[Estimated time to read: 3.5 minutes]

Arguably, there’s one question that all investors want the answer to.

“How can I make higher returns?”

After all, who invests if they don’t want to make more money?

“Money is not the only answer, but it makes a difference”

- Barack Obama

The evidence highlights 2 changes that you can make if you want higher investment returns.

1. Go Passive

Passive investing, or indexing, is where you replicate market performance using index funds or exchange-traded funds (ETFs) that track major indices.

It’s the increasingly popular alternative to active investing, which is what most investors do.

![]() According to calculations by the fiduciaries at Index Fund Advisors Inc., an average passive investor, invested in their diversified portfolio of index funds, enjoyed a 12.34% annualised return over 30 years to 2014.

According to calculations by the fiduciaries at Index Fund Advisors Inc., an average passive investor, invested in their diversified portfolio of index funds, enjoyed a 12.34% annualised return over 30 years to 2014.

In comparison, market researchers Dalbar estimate that the average actively-invested investor enjoyed a 3.79% annualised return over the same period.

That’s an annualised difference of 8.55%.

On a £100,000 investment over 30 years, the passive investor from this example would make £2,975,942.30 more!

How does a passive approach deliver higher returns?

There are 3 main reasons why index funds deliver higher returns:

#1 - They cost far less.

On average, active US equity funds are 7 to 8 times more expensive than passive funds of a similar asset class.

Just a 1% difference in overall costs over the course of 30 years is a whopping 25% reduction in accumulated wealth!

#2 - Market returns are attractive over the long-term anyway!

From 1928 to 2015, the S&P 500 delivered a 9.27% annualised return.

That equates to an investor doubling their money every 8 years, and about 5 times over their working life.

From 1928 to 2015, a globally diversified portfolio would have delivered an 11.49% annualised return.

That equates to an investor doubling their money every 6 years, and roughly 7 times over their working life.

Therefore, even if you do nothing more than follow the index, you’re likely to enjoy good returns over the long-term.

#3 - Index funds are highly efficient.

Like the markets they mirror, index funds are very efficient.

Markets around the world simultaneously price the cost of capital and expected return of capitalism, and are highly efficient.

As it’s extremely unlikely that a single investor knows more information about a particular security than the collective wisdom of the entire market, index funds are always going to be more efficient.

2. Get advice

The second way to increase your returns as an investor is to get good advice.

A recent Vanguard study explored exactly how much monetary value a good fee-based financial adviser typically adds to your investments.

This consisted of:

- Lowering expense rations: 45 basis points (0.45%) back in your pocket

- Rebalancing portfolio: 35 basis points (0.35%) of increased performance

- Asset allocation: 75 basis points (0.75%) of increased performance

- Withdrawing the right investments in retirement: 70 basis points (0.70%) in savings

- Behavioural coaching: 150 basis points (1.50%) for helping you

This is a grand total of 3.75% pa of added value - before you look at tax reduction and financial planning benefits!

International investment management is traditionally far more medieval than the US and UK markets from which this study draws.

All the evidence we have seen indicates the value of a good fee-based adviser to an expatriate can very often be 5% or higher each and every year compared against the widely used ‘brokers’ or ‘IFA’s in this marketplace.

“The investor’s chief problem—and even his worst enemy — is likely to be himself.” - Benjamin Graham

Here’s what Vanguard said:

“Guiding clients to investing success happens not as a result of some fanciful, perfect product, but from advisors’ adherence to certain guiding principles…”

- Being a behavioural coach who helps clients to get on the right path and prevents them from taking wrong turns;

- Being tax-efficient through prudent asset location and tax-smart spending strategies;

- Keeping investment costs low;

- Rebalancing in a disciplined fashion.

Is 3%+ pa worth the cost of advice?

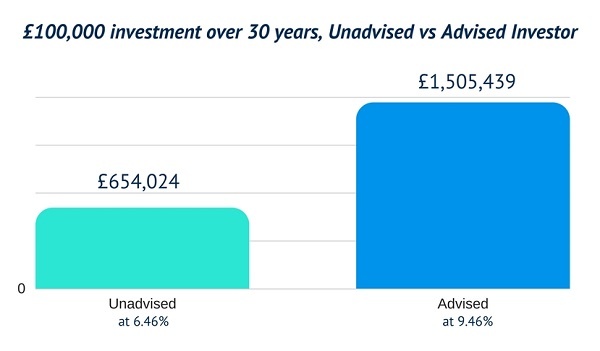

For the 30 years to 2013, the afore-referenced fiduciaries at Index Fund Advisors Inc., calculated that their Index Portfolio 70 had an annualised return of 9.46%.

A hypothetical unadvised investor would have got 3% less, namely 6.46%.

That equates to a massive 68% less!

On a £100,000 investment over 30 years, the advised investor from this example would make £851,415 more than the unadvised.

“There seems to be some perverse human characteristic that likes to make easy things difficult.”

- Warren Buffett

The evidence demonstrates that professionally advised, passive investors make the most money.

Therefore, if you want to make the most money when investing, you should do 2 things.

- Select a fee-based professional financial adviser with chartered status, who is a fiduciary duty-bound to work in your best interests; This rules out 95% of brokers, wealth managers, bankers, IFAs and other financial salespeople.

- Opt for passive over active – index funds not mutual funds.

If you do these 2 things, you are highly likely to be the most successful investor you can possibly be.

How to be as successful as possible – your step-by-step guide

If you want to be as successful an investor as you possibly can be, here’s my offer for you:

- Get an X-Ray Review of your current portfolio;

- Get evidence on the opportunities to increase your potential performance;

- And receive a comprehensive financial plan that shows you how to be a more successful investor…

All recommendations will be focused on increasing your returns.