Expat Guide to UK Property Tax: Understanding Stamp Duty and SDLT in 2024

If you buy, own, sell or inherit property in the UK...

There's acres of UK tax information you need to know about.

So let's jump right in.

First off, let me say we're not tax specialists.

We do however advise our clients on structuring their international assets to be tax efficient.

This blog simply provides information on the taxes which apply in relation to UK property.

I have made the British property tax information 'expat-appropriate' where relevant.

Stamp Duty Land Tax - the latest

As part of government’s commitment to support homeownership and promote mobility in the housing market, in turn supporting economic growth, a Stamp Duty Land Tax reduction was announced in September 2022.

The measure increases the residential nil-rate tax threshold from £125,000 to £250,000.

The nil-rate threshold for First Time Buyers’ Relief is increased from £300,000 to £425,000 and the maximum amount that an individual can pay while remaining eligible for First Time Buyers’ Relief is increased to £625,000.

The measure means that all purchasers of residential property bought between 23 September 2022 and 31 March 2025 will pay less or no SDLT.

For those not resident in the UK

There was a Stamp Duty Land Tax surcharge introduced from 1 April 2021, for buyers of residential property in England and Northern Ireland who are not resident in the UK.

There is a further 2% surcharge that applies to all ‘non-resident transactions’, even if you intend to live in the property you’re buying, and regardless of whether or not you already own a residential property.

The ‘effective date of the transaction’ is the key date used to establish residence status. This is normally the date that the transaction is completed.

The surcharge does not apply to purchases of land or buildings in Scotland or Wales.

There are residence tests which need to be applied to establish whether or not you're classed as a non-UK resident in relation to the purchase.

These include tests if you are:

- buying with someone else

- an individual

- married or in a civil partnership

- a company/business partnership

- a trust.

More information on these tests can be found here.

What is Stamp Duty Land Tax?

Stamp Duty Land Tax, also known as SDLT or just stamp duty, was originally introduced in 2003 and revised in 2014 and 2015.

You must pay Stamp Duty Land Tax (SDLT) if you buy a property or land over a certain price in England and Northern Ireland.

The tax is different if your property or land is in Scotland or Wales.

For self-builders, stamp duty is payable on land but not on build costs.

SDLT applies to the majority of sales and transfers of land or property.

Basic stamp duty rates and thresholds

There were different rates before 23 September 2022. If you don’t own any other property in the UK or overseas, the amount of stamp duty you will currently pay to HM Revenue and Customs is:

- 0% up to £250,000

- 5% between £250,001 and £925,000 (the next £675,000)

- 10% between £925,001 and £1,500,000 (the next £575,000)

- 12% on anything over £1,500,000

An example of a basic stamp duty calculation

If you bought a British property for £295,000 you would pay 0% tax on the value of the property up to £250,000, and 5% tax on the remainder:

- 0% on the first £250,000 = £0

- 5% on the final £45,000 = £2,250

This is a total SDLT of £2,250.

This is an effective tax rate of around 0.76%.

Buy-to-let/second home higher stamp duty rates and thresholds

It was announced in 2015 that as of April 2016, anyone buying a second property in the UK, including a buy-to-let property, would pay an additional 3% on top of the relevant standard rate band.

The thresholds and rates however changed after 23 September 2022.

Stamp duty on buy-to-let will see you paying higher rates on top of usual stamp duty land tax (SDLT) rates, so it could make your holiday home or next investment more expensive. So although buy-to-let can still be a good investment, you should do your sums carefully.

As with normal stamp duty, second home stamp duty is charged using a tiered system.

So you pay an additional 3% on the first £125,000 and then an additional 5% for anything that falls within £125,001 to £250,000, and so on. These are the current rates:

- 0% on properties under £40,000

- 3% between £0 and £250,000 (unless the property is below £40,000)

- 8% on properties between £250,001 and £925,000 (the next £675,000)

- 13% on properties between £925,001 and £1,500,000 (the next £575,000)

- 15% on properties over £1,500,000

You’ll also have to pay higher rates when you buy a second property in Scotland and Wales. However, Welsh stamp duty (LTT) and Scottish stamp duty (LBTT) have different rates for purchases of additional properties.

An example of additional SDLT

If you buy a second property for £300,000, you’ll have to pay 3% on the first £250,000 and then 8% on the remaining amount.

- 3% on the first £250,000 = £7,500

- 8% on the final £50,000 = £4,000

This is an effective tax rate of around 3.8%.

When do I pay basic stamp duty?

There are exceptions and allowances.

Second properties under £40,000 and all caravans, mobile homes and house boats are exempt from additional stamp duty.

In fact, first-time buyers benefit from SDLT relief on purchases up to £425,000 when purchasing their main residence.

On purchases up to £425,000, no SDLT is payable. For purchases between £425,001 and £625,000, a flat rate of 5% is charged.

If in doubt, use this SDLT calculator.

Who pays second home/buy to let stamp duty?

Anyone who owns a residential property or has a share in another residential property anywhere in the world has to pay the higher rate of stamp duty if they buy a property in the UK, assuming their share of the property ownership is valued at more than £40,000.

Stamp duty when replacing your main home

Even if you own or have a share in another property, if you're directly replacing your main residence, you don't have to pay the higher rate of stamp duty (3%).

If you end up buying your new main residence before you’ve sold your old main residence, you will have to pay the higher rate (because you'll own 2 homes), but you may be able to reclaim the difference.

In these circumstances, as long as you exchange contracts to sell your former main residence within 3 years, you can claim a refund from HMRC of the additional 3% stamp duty paid.

Can I avoid stamp duty?

According to the latest data, the average price of a house in the UK is £296,000, meaning most people in most cases cannot avoid stamp duty.

However, in some cases, the transfer of a property’s deeds as a gift or in a will may negate SDLT liability.

Can I reduce my stamp duty liability?

If the price of the property you want to buy is close to the bottom of an SDLT threshold, negotiate hard on the price to try and bring it in under that threshold.

If you own a property jointly and are transferring it due to a divorce for example, you may be able to transfer some or all of the property’s value to the other party, thus reducing your own liability.

Who pays stamp duty and how?

The buyer pays stamp duty.

Usually the buyer’s solicitor handles the administrative side of the transaction.

SDLT returns have to be submitted and paid within 30 days of completing the purchase.

Late returns or payment can incur a financial penalty.

Income tax on UK property

Income from British property is taxable as income in the UK.

UK income tax facts and figures (2021/2022)

In the UK there is an income tax-free personal allowance, and it's available to all non-resident British expats.

| Band | Taxable income £ | Tax rate % |

| Personal allowance | Up to 12,570 | 0% |

| Basic rate limit | 12,571 - 50,270 | 20% |

| Higher rate threshold | 50,271 - 150,000 | 40% |

| Additional rate | Over 150,001 | 45% |

Landlords can deduct costs including mortgage interest from their profits before tax is calculated and payable.

However, your personal tax-free allowance decreases by £1 for every £2 that your adjusted net income is above £100,000, meaning your personal allowance is zero if your income is £125,000 or above.

Income tax for landlords

Up until the 2016/17 tax year, landlords could deduct mortgage interest and other allowable costs from their rental income, before calculating their tax liability.

Since 6 April 2020, tax relief for finance costs has been restricted to the basic rate of income tax, currently 20%. Relief will be given as a reduction in tax liability instead of a reduction to taxable rental income.

The changes started to be phased in from April 2017.

From now on, nobody will receive more than 20% tax relief.

As of April 2016, landlords who let furnished properties have lost the right to automatically claim that up to 10% of rent earned goes towards wear-and-tear costs, and shouldn’t be taxed.

Now landlords can only deduct costs they have actually incurred.

Deductions

As a landlord, you can deduct so-called allowable expenses before your tax bill is calculated.

These include:

- Mortgage interest costs

- Maintenance costs

- Lettings agent fees

- Insurance premiums

- Council tax where applicable

- Utility bills where applicable

Your income tax rate will depend on your net income, i.e., after costs.

Non-resident landlord scheme

The non-resident landlord scheme was set up by HM Revenue and Customs to stop income tax being avoided by non-UK residents renting out a UK property.

You are a non-resident landlord if you have UK rental income and your ‘usual place of abode’ is outside the UK.

For the purposes of the scheme, landlords include individuals, companies and trustees. In the case of partnerships, each partner is treated as a separate landlord in respect of their share of the rental income.

Through the scheme, if weekly rent exceeds £100 then tax must be deducted from the rental income by either the letting agent or, if there is no letting agent, by the tenants before they pay their rent.

As a non-resident landlord you can apply to have your rent received without tax deducted however, if you satisfy the following criteria:

- Your UK tax affairs are up to date; or

- You have never had any UK tax obligations; or

- You do not expect to be liable to UK tax for the tax year in which the application is made.

You need to make your application no more than three months before you leave the UK – or, if you have already left the UK, you can apply immediately.

If you apply and are successful your income is still subject to tax, but instead has to be declared via a self-assessment tax return.

Capital gains tax (CGT) - the latest

Currently, the annual tax-free allowance for CGT is £12,300. This means that, when you sell a property, you only pay tax on gains over this amount.

However, announced in the 2022 Autumn Statement, from April 2023 the tax-free allowance will drop by more than half to £6,000.

In April 2024, it will drop again, to £3,000.

Capital gains tax is the tax on gains received when you sell or dispose of an asset such as property.

In very simple terms the total gain, or profit, is calculated by subtracting the sale value from the original purchase value.

If you’re selling a property the sale value will normally be the sale price.

Sometimes the market value the property could reasonably be expected to sell at in an open market is used instead.

This may apply if you give the property away, sell it at a reduced cost, or pass it to a connected person such as a family member.

Sometimes the market value is used when calculating how much the property originally cost too.

This can be the case if you inherited the property or acquired it before March 31st 1982.

Deductions and calculations

Before calculating CGT, it's sometimes possible to deduct the costs of improvements made to the property during ownership.

These costs may include advice received, general improvements such as building extensions or garages, (excluding decorating and maintenance), and also some taxes.

The total gain is then calculated and as the vendor you then need to apply any tax relief and/or allowances before calculating your capital gains tax liability using the appropriate rate.

CGT is charged at the rate of 28% where the total taxable gains and income are above the income tax basic rate band.

Below that limit the CGT rate is 18%.

For trustees and personal representatives of deceased persons, the rate is 28%.

New CGT rules for British expats and UK non-resident property owners

Before the 6th April 2015, you were not taxed in the UK on gains made when you sold UK property if you were non-UK resident for five consecutive UK tax years.

Since that date, if you’re a British expat who owns property in the UK, you have to pay CGT if you sell your property for a gain.

The new rules apply to:

- Non-UK resident individuals (expats)

- Non-resident partners in UK resident and UK non-resident partnerships, companies and trusts

Note: It doesn’t matter how long you’ve lived outside the UK or even if you never intend to return…you still have to pay.

The new tax applies on the sale of all UK residential property that’s defined as: “property used or suitable for use as a dwelling.” i.e., it is chargeable whether or not anyone is living in your property.

This covers:

- Residential property used as an investment

- Property rented out

- Multiple dwellings that are sold at the same time

- Any interest you have in off-plan properties

If you’re liable, you have to pay tax on any gains arising since the 6th of April 2015.

Calculating the tax

In most cases you can choose whether to rebase the value of your property to the 5th of April 2015, or time-apportion the gain.

You also have the option of computing the gain over the whole period of your ownership.

The tax charge is the same as that paid by UK residents.

I.e., the net gain on your UK property is added to any other UK-source income for the tax year in question, and then taxed at either 18% or 28%, depending on whether your UK income puts you in the basic or higher-rate tax bracket.

Companies pay tax at 20%, or 28% if it falls within the annual tax on enveloped dwellings (ATED).

Trusts also pay 28%.

Exemptions and allowances

For the tax year 2023 to 2023, individuals and partnerships have an annual exempt amount (AEA) of £6,000; for trustees it’s £3,000.

Under UK law, if you meet the conditions for private residence relief (PRR), you don’t have to pay capital gains tax as long as it’s your main home you’re selling.

Both non-residents selling UK residential property and UK residents selling residential property abroad may still be able to get this relief as a non-UK resident if they meet new qualifying conditions.

For example, you can apply PRR to a property you’re selling as long as you’ve lived in it for 90 days or more over the UK tax year in question.

For those who own more than one property in a country, the 90 days can be split between properties.

If you’re a UK resident you can apply the relief to any property you own overseas as long as you spend 90 days in it.

For expats, if you live outside the UK but spend 90+ days in your UK property, you can nominate this to be your principal residence and get PRR.

Be wary of this approach however, as it may push you into a different residency category for tax according to the UK’s Statutory Residence Test.

This could have serious tax implications on your income and even result in you having to pay UK tax on your worldwide income.

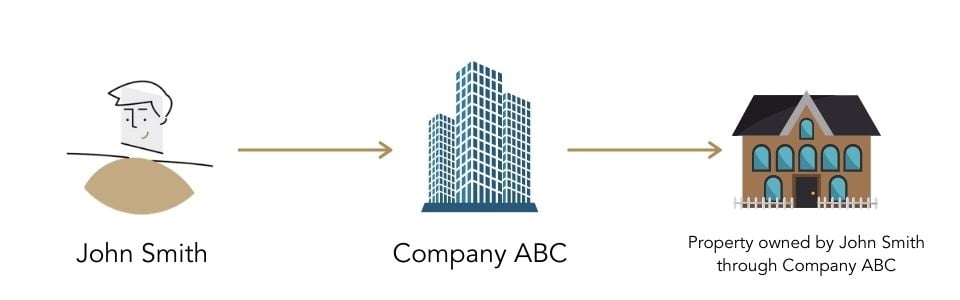

Annual tax on enveloped dwellings

The annual tax on enveloped dwellings (ATED) was introduced as part of a package of measures aimed at making it less attractive to hold high-value UK residential property indirectly, e.g. through a company, in order to avoid or minimise taxes.

Other measures included in the anti-avoidance package relating to high-value UK residential property include:

- A higher 15% rate of SDLT on the acquisition of high-value UK residential property for non-natural persons (NNPs) and

- A capital gains tax (CGT) charge on sales of high-value UK residential property by NNPs

In this context, non-natural persons (NNPs) are companies, partnerships with company members, and collective investment schemes such as a unit trust or an open-ended investment vehicle.

You’ll need to complete an ATED return if your UK dwelling was valued at more than:

- £2 million (for returns from 2013 to 2014 onwards)

- £1 million (for returns from 2015 to 2016 onwards)

- £500,000 (for returns from 2016 to 2017 onwards)

A new ATED band came into effect on the 1st of April 2016 for properties valued between £500,000 and £1 million.

Note: HMRC’s definition of dwelling in this sense is...

“if all or part of it is used, or could be used as a residence, for example a house or flat. It includes any gardens, grounds and buildings within them.”

Current ATED rates

Chargeable amounts for 1 April 2023 to 31 March 2024:

| Property value | Annual charge |

| More than £500,000 up to £1 million | £4,150 |

| More than £1 million up to £2 million | £8,450 |

| More than £2 million up to £5 million | £28,650 |

| More than £5 million up to £10 million | £67,050 |

| More than £10 million up to £20 million | £134,550 |

| More than £20 million | £269,450 |

Valuations and ATED reliefs and exemptions

If you have to pay ATED you need to value your dwelling. You can either do this yourself or by asking a professional valuer.

A valuation has to be on an open-market willing buyer, willing seller basis, and it has to be a specific amount.

The valuation date you need to use depends on when you owned the property.

If you’re not sure which value band your property falls into, you may be able to ask HMRC for a Pre-Return Banding Check (PRBC).

You can ask for one if:

- you’re not due a relief that will reduce your ATED charge to nil

- your property valuation falls within 10% of a banding threshold

To apply complete the PRBC form on HMRC’s website.

Inheritance tax (IHT) - the latest

It was announced in the 2022 Autumn Statement that the inheritance tax (IHT) thresholds will be fixed at their current levels for tax years 2026 to 2027 and 2027 to 2028.

This means:

- a nil-rate band (NRB) at £325,000

- a residence nil-rate band (RNRB) at £175,000

- a RNRB taper, starting at £2 million

The £325,000 NRB is available to everyone, and can be set against all asset types on their death.

It can also be used both:

- to allow individuals to make lifetime chargeable transfers up to £325,000 within a 7-year period, without the need to pay IHT

- in calculating the periodic and exit charges on relevant property trusts

The £175,000 RNRB is available to those passing on a qualifying residence on death to their direct descendants.

A taper reduces the amount of the RNRB by £1 for every £2 that the net value of the estate is more than £2 million.

Unlike your residency status, which you can relatively easily change, your country of domicile is usually fixed and very difficult to alter.

It is generally based on the country your father considered his permanent home when you were born, according to HMRC.

However, because IHT is a significant income generator for the taxman, if you were born and/or raised in the UK and you retain property in Britain, you’re likely to be deemed domiciled in the UK for inheritance tax purposes.

If you are, then HMRC can effectively levy IHT against your worldwide estate.

This means if you’re deemed domiciled in the UK, and your estate is worth more than £325,000 when you die, your heirs may have to pay inheritance tax on everything over that amount at a rate of 40%, no matter where your assets are located in the world.

Property is expected to account for over 70% of the wealth transferred over the coming years.

Make sure not to neglect financial planning - IHT receipts received by HMRC during the financial year 2021 to 2022 were £6.1 billion. This was an increase of 14% (£729 million) on the financial year 2020 to 2021, and is the largest single-year rise in IHT receipts since the 2015 to 2016 financial year, when receipts rose by 22% (£848 million).

If in any doubt about your country of domicile do not leave it to chance, get specialist advice.

Note: if you’re currently deemed domiciled in Britain and you wish to change your country of domicile, you’re highly likely to be advised to sell your British property assets and cut all ties with Britain.

As stated, questions relating to domicile and potentially changing it require expert tax advice.

Assuming you’re domiciled in Britain and own UK property for the sake of this article, you will need to think carefully about inheritance tax planning.

IHT is one tax that can potentially be mitigated, if you structure your affairs appropriately.

Inheritance tax (IHT) rates and charges

As an expat deemed domiciled in Britain, your worldwide estate is potentially liable to IHT.

Your estate includes your property, savings, and any other assets you pass on, after outstanding debts and funeral expenses have been paid for.

The tax rate is currently fixed at 40% on anything over the £325,000 nil-rate band, unless you give away 10% or more of your estate to charity, and then it’s cut to 36%.

If your estate is entirely inherited by your spouse or your civil partner, they don't have to pay any inheritance tax.

Your nil-rate band can also be passed on to a surviving spouse or civil partner and they can add it to their own, meaning that when they die they can potentially leave an estate worth £650,000 free of IHT.

In 2017, a new IHT allowance called the transferable main residence allowance was introduced.

This allowance relates to the value of your main residence. From 2020 - 2028, this will sit at £175,000.

This allowance, combined with the already existing nil-rate band, means a qualifying individual will be able to leave £500,000 IHT free, and a couple up to a million pounds without their estate being subject to inheritance tax at all.

The transferable main residence allowance comes into effect when a residence is passed on death to a direct descendant, i.e., a child including a step-child, adopted child or foster child, and their lineal descendants.

The allowance’s introduction looks like this:

- £100,000 in 2017 to 2018

- £125,000 in 2018 to 2019

- £150,000 in 2019 to 2020

- £175,000 from 2020 to 2028

Just like with the current nil-rate band, any unused transferable main residence allowance will be transferable to a surviving spouse or civil partner.

According to HMRC,

“the additional nil-rate band will also be available when a person downsizes or ceases to own a home on or after 8 July 2015 and assets of an equivalent value, up to the value of the additional nil-rate band, are passed on death to direct descendants.”

It’s worth noting that there will be a tapered withdrawal of this transferable main residence allowance for estates with a net value of more than £2 million. This will be at a withdrawal rate of £1 for every £2 over this threshold.

Structuring your international assets to be tax efficient

International estate and tax planning for cross border families is an important part of our work as a fiduciary, life financial planners, and financial advisers in Dubai.

We look at every financial planning case on an individualised basis, and from an integrated perspective, meaning we examine everything from income, outgoings and liabilities, to taxation, risk and goals.

Where there are methods to consider for taxation mitigation they will be included in a comprehensive financial plan.