In 2012, Vanguard Group founder John C. Bogle released a book.

In it, he urges a return to the common-sense principles of long-term investing.

So, what are they?

Bogle created the first Index fund.

His views on the changing culture in the mutual fund industry are provocative.

But with 60-plus years in the investment field, they are well founded.

Views like…

‘Speculation has invaded our national retirement system…’

‘Our money managers have failed to effectively participate in corporate governance…’

‘We need a federal standard of fiduciary duty.’

But perhaps my favourite part of the book is right at the end.

Here we find ten simple rules that will help investors meet their financial goals.

So, while he advises not to hold your breath waiting for the financial system to get fixed, the good news is that you can immediately begin following his lessons to get better results.

A common-sense strategy that "may not be the best strategy ever devised. But the number of strategies that are worse is infinite."

The lessons are immeasurably valuable:

1. Remember reversion to the mean

What's hot today isn't likely to be hot tomorrow. The stock market reverts to fundamental returns over the long run. Don't follow the herd by selecting your investments for tomorrow by picking the winner from yesterday.

2. Time is your friend, impulse is your enemy

Take advantage of compound interest and don't be captivated by the noise of the market. That only seduces you into buying after stocks have soared and selling after they plunge.

3. Buy right and hold tight

Once you set your asset allocation, stick to it no matter how greedy or scared you become. Change your portfolio allocation only as your investment profile changes.

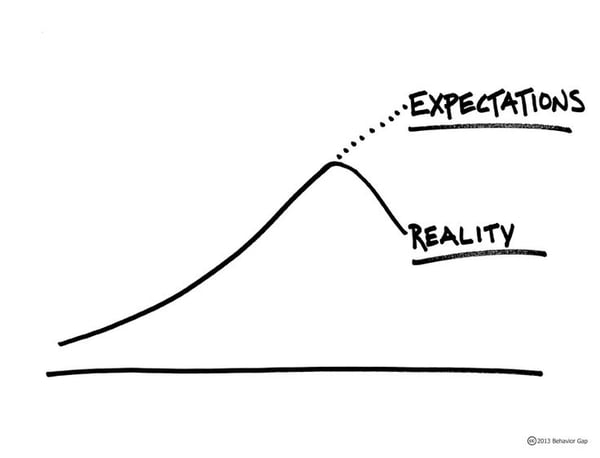

4. Have realistic expectations

You are unlikely to get rich quickly. Bogle thinks a 7.5 percent annual return for stocks and a 3.5 percent annual return for bonds is reasonable in the long-run.

5. Forget the needle, buy the haystack

Buy the whole market and you can eliminate stock risk, style risk, and manager risk. Your odds of finding the next Apple are low.

Owning the entire stock market is the ultimate diversifier for the stock allocation of the portfolio. When you understand how hard it is to find that needle, simply buy the haystack.

6. Minimise the "croupier's" take

Beating the stock market and the casino are both zero-sum games, before costs. You get what you don't pay for.

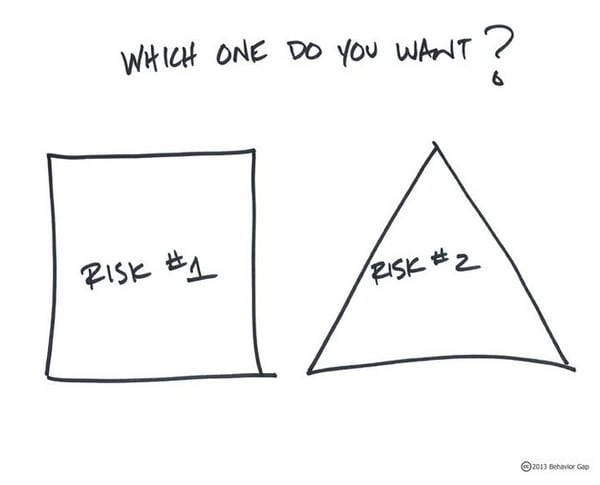

7. There's no escaping risk

When you decide to put your money to work to build long-term wealth, you are not deciding whether or not to take risk, for risk is everywhere.

What you must decide is what kind of risk you wish to take.

I've searched for high returns without risk; despite the many claims that such investments exist, however, I haven't found it.

And a money market (sitting in cash) may be the ultimate risk because it will likely lag inflation.

8. Beware of fighting the last war

What worked in the recent past is not likely to work going forward. Investments that worked well in the first market plunge of the century failed miserably in the second plunge.

9. Hedgehog beats the fox

Foxes represent the financial institutions that charge far too much for their artful, complicated advice. The hedgehog, which when threatened simply curls up into an impregnable spiny ball, represents the index fund with its "price-less" concept. For more on the hedgehog concept, I’d recommend reading one of my favourite books, Good to Great by Jim Collins.

10. Stay the course

The secret to investing is there is no secret. When you own the entire stock market through a broad stock index fund with an appropriate allocation to an all bond-market index fund, you have the optimal investment management strategy. Discipline is best summed up by staying the course.

Though Bogle will never be able to convince most financial ‘advisers/salespeople’ of their disservice to clients, he appears to be having success persuading an increasing number of investors to keep away from the fox.