Get richer quicker – 3 valuable lessons from Tony Robbins’ Unshakeable

[Estimated reading time: 3 minutes, 57 seconds]

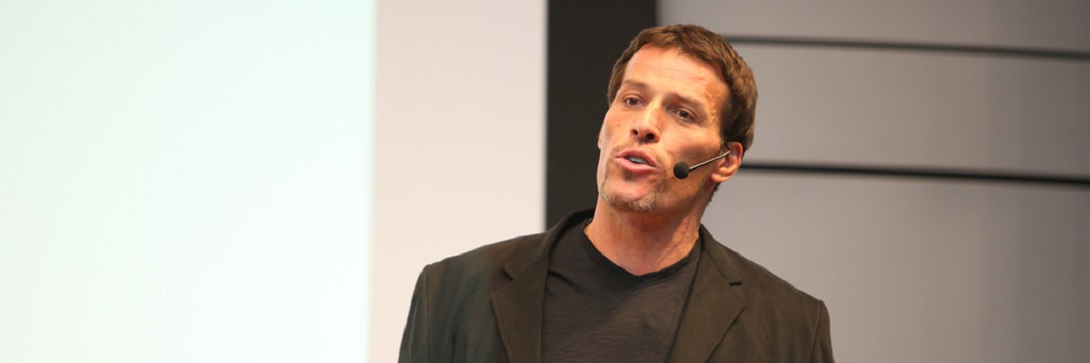

Tony Robbins grew up in poverty.

![]()

![]()

And, like 1 in 8 Americans, he often went to bed hungry.

His mother was an alcoholic, he worked nights to support himself through school…

…he knows what suffering feels like…

He also knows how – in his words – to “rise from pain to power.”

Today, Robbins is a self-made man of fame and great wealth…

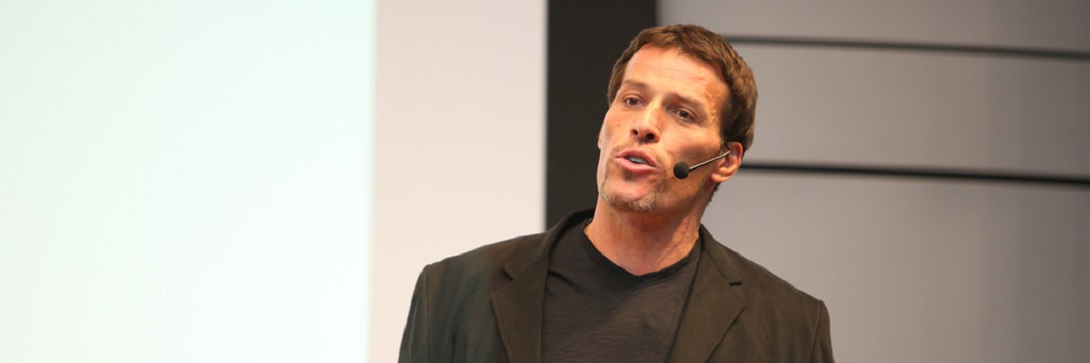

And, whilst his latest investment bestseller Unshakeable won’t make you as famous as he is…

…if you heed Robbins’ invaluable insights, you will learn how to get richer quicker…

How Unshakeable will make you wealthier

Every chapter of Unshakeable brings unique inspiration to spark your success as an investor…

But the following 3 lessons really stand out – because they will make you wealthier…

#1. Sitting on the sidelines is the costliest mistake you can ever make:

In 2008 the US stock market plunged 37%.

Having lived through that, 60% of millennials say they distrust financial markets, preferring to keep their savings in cash.

Robbins says: “the greatest danger to your financial health isn’t a market crash; it’s being out of the market. In fact, one of the most fundamental rules for achieving long-term financial success is that you need to get in the market and stay in it, so you can capture all of its gains.”

But with the markets so high, should you wait to invest?

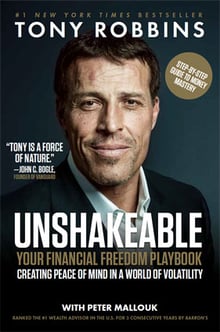

In 2013, the Schwab Center for Financial Research studied the impact of investment timing on the returns of five hypothetical investors.

Each had $2,000 in cash to invest once a year for 20 years, starting in 1993.

Here’s how they fared…

The evidence shows that if you stay out of the market and in cash investments (like too many millennials) you’ll fare badly…

But – if you get in the market, stay in and invest consistently, even if you mis-time entry every single year, you will make money.

If you’re not invested yet, stop sitting on the sidelines – because you’re scuppering your financial future.

#2. Avoid the drain of excessive fees

In Unshakeable, Robbins demonstrates how actively managed funds charge up to 60 times more than simple index tracking funds.

He also demonstrates how investors who pay fund managers to grow their money put up 100% of the capital, take 100% of the risk – and are lucky if they get 33% of the returns – because of fees.

This is how excessive fees affect expat investors like you: -

The average expat investor pays 4.91% to be invested.

In contrast, an expat can choose a far more cost effective method to get investments and advice (such as the AES Index Account). This has custody, investment advice and on-going service for 1.75% all in.

That difference of 3.16% doesn’t sound like a lot…but fees compound and devastate.

Here’s how:

- On an investment of $100,000 over 25 years;

- Assuming annual average stock market returns of 7%;

- The average expat investor paying 4.91% in fees loses $375,025 in charges;

- And takes home just $167,718 for their retirement

- The investor who pays 3.16% less in fees walks away with $359,379

- Or, to put it another way 3.16% less today = 214.28%% more tomorrow

Cut your costs today, grow your financial future exponentially.

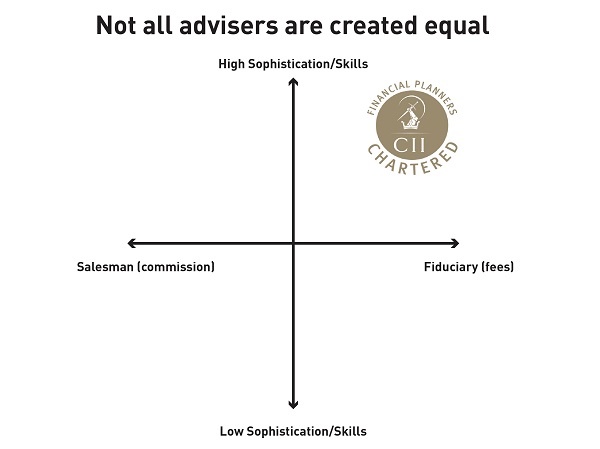

#3. If you don’t understand the incentives of your advisor, you’re liable to discover that you’ve done wonders for his financial future while potentially wrecking your own.

In Expatriateland, where you and I live, 99% of financial advisers are brokers…only 1% are fiduciaries.

In America, the split is 90% brokers / 10% fiduciaries…

Robbins explains that: “[Brokers are] trained and incentivized to sell, regardless of whether you need what they’re selling! That’s not a criticism. It’s just a fact…”

According to the Wall Street Journal, these brokers go by any one of 200 different job titles.

Because you can’t tell how your adviser is incentivised by their job title therefore,

Robbins cautions: “…learn to distinguish between … different types of advisors so you can sidestep the salespeople and choose a fiduciary who is required by law to act in your best interests.”

In a 2015 article entitled Exposed: the rip-off investment 'advisers’ who cost British expats billions The Telegraph detailed the very real cost to expats of failing to understand what’s incentivising their adviser… Some who chose a broker over a fiduciary…

- Lost 12% of their pension;

- Incurred a 99% exit penalty;

- Paid 7% in hidden commission…

Robbins explains that “What will protect you is knowing how the system can work against you…remember, people can be sincere — and sincerely wrong.”

Heed his guidance, and you’ll be the one growing wealthier with good financial advice from an unconflicted fiduciary.

This diagram explains it well: -

A final word to the wise…

Even if you’ve opened investment books before, and failed to get beyond the first probably impenetrable chapter, give Unshakeable a chance…

It’s an accessible and “short book that you can read in a couple of evenings or a weekend”, and it has the power to positively change your life.

Apply Robbins’ advice, and you will grow richer quicker…it’s that simple.