If you're a regular reader, you’ll know my thoughts on stock pickers.

Those who try to forecast market movements...

May as well enter a casino and place their life savings on red.

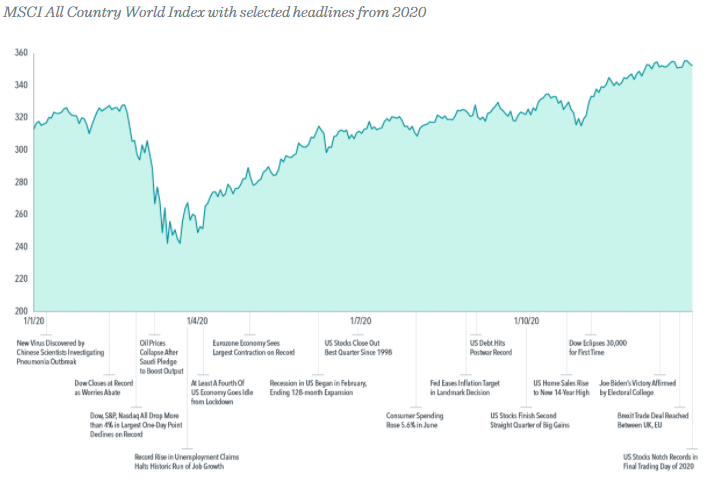

2020 showed us many examples of this unpredictability...

The outbreak of COVID-19 proved to be one of the most tumultuous in modern history, marked by a number of developments that were historically unprecedented.

But the year also demonstrated the resilience of people, institutions, and financial markets.

March saw the S&P 500 Index’s decline reach 25.66% from the previous high as the pandemic worsened.

This was followed by a rally in April, and stocks reached their previous highs by August.

Ultimately, despite a sequence of epic events and continued concerns over the pandemic, global stock market returns in 2020 were above their historical norm.

The US market finished the year in record territory and with an 14.74% annual return for the S&P 500 Index.

Global developed markets, as measured by the MSCI World Index returned 12.32%.

Emerging markets, as measured by the MSCI Emerging Markets Index, returned 14.65% for the year.

A far cry from the headlines of panic in the first quarter.

Ups and downs

There were, however, plenty of investors who made reactionary moves during March that ultimately missed out.

A move to cash at that time for example would have been a very costly decision.

If you had cashed out at the bottom in March and stayed out of the market, you would have lost out on a massive 68% return on the S&P 500 by the end of the year.

Guessing game

One major theme of the year was the perceived disconnect between markets and the economy.

How could the equity markets recover and reach new highs, when the economic news remained so bleak?

The market’s behaviour suggests investors were looking past the short-term impact of the pandemic to the future rebound of business activity and an eventual return to more-normal conditions.

Seen through that lens, the performance of share prices reflected a market that is always looking ahead, incorporating both current news and expectations of the future.

Having said that, the downturn in stocks impacted some segments of the market more than others.

For example, airline, hospitality, and retail industries tended to suffer disproportionately with people around the world staying at home, whereas companies in communications, online shopping, and technology emerged as relative winners during the crisis.

However, predicting at the beginning of 2020 exactly how this might play out was practically impossible.

In any market, there will be winners and losers - and investors have historically been well served by owning a broad range of companies, rather than trying to pick potential winners and losers.

It’s a reminder that playing the prediction game can be a losing one for investors.

Perennial wisdom

History has shown there’s no compelling or dependable way to forecast stock and bond movements, and 2020 was a case in point.

Neither the mainstream fortune tellers nor the hindsight of recent strong performance predicted the outcomes of 2020.

The events of the year provided investors with many lessons, affirming that a wiser strategy would be to hold a range of low-cost investments that focus on systematic and robust drivers of potential returns.

Rather than basing investment decisions on predictions of which way debt or equity markets are headed...

Which is exhausting and a complete waste of time...

Investors who were broadly diversified across asset classes and around the globe were able to potentially enjoy the returns that the markets delivered in 2020.

Last year, this year, next year...

Our expectation is that bearing today’s risk will be compensated with positive returns in the future.

That approach is a timeless one.