[CASE STUDY] How one client earned a 60% investment return in a single year

![[CASE STUDY] How one client earned a 60% investment return in a single year](https://www.aesinternational.com/hubfs/2021%20blog%20headers%20%282%29-2.png)

![[CASE STUDY] How one client earned a 60% investment return in a single year](https://www.aesinternational.com/hubfs/2021%20blog%20headers%20%282%29-2.png)

A lot can happen in a year.

The world can be thrown in turmoil.

A global recession can hit and people the world over can have their lives changed forever.

But there can be incredible opportunities too.

Nature can renew miraculously.

The air quality can drastically improve…

Businesses can change their focus to people more than profit...

And record-breaking market movements can provide profound opportunities for investors.

Such was the case for one of our clients.

While many were reactively selling or rebalancing their portfolios in the wake of a market crash, he remained undeterred.

As a CEO in Asia, he is no stranger to challenging environments.

He’s built a business from the ground up, experienced extreme highs and lows, but always stuck to his vision to create a successful business.

Investing is no different.

When John first came to us, he was knowledgeable about investing but admitted he didn’t have the time nor the inclination to manage his financial affairs alone.

When his investment halved in value, it was clear he needed an expert's help before it was too late.

This is when he sought our expertise 5 years ago.

Back then, his portfolio consisted of:

- 3 properties – one in the UK, one in Italy and one in Asia

- $800,000 in a fixed income account

- $450,000 in cash

- And a pension worth $1.2 million

The first thing we did was conduct a review of his policies.

Off the back of that, we:

- Readjusted his risk to 60% equities and 40% fixed income.

- Increased his diversification across global asset classes and markets to minimise his concentration risk and increase his chances of capturing returns despite what was happening in the world.

- Set up one investment account according to his financial goals, separate from his retirement savings so those go untouched up until the day he stops working.

- Adopted a long-term, systematic investment approach driven by data and evidence, not hunches and guesswork.

- Reviewed his plan annually to ensure it’s still aligned to his objectives.

- Maintained an emergency cash account to cover expenses should life take an unexpected turn.

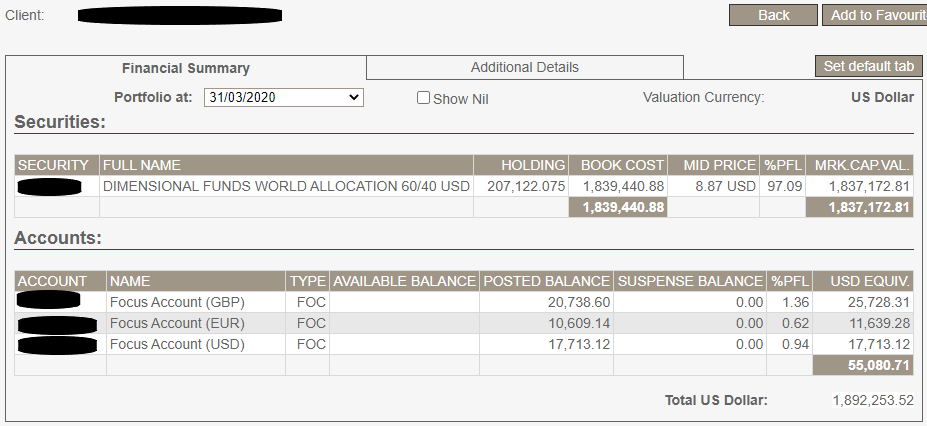

Then, in March 2020, at the height of the pandemic and market volatility, the amount invested was slightly higher than the current value i.e. a loss.

In April and September of the same year, when everyone was selling in panic, he invested a further $2 million.

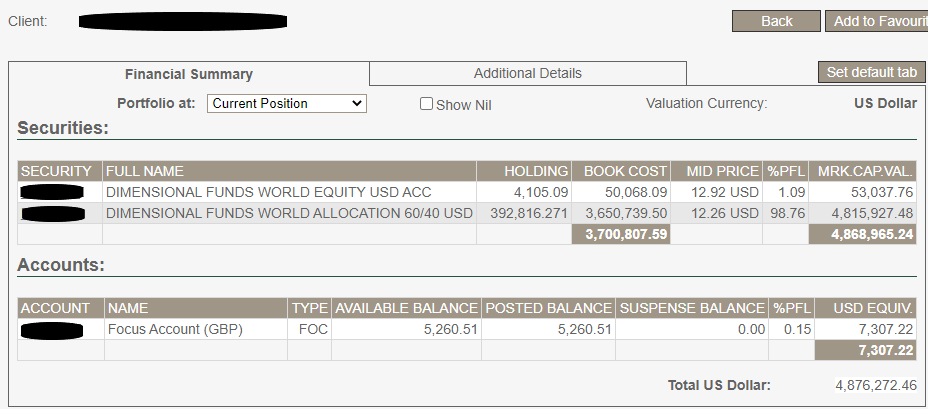

After a short while, these additional investments were up $410,000 in returns!

Fast forward to a full year later and he’s earned a sizeable $1.2 million; a 60% increase on those top ups alone.

It’s important to stop here and re-affirm one of our key investing principles – which is that you cannot time the markets.

No one can.

Having the right plan in place can help you seize opportunities and be greedy when others are fearful.

Black swan events such as what we saw in 2020 tend to lead to sell-offs.

This was the case during the onset of the pandemic when markets dipped around 35%.

However, markets always recover (usually very quickly) and these short-term drops can offer fantastic opportunities for long-term investors.

In addition, when you have the right financial planner who’s as focussed on your goals as you are, it can make the world of difference.

Someone who’s not just interested in investing your money, but keeping you in check when the markets go awry.

And can be your emotional sounding board when your natural instincts (like reacting to moments of panic and uncertainty) work against you.