As an expat, how can I diversify my investment portfolio? (3 top tips & 1 free guide!)

Fully updated January 2018

[Estimated time to read: 3 minutes - read while petting your dog.]

Here's a typical question my colleagues and I get asked by international executives looking for the best way to invest:

"Are there any special funds I can invest in?"

They ask because expatriates are typically led to believe they must access a new world of wonderfully diverse investment opportunities now they live abroad, if they want to be successful.

But, although investment diversification is an important part of building a balanced portfolio, over-diversifying - or worse still, diversifying into abstract and risky funds or sectors - isn't a good idea.

In this article, I will:

- Discuss the basics of diversifying your expat investment portfolio,

- Touch on what a well-diversified portfolio might look like for you, and

- Give you 3 top tips and 1 free guide to get you on the right track.

Diversification: your key to balancing risk and return

When anyone asks whether there are any new ideas, interesting investments or special instruments to invest in as an expat, alarm bells start ringing at AES HQ!

- Good investing isn't speculating.

- It's not about rushing headlong into 'the next big thing.'

- And, when done properly, successful investing is actually inherently dull for the investor!

Successful investing is about:

- Balancing risk and return,

- Using evidence (not guesswork), and

- Staying the course for the long-term...not flitting from one headline grabbing investment (like bitcoin!) to another.

And yes, it's true, investment diversification is one of the main keys to building a robust and successful portfolio.

But that doesn't mean diversifying into complex strategies, emerging markets, cryptocurrencies and fine wines!

It means establishing the correct target diversification and mix of assets based on many elements that are specifically personal to you - like your age, number of dependents, tolerance for risk, overall investment management objectives, proximity to retirement...

And, it includes a requirement to rebalance occasionally, and review periodically.

New doesn't necessarily mean better

We're known for being a forward-thinking firm, and are strong believers in exploring new investment ideas.

Our company is also full of bright individuals with inquisitive minds, open to new ideas and research.

However, we are also firm believers in not taking unnecessary risks, and always following the evidence (rather than the headlines).

We know that your wealth represents your sacrifices and hard work, your hopes for the future, and your potential for lasting peace of mind. And just as we don't take risks with our own families' finances, so we don't take risks with our clients' money.

And, we go a step further, and caution any international executive investor against taking unnecessary risks with their wealth.

There are often real and significant risks associated with that new, exciting investment idea or structured savings strategy that's being actively promoted by an expat financial salesperson.

Tread carefully.

I know some investors believe that by purchasing but-to-let property, investing in structured products, direct trading or buying esoteric, specialised funds they will achieve proper diversification away from mainstream (read: dull) investments - and they'll get rich quicker.

But it's not necessarily true.

Remember, investment done properly is as dull as watching paint dry and grass grow.

You can't out-trade a poorly diversified portfolio

In the same way you can't out-train a bad diet, (so my wife keeps telling me), so you can't out-trade a badly diversified portfolio.

No matter how many times you chop and change or sell and buy, you'll be incurring fees, potentially facing excessive risk, attempting the impossible (i.e., timing and guessing the market) and ultimately undermining your financial future.

When you hear about the next big thing, especially in Expat-land where you and I live, in many cases you should file these so-called opportunities into the ‘too good to be true’ category and walk away.

Chances are, you'll just be buying into a new kind of risk, like fraud, or hidden fees, or fund manager failure.

And the sad truth is, all too often the more diverse or complex an investment, the more likely it is to fail you.

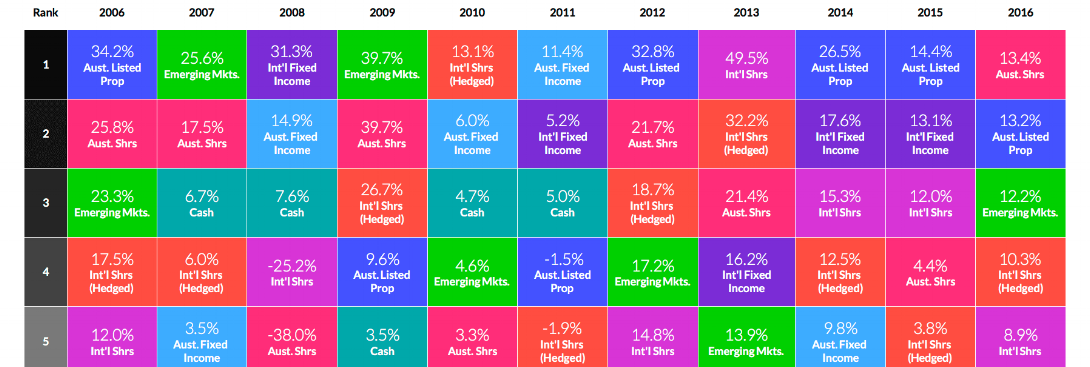

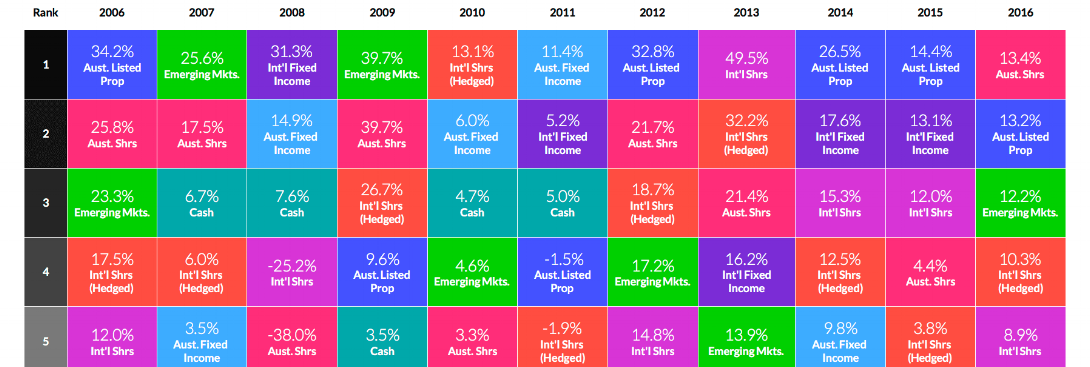

So, what does a well-diversified portfolio look like?

Diversification is about understanding the risks within an investment and, across a portfolio, balancing those risks and ensuring that particular risk is not repeated too frequently.

For example, an investment in an Asian equity fund is likely to give you exposure to China.

To then buy two further Chinese equity funds would mean your exposure to Chinese equities is too high!

As ever, investing is about having your eyes open, having a plan and not being swayed by short term market movements or “get-rich-quick” investment schemes.

If my colleagues and I can help in anyway, please get in touch...otherwise, here are some useful resources for you:

3 tips for investment diversification

- Choose index funds: investing in funds that track different indexes is a brilliant, long-term diversification and investment strategy for financial success.

- Think eggs and baskets: and don't put all your wealth in one stock, sector, country or currency.

- Fixate on fees: the more you pay in fees, the less you get to invest for your future. Cut unnecessary charges down to size.

1 free guide (and 1 bonus article)

If you want to learn about building a well-balanced, properly diversified portfolio as an expat investor, download our FREE guide to building a portfolio.

And finally...

Just in case you want to learn even more on the topic of diversification, we published a deeper dive into portfolio diversification for international executives like you last year...

You may find it useful.