[Estimated reading time: 3 minutes - read while eating an apple on your lunch break!]

Stress affects our bodies, thoughts, feelings and behaviour.

Left unchecked, it causes health problems…

Considering everyone worries about money[1], even children[2], alleviating financial stress will create positive change.

Here’s how to tackle 5 of the most common money worries…

1. An emergency strikes!

Emergencies happen more often than you expect.

From burst pipes to broken cars, you must allow for emergencies and get financially positioned to cope.

Borrowing money to fund an emergency will mess up your budget and create more stress.

Solution = Build an emergency fund as quickly as you can, and accept everyone encounters unforeseen problems.

Get 3 – 6 months of your outgoings squirreled away to alleviate some of the stress an emergency causes.

Leave the money in your bank account so it's easily accessible – and when you use your emergency fund, build it straight back up again.

2. Buying a home.

It’s probably the largest purchase you’ll ever make, and it can be overwhelming.

Home buyers in the US underestimate the cost of buying a new property by an average of $10K, and overspend by an average of $40K.

Lenders have learned little from the last financial crisis it seems, because they’re enabling personal debt levels to rise rapidly again.

Know that a lender will give you as much money as they can, but that’s not good for your long-term financial or emotional wellbeing (especially when interest rates go back up).

Solution = Plan ahead and stick rigidly to your budget.

Make sure you get a good deal on a home and on your mortgage, and do not overstretch yourself.

3. How much to save for retirement?

Many people go with flow, saving into a company pension, paying in just enough to get the employer’s contribution…and that’s it!

That will not fund the retirement of your dreams.

Not knowing if you have enough money to live a secure and happy future is one of the greatest sources of stress.

Solution = It’s your life, you have to plan for it!

You might have assets such as property and only need to save 5% of your salary into a pension.

Or you might be the ‘average’ person who needs to save about 15% - 20% of income towards retirement.

But it’s your life, and it’s personal – so get a comprehensive personal financial plan to guide your decisions.

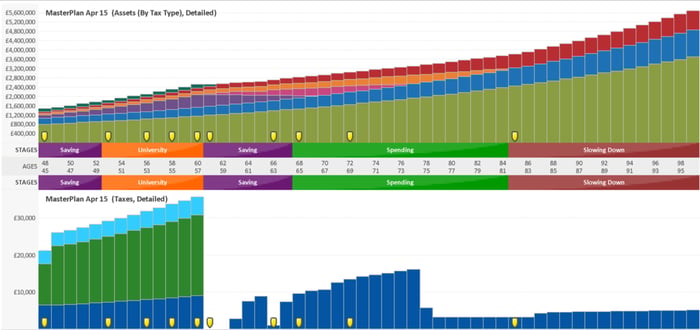

Your financial plan should include a cashflow forecast, enabling you to see how your future may look...

4. Knowing when to retire.

You may have an age in your head – 65 perhaps – but what happens when you get closer to that age?The most common questions that come up are:

‘Am I really ready?’ and ‘Do I have enough money to retire?’

Solution = It’s the same as number 3! Get a detailed cashflow plan to give you the peace of mind that the decisions you make are the right ones.

You might have enough to retire early!

5. When to cut your children’s money-cord.

Does this sound familiar...

- I just can’t say no.

- I just keep paying.

- I don’t know how to approach the subject of financial independence with my children.

- I don’t want to face it...?

Know that not encouraging independence is preventing your children from experiencing freedom – freedom to discover they can do it on their own.

Solution = Be upfront about what will happen early, and repeat it often – don’t just cut them off.

Show your soon-to-be adult children what you’re paying, list it out and detail what their expenses cost.

Car insurance, phone bills, health insurance, clothing, university, accommodation…etc., etc…

Then, have a conversation about when bills are going to start flowing to them.

Ideally it should be a gradual process, and if you get them onside early, they will be well prepared to begin taking full financial responsibility.

Money worries aren’t the only stressors in life. Relationships, divorce, work, children and bereavement are other examples of stressors.

But as with the 5 issues detailed above, financial planning can help lessen even the worries events such as these cause.

Just remember:

“a problem shared is a problem halved”…and contact us.

We’ll likely have an article, an eBook, or personal advice to help…

References:

[1] http://www.telegraph.co.uk/finance/personalfinance/7134785/Money-is-nations-biggest-worry-say-survey.html

[2] http://www.telegraph.co.uk/money/consumer-affairs/one-in-three-children-have-money-worries/