The employment landscape across the Middle East is shifting beneath our feet.

Some major projects are being scaled back or brought to a premature close.

At the same time, bold new initiatives are being announced - from the expansion of the DIFC to fresh investments in finance, technology, and infrastructure - reshaping where opportunity will sit next.

Workforce changes are happening at flagship developments - the very megacities, industrial zones, and green energy initiatives that once attracted some of the world's best talent, even as new hubs and opportunities begin to rise alongside them.

For many professionals and their families, the question is no longer "if" but "how" these changes will affect them personally.

When life changes, money changes.

And when money changes, life changes.

Transitions in life aren't just inevitable. They're constant.

For global families with increased complexity around their multi-jurisdictional lives, there are 13 crucial moments of transition that may shape your financial future.

But here's what most people miss: true financial planning isn't just about managing money.

It's about managing your life.

Because what good is financial success, if it doesn't enable you to live without regrets, sleep peacefully at night, and know your family will be okay - no matter what?

You've probably been through more than one of these in the past few years.

You may even be going through one of them now.

1. Losing your job

There will be some obvious turns in your life's journey - marriage, children, retirement - that will trigger changes in your financial plans.

Then there may be unexpected events that require even more careful handling.

Whether you're asked to leave your job or you depart voluntarily, the result is the same - a heavy strain on finances. For international professionals in the Middle East, job loss carries additional complexities that go well beyond the immediate loss of income.

Recent developments across the region - including adjustments to major infrastructure projects like those in Saudi Arabia's flagship developments at NEOM - The Line, Trojena, Oxagon, and Sindalah, as well as workforce realignments at entities like the NEOM Green Hydrogen Company and NEOM Investment Fund - have brought these concerns into sharp focus for international families. Just this week, reports have also emerged that the future of the ambitious Mukaab megaproject in Riyadh is uncertain.

The intersection of emotion and finance during job loss is where most people make their worst decisions. Fear drives us to react rather than respond. Uncertainty clouds judgement. And in the expatriate context, the pressure is amplified - visa timelines tick down, families look to you for answers, and the financial runway shortens with each passing week.

This is when you need more than technical expertise. You need a thought partner who has guided dozens of families through exactly this situation. Someone who knows what happens next, what decisions matter most, and which moves you'll regret later.

Critical financial considerations when facing job loss include:

Severance package evaluation and negotiation – Understanding your entitlements is crucial.

End-of-service gratuity calculations, notice period payments, accrued leave settlements, and discretionary bonuses all need to be carefully reviewed. For senior professionals, severance packages may be negotiable, and having expert guidance on what to ask for - and how to structure it - can make a substantial difference.

Consider the timing of payments, tax optimisation strategies, and how the package affects your visa status and timeline for departure.

Emergency fund and runway assessment – For international professionals, the stakes are higher.

You're not just covering living expenses; you're potentially covering the cost of staying in the region while you search for new opportunities, or the substantial cost of repatriation if you need to return home. A robust emergency fund should cover 6-12 months of expenses for expatriates - more than the typical 3-6 months recommended for domestic situations.

This calculation should include housing, school fees, insurance premiums, and potential relocation costs.

Visa status and timeline pressures – In most Gulf jurisdictions, your residence visa is tied to your employment.

Losing your job starts a clock on your ability to remain in the country legally. Understanding your grace period, options for dependent visa transfers, and the realistic timeline for securing new employment is essential.

This affects not just your job search strategy, but your family's housing situation, your children's schooling, and your ability to maintain financial accounts and investments in the region.

Healthcare coverage continuity – Your employer-sponsored health insurance typically ends with your employment.

For families with ongoing medical needs, pre-existing conditions, or children requiring regular care, the gap in coverage can be both financially devastating and medically dangerous.

Understanding your options for continuation coverage, private insurance, or coverage in your home country is a critical part of your transition planning.

Strategic job search planning – Do you search for opportunities within the region, or do you expand your search internationally?

Each option has different financial implications. Staying in the region may mean lower relocation costs but potentially longer search timelines in a competitive market. Returning home or relocating to another country involves significant costs but may offer more opportunities.

The decision should be informed by a clear understanding of your financial position, your runway, and your long-term career and life goals.

Repatriation cost planning – If you need to return to your home country, the costs can be substantial.

Shipping household goods, breaking lease agreements, settling final bills, air travel for the family, temporary accommodation, and re-establishing yourself at home all require capital.

Many professionals underestimate these costs, which can easily reach $50,000-$100,000 or more for senior international families with significant household effects and established lives in the region.

Investment and asset management – Job loss doesn't mean your investment strategy should go on hold.

In fact, it's more important than ever to ensure your portfolio is positioned appropriately for your new circumstances. You may need to shift to more conservative allocations, ensure sufficient liquidity, or make strategic decisions about maintaining or liquidating certain positions.

Knee-jerk reactions driven by stress can be costly; having a sage guide helps you make rational decisions.

Even if you haven't lost your job, now can be a good opportunity to start creating a sound financial plan. This will put your life into numbers and allow you to plan for such events.

A comprehensive financial plan (or Life Strategy as we call it) serves as both a roadmap for normal times and a safety net for unexpected transitions, giving you the confidence to navigate whatever changes come your way.

2. Changing career

Now more than at any time in recent history, massive numbers of professionals are considering and seeking a new career path.

Some may adopt a different focus in their current profession, while others may embrace a completely new career.

For successful families in the Middle East, career changes often come with unique complexities that extend far beyond salary negotiations. Whether you're moving between major regional employers or considering opportunities in other jurisdictions, the financial implications can be significant and lasting.

Critical considerations for international professionals include:

Total compensation analysis – Your headline salary is just one piece of the puzzle.

For expatriates, benefits packages can vary dramatically between employers. Housing allowances, education allowances for children, annual flights home, end-of-service gratuities, health insurance coverage, and retirement contributions all need to be carefully evaluated.

A seemingly lower salary with superior benefits may actually represent better long-term value, especially when considering the tax treatment of different compensation elements.

Tax and residency implications – Changing employers in the region may seem straightforward from a tax perspective, given the favourable tax regimes in the Gulf.

However, your employment status affects your tax residency in your home country, your ability to maintain beneficial tax treaties, and your reporting obligations.

If you're considering a role that involves working across multiple jurisdictions or remote work arrangements, the tax complexity multiplies significantly.

Visa and immigration status – Your employment visa is tied to your employer.

Career transitions involve immigration processes that affect not just you, but your entire family. The timing of visa transfers, gaps in coverage, and the administrative requirements can impact your family's stability, your children's education continuity, and even your ability to maintain your residence and banking relationships.

Retirement and savings continuity – Unlike domestic job changes, international career moves often involve complex decisions about pension transfers, retirement savings portability, and the continuation of investment strategies.

If you've been building wealth through offshore structures, investment platforms, or pension schemes tied to your current employer, you'll need a clear plan for maintaining, transferring, or restructuring these arrangements without triggering unnecessary tax events or losing beneficial treatment.

Long-term career trajectory – Every career decision should be viewed through the lens of your ultimate goals.

Are you building toward eventual repatriation to your home country? Planning for retirement in the region or elsewhere? Considering permanent residency options? Each path has different financial planning implications, and making moves that align with your long-term vision is crucial.

Every decision you make as part of your career change should be viewed through the lens of your personal financial needs - not just for today, but as part of your longer-term life strategy.

And here's the critical distinction: this isn't about optimising for the highest salary or the best benefits package. It's about ensuring these decisions align with your definition of a successful, contented life.

Your mistakes aren't the best teacher - just the most expensive. A financial life manager helps you master the best of what others have already figured out, so you don't have to learn through costly trial and error during one of life's most consequential transitions.

3. Retirement

Retirement is one of the biggest life transitions many people will ever make.

Yet most people are not prepared for retirement and need assistance in not only planning for retirement, but also living in retirement.

The vast majority get retirement planning wrong and often only find out far too late.

The key is to identify what you want early on and have a cashflow plan that helps you understand whether or not you're on track.

Retirement planning is a holistic approach that doesn’t just cover you financially, but helps you make better lifestyle choices to achieve your ideal future.

You can start your retirement planning at any point in time; the earlier the better.

4. Divorce

Unfortunately, not all the transitions are necessarily expected, but they happen nevertheless.

There are often legal implications and complexities in an expat divorce and the intersection of emotion and finance during a divorce situation may require outside help.

Even simple things like changing beneficiaries, estate-planning documents, and so on can be difficult to focus on during a stressful divorce.

Couples will likely need to consult with a planner on how to split assets to minimise cross-border tax consequences.

These are just a few of the areas where financial life managers can provide value and support.

5. Death of friends or family

The loss of a friend or family member is a difficult time.

In addition to coping with your grief and potentially planning a memorial service or funeral, there are often many financial decisions that follow soon afterward.

This might include dealing with estate plans including trusts and wills, updating financial accounts including beneficiaries on insurance policies and determining how property and assets will be maintained and updated.

6. Moving country

Financial life management for the average investor comes with its fair share of challenges, but tax, retirement, and estate planning become even more complicated when working with globally-mobile families whose financial lives cross national borders.

There are also various stages of this transition to consider, such as pre-move, acclimation, global integration and retirement and independence, all of which come with unique financial life management issues.

Whether temporary or permanent, short-term or long-term, expatriate status can present multiple stumbling blocks for financial planning.

7. Buying a house

Even wealthy, successful families need help during this transition.

Questions arise about the benefits of paying cash instead of securing a mortgage, or what assets to liquidate for a down payment or payment in full.

Then there is the subject of renting versus buying.

These are topics that come up rarely for individuals, but for focused planners they should be easy areas to provide value and expertise.

Take for example an adult child's first home purchase. One key question during this life event centres on whether or not parents should help children with a down payment.

The answer often comes down to the family’s principles, including how parents and children view money or how the parents want the children to view money.

This can be a highly emotional decision.

On the one hand, parents can feel the urge to help, but worry that their kids might develop an unhealthy sense of entitlement. On the other hand, kids can feel like their parents aren’t being helpful enough during a major step in their lives.

A financial life manager can help families sort through this.

8. Receiving an inheritance

A large inheritance can be both a blessing and a burden.

A blessing because the money could be life changing for you and your family and a burden because it imposes a certain responsibility on you to use it wisely and not simply squander it.

A financial planner can help you decide how to handle the money in the short term as well as devise a long-term financial plan that takes all your assets and obligations into consideration.

9. Selling a business

There are many stages involved in selling a business and some may change/vary depending on the size of your business, where you operate, how you’re regulated and a number of other factors.

These stages involve pre-sale preparation which considers how your business works as a whole, the weak points, the improvements needed and what can be done to make things better. You may need to consider if you need to engage in some form of restructuring to help with the sale.

Another stage will be putting together a summary, teaser or information memorandum, with the assistance of a financial planner. This should be a short document that describes what your business is and the opportunity it represents. It should give enough information to create interest while being anonymous and confidential.

We also work with clients on identifying potential buyers, helping with the bid/auction process and all the necessary due diligence.

10. Ageing parents (and long-term care issues)

This is only going to become a more common transition as the baby boomer generation continues to age.

How should children handle the emotional and financial consequences of taking care of their parents?

Should they keep their parents in their current house or move them to a facility?

What are the financial implications of each situation?

Caring for an ageing parent is one of the hardest transitions that exist and it’s an area where you will need continued financial and emotional advice.

The decisions made during this transition are based on much more than the financial calculations.

Money clouds judgement.

A financial life manager steps in during this transition and makes sure everyone is treated with dignity and respect.

11. Illness or death of a spouse

Nobody wants to see a spouse fall gravely ill or pass away.

Both situations are highly emotional, but they also require good financial decision making.

When a severe diagnosis is made, a financial planner will immediately work with the client’s estate-planning lawyer to ensure estate documents and assets are titled in the right way, so the family can be prepared when a tragic event occurs.

Handling sickness and death entails much more than just estate planning; it’s about taking in the entire financial and emotional picture.

These challenges (when an investor’s emotional and financial experiences intersect) require a human element.

In the same way a doctor focuses on limiting anxiety by getting cancer patients to understand the facts about their treatment, a financial life manager can do the same for an investor going through the death of a spouse.

It requires deep subject matter expertise.

12. Legacy issues

Successful international families need to think about a number of things, like whether their legacy and planning be built around other planning vehicles like charitable lead trusts or charitable remainder trusts.

Other legacy issues are equally as important, regardless of a client’s net worth.

If they have kids, how do they talk to them about money issues?

If charity and giving back to the community is important, how do they continue to use the resources they have to encourage this?

13. Wealth accumulation, deaccumulation and transfer

Accumulation is the period when you're accumulating assets. You're working and trying to save and invest for life goals.

Deaccumulation is when the time has come for you to spend the money you have saved and invested. This generally occurs in retirement.

In terms of transfer, this means the time has come for you to transfer money to loved ones and charities, and to pass other legacy items to the next generation.

If you review the other major transitions and other smaller transitions people will go through throughout their lives, they occur in each of these three categories.

The common thread

If you look closely at these 13 transitions, you'll notice something: they all represent moments when life's complexity suddenly multiplies. The moving parts increase. The stakes get higher. And 'learning by trial and error' or relying on 'gut feel' can lead to catastrophic consequences.

Financial life management isn't just about having a plan. It's about having certainty that you and the people you care about most are going to be okay - no matter what. It's about having clarity on where you are, where you're going, and what decisions need to be made to move along your future pathway.

And most importantly, it's about ensuring you don't just survive these transitions - you thrive through them, living without regrets.

One more, compelling reason

So, there you have it, 13 reasons you may need a financial life manager this year.

As you think of your goals for the year ahead, ask yourself why you want to achieve that goal.

Now, ask yourself why that is important to you.

You'll find that no matter your goal, eventually these goals are important because you want either yourself or someone you love to be happy.

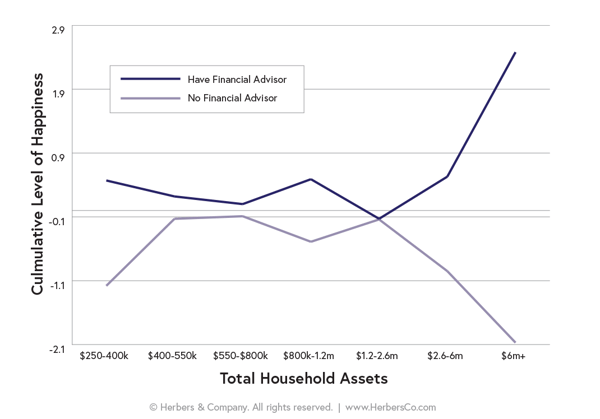

In a recent survey of 1,000 random consumers across the US...

(all of whom had self-reported assets of $250,000 or more),

Researchers found that those with a financial planner were statistically happier than those without one.

This survey identified four core factors that make people happier: fulfilment, intention, impact and gratefulness.

The result?

All four predictors of happiness were heightened among consumers who work with financial planners — by a wide margin.

This held true even when controlling for gender, age, income and asset levels.

But what I found most interesting...

As individuals move past $1.2 million of assets, those who work with financial planners rapidly increase in happiness, while those without planners rapidly become less happy.

So what's the true value of a financial life manager?

Yes, they provide investment management advice, financial planning services, and guidance for their clients’ financial futures.

More importantly though, hiring financial life managers helps make them happier too.

In fact, for individuals with more than $1.2 million in assets, a financial life manager is critical to happiness.

Every day, families have to deal with crucially important financial decisions and situations that they never dreamed would crop up in their lives.

Their stories are real and often serious.

But for us, successfully guiding clients through the changes and transitions of life requires more than sound technical knowledge and advice. It's about serving as your family's thought partner, trusted advocate, and executive team. It's about understanding that your most valuable asset isn't your investment portfolio - it's your human capital, your family's well-being, and your ability to navigate life's complexities with confidence.

Great financial life management is like an iceberg, with most of the real story happening below the surface. Without realising it, most people are stuck in the shallows of basic financial advice - where banks, brokers, and advisers sell products to enhance their own bottom line, not yours.

As the only certified investment fiduciary in the Middle East, we operate under a different standard. We're legally and ethically bound to put your interests first. Always.

For every one of us who encounters a divorce, unexpected death, job loss, or some other triggering point, we should at least be aware that there's a better way forward. Not just advice that's "good enough," but guidance that ensures you're living the life you want - starting from today.

These life events are the financial game-changers. The question is: will you navigate them alone, or with a Sherpa who's already mapped the terrain?

Image generated using AI.