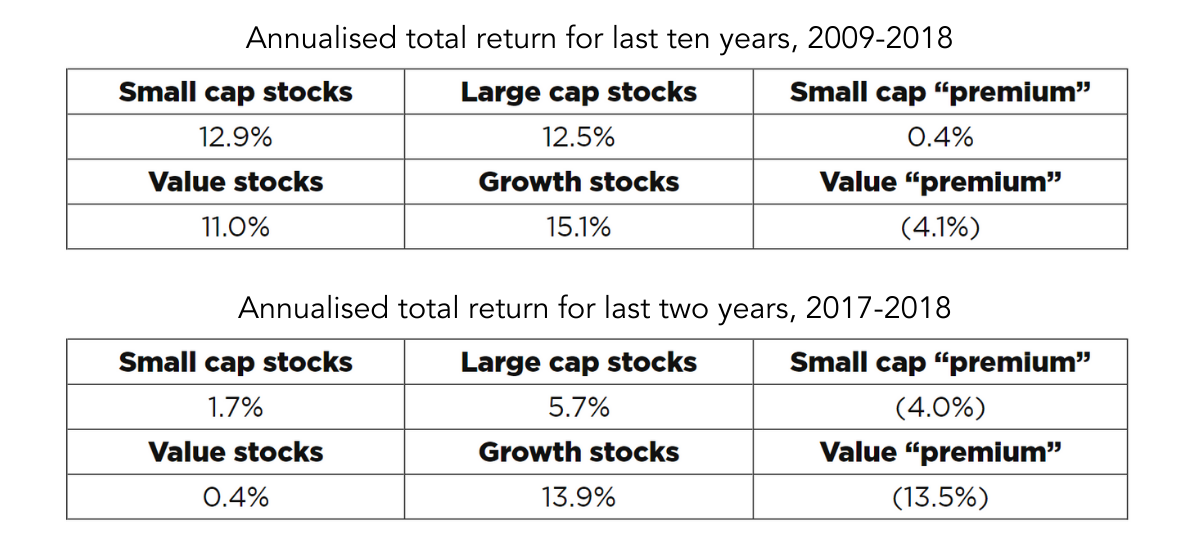

Just as stocks can underperform bonds for extended periods (i.e., the equity risk premium can be negative in any given 1-, 5-, or even 10-yr period), the small-cap and value premiums are often negative in spurts as well.

This short-term underperformance is a feature and not a bug.

If stocks never underperformed bonds, then investors wouldn’t require the added compensation to own them and the premium wouldn’t exist in the first place.

The same is true for small-cap and value stocks...

If the premiums were never negative, there would be no premiums.

Indeed, the small-cap and value premiums have been mostly negative over the past ten years (ending in 2018), particularly the most recent two:

Just as it would be a mistake to abandon stocks during periods when they underperform bonds, it’s important to stay committed to small-cap and value stocks even during bad stretches, as the periods that follow are often when premiums are at their greatest.

Analysing all of the ten-year periods since 1927 in which the small-cap premium was negative, the average premium over the following ten-year period was a healthy 4.6%.

For the value premium, it was an incredible 8.3%!

So what would make us abandon this strategy?

As evidence-based investors, we follow the data.

The evidence in peer-reviewed academic literature strongly favours tilting portfolios towards small-cap and value stocks.

If the supporting evidence ever changes, we would be forced to reevaluate.

Few investing concepts are both as potentially powerful and as academically supported as tilting towards small-cap and value.

But like so much else in investing, the benefits from tilting don’t come free – there will always be periods that test investors’ resolve.

Only those with the discipline to stay the course get to earn the potential long-term premiums.