Outguessing market prices.

Picking the next winner.

Finding a truly undervalued investment.

All proponents of the traditional approach to investing…

Yet all, according to evidence, impossible.

Here’s why.

The global financial markets process millions of trades worth hundreds of billions of dollars each day.

These trades reflect the viewpoints of buyers and sellers who are investing their capital.

Using these trades, the market functions as a powerful information-processing machine, aggregating vast amounts of information into prices and driving them toward fair value.

Just think about that for a moment.

Millions of trades.

Billions of dollars.

Every day.

When any news or data comes out that might affect the value of a company’s stock or bonds, the market quickly incorporates it into the price of those assets.

In other words, the market is efficient.

This idea was formulated in the 1960s by Eugene Fama, a professor at the University of Chicago Booth School of Business, who was studying how markets price assets.

The hypothesis maintains that the market itself (meaning the sum of all the millions of institutional and individual investors out there) quickly absorbs and responds to that information.

Prices rise and fall to reflect the market’s collective take on its current value.

The price of a stock or bond reflects all of the public information available to investors at any given time.

Matt Hall explains this beautifully in his book, Odds On:

“Let’s say a company announces several new, long-term contracts that are likely to boost revenues and profits for years to come. An investor reading the news about its new contracts might make the reasonable assumption that revenues will grow and the stock price will rise, and might buy the stock in the belief that the firm’s improved outlook will drive the price higher. The trouble is, millions of other investors have also heard the news, made the assumption, and bought the stock. As a result, the value of those future contracts is already reflected in the stock price.”

Investors who therefore attempt to outguess prices are pitting their knowledge against the collective wisdom of all market participants.

So, are investors better off relying on market prices or searching for mispriced securities?

If markets do a good job of pricing securities, you should expect managers who focus on finding pricing “mistakes” to struggle.

How could they not, given the above?

Dimensional’s Mutual Fund Landscape 2019 study confirms this.

The results suggest that investors are best served by relying on market prices.

A test of market prices

Mutual fund industry performance offers one test of the market’s pricing power.

If markets do not effectively incorporate information into securities prices, then opportunities may arise for professional managers to identify pricing “mistakes” and convert them into higher returns.

In this scenario, we might expect to see many mutual funds outperforming benchmarks.

But the evidence suggests otherwise.

Across thousands of funds covering a broad range of manager philosophies, objectives, and styles, a majority of the funds evaluated did not outperform benchmarks after costs.

These findings suggest that investors should still accept the price.

Survivorship and outperformance

The size of the mutual fund landscape can obscure the fact that many funds disappear each year, often due to poor investment performance.

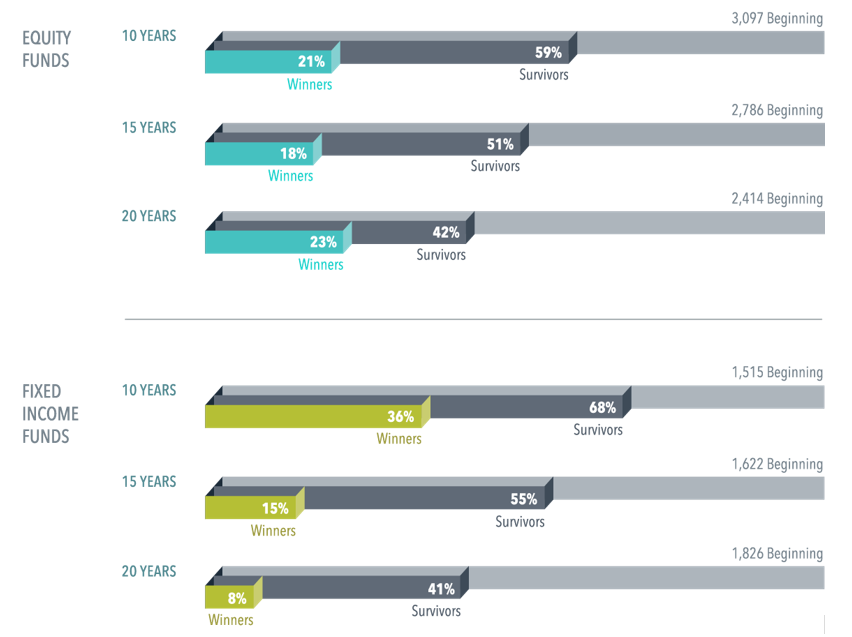

Investors may be surprised by how many mutual funds disappear over time.

(More than half of the equity and fixed income funds were no longer available after 20 years).

Including these non-surviving funds in the sample is an important part of assessing mutual fund performance.

Why? Because it offers a more complete view of the fund universe and possible outcomes at the time of fund selection.

Again, the evidence shows that only a small fraction of actively managed funds succeed in beating the market with any degree of consistency.

In fact, only a low percentage of funds in the original sample were “winners”—defined as those that both survived and outperformed benchmarks.

Few mutual funds have survived and outperformed

Performance periods ending December 31, 2018

Survival and outperformance rates were low. For the 20-year period through 2018, 23% of equity funds and 8% of fixed income funds survived and outperformed their benchmarks.

The search for persistence

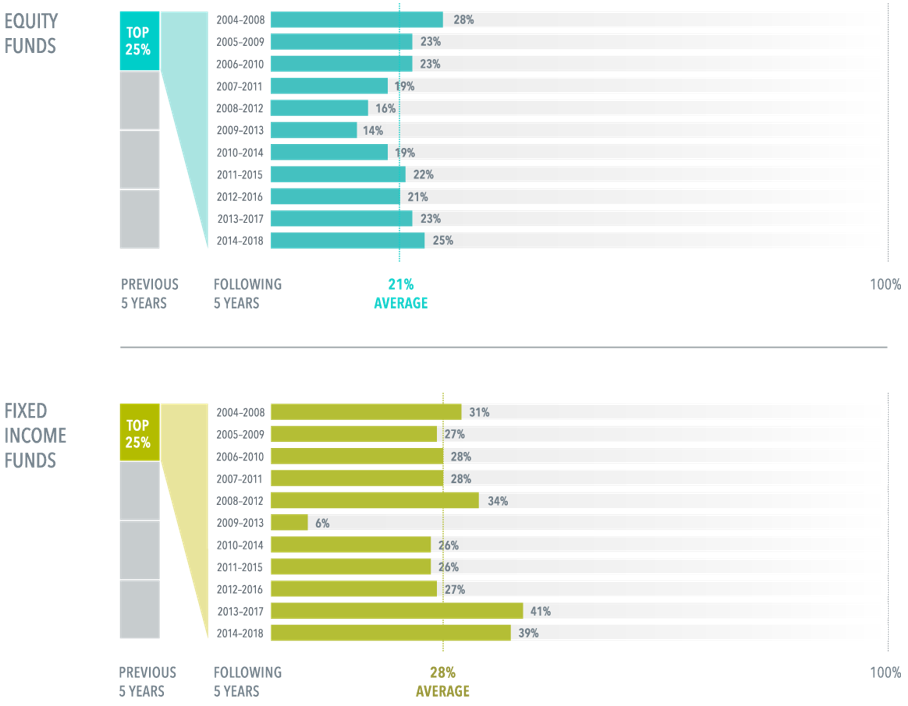

Some investors select mutual funds based only on past returns.

But sometimes good track records happen by chance, and short-term outperformance fails to repeat.

Below shows that among funds ranked in the top quartile (25%) based on previous five-year returns, a minority also ranked in the top quartile of returns over the following five-year period.

This again casts further doubt on the ability of managers to consistently gain an informational advantage on the market.

Some fund managers might be better than others, but track records alone may not provide enough insight to identify management skill.

Stock and bond returns contain a lot of noise, and impressive track records may result from good luck.

The assumption that strong past performance will continue often proves faulty, leaving many investors disappointed.

A fund’s past performance is not enough to predict future results

Percentage of funds that were top-quartile performers in consecutive five-year periods

Most funds in the top quartile of past five-year returns did not repeat their top-quartile ranking over the following five years. Over the periods studied, top-quartile persistence of five-year performers averaged 21% for equity funds and 28% for fixed income funds.

In conclusion

The performance of US mutual funds illustrates the power of market prices.

Price, we can say, is king.

For the periods examined, the research shows that:

- Outperforming funds were in the minority

- Strong track records failed to persist

The result?

Investors are best served by relying on market prices.

Relying on a manager’s ability to outguess market prices has resulted in underperformance for the vast majority of mutual funds.

If, like me, you are interested in pursuing the truth, then there is surely only one investment principle we can take from this data:

The capital markets do a good job of pricing securities.

Despite the evidence, many investors continue trying to beat the market by picking individual stocks.

Do they believe that they’ve spotted a strength or weakness that millions of other investors have somehow overlooked?

I also continue to see investors looking to past performance as the main criterion for evaluating a manager’s future potential.

The world’s greatest economic minds clearly show this doesn’t work.

If you are interested in discovering more about investment philosophy and portfolio design to get yourself better results…

Thank you to Dimensional for providing yet more evidence to help you get greater clarity, confidence and control over your ideal future.