I recently asked you for your feedback on what we can we do to help more people understand the risks they face from financial salespeople.

Many of you were kind enough to share your thoughts and ideas...

You also fed back on how we can help people identify the safer, better alternatives that exist for expat savers and investors.

Thank you to everyone who commented.

In return for the favour, here are answers to three of the most frequently asked questions that we’re asked by our readers and prospective clients.

I hope these come in handy when you’re ready to make your own plans.

And if you have any issues or burning questions of your own, talk to us – we’ll make sure you get the help you need.

#1 Can I get out of a regular savings plan?

The short answer is “yes you can.”

Obviously every individual case is unique, policies have different terms and conditions, and after you’ve considered all your options you may choose a different solution.

But first things first:

- You need to know what you’re dealing with,

- What’s the impact or cost if you cancel,

- And what your choices are.

How to get the information you need

If you have over £500,000 in any savings or investment management solution that you’re considering cancelling, or that you have a nagging feeling about, the easiest way to get all the answers is by requesting a Second Opinion.

We’ll uncover: -

- How much you’ve been paying in charges and commissions

- What your performance has been to date

- What impact costs and asset allocation are having on your wealth

- If any better alternatives exist for you

You’ll also get the definitive answer about whether you can get out of your contractual savings plan, and what it will ultimately cost you.

You always have choices

We meet people every day who feel they are in a hopeless situation with their finances, but there is always an alternative route to consider.

- If you discover that yours is an expensive or inefficient policy, cancelling your policy and starting a lower cost and more flexible one may give you much better investment growth over the long term.

- Depending on your commitment to your current policy however, and the flexibility you need, you may prefer to continue with it. This is rarely beneficial with a high cost plan, but it is an option that you can consider.

- If you have a very short time until your plan matures, it may be most suitable to see the policy through to the end of its term before starting something more appropriate to your requirements.

Your choices should be considered in conjunction with your other financial arrangements and commitments.

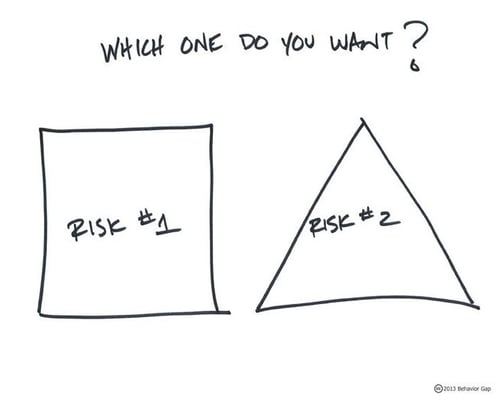

Keeping your attitude to risk and your investment time horizon in mind is also critical.

Talk to us if you need any help or advice, and get your X-Ray so you know what your options are.

Talk to us if you need any help or advice, and get your X-Ray so you know what your options are.

#2 How do I know if my international investments are working for me?

There are many questions you need to ask and have answered to reach a definitive conclusion on this point.

Among other things, you need to think about: -

- Why you’re investing

- Your appetite for risk

- Your tax status

- The time left until you want to access your investment

- If you are looking for income or growth from your investment

- What you’re paying in fees and charges

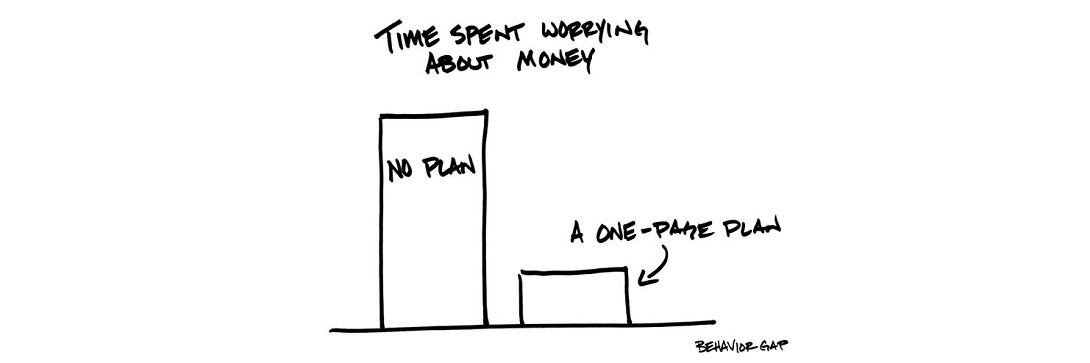

It doesn’t have to be complicated

Whether your money is working appropriately for you is a very personal, subjective issue.

I recommend you get the most detailed picture of your investments with our aforementioned X-Ray portfolio review service, and then you can decide whether what you’re paying and earning matches your ambitions and expectations.

Your report is written in plain English.

The conclusions are very accessible.

You’ll also get alternatives to consider if you feel your investments aren’t working for you.

You may also find our Do-It-Yourself Investing eBook useful.

#3 Should I transfer my pension?

Pension transfers can benefit some people, but they are heavily marketed, over-sold and sometimes even mis-sold to expats.

Why?

Because transfers can generate financial salespeople massive commissions, which come from your pension.

You have to tread very cautiously when seeking advice on this subject.

Make sure any advice you take is regulated, professional, and qualified.

If your financial adviser makes the wrong choices for your pension you may face a 55% tax penalty.

Also, if your pension has any safeguarded benefits, (e.g., if it’s a final salary pension or guaranteed minimum pension for example), and it’s valued over £30,000, a pension transfer has to be legally signed off by a Pension Transfer Specialist.

Whilst we offer this service and are one of very few companies to have this expertise in-house, we cannot urge caution highly enough when it comes to pension transfers.

Please do not rush a decision, and if in doubt we can offer you an expert second opinion.