My 10-year old daughter recently asked me a question.

It caught me off guard.

“Dad, how much money is enough?”.

I wanted to tell her that if she starts investing early enough, she won’t need to worry.

Perhaps she’s too young for that.

So, I replied with a philosophical, “not much”.

Job done…

Not quite.

She asked me another question.

“But how much money do I need to feel comfortable?”

Philosophical answers aside, this is a very important question.

We already know that 95% of people don’t have enough money in their retirement.

It is a quantitative question for sure.

But the question’s qualitative nature is what makes it special.

It is about how money makes us feel comfortable.

According to a survey by Charles Schwab, Americans require US$ 1.4 million (average net worth minus liabilities) to feel “financially comfortable.”

That sounds like a decent number.

Of course, this doesn’t guarantee happiness.

Or comfort.

I’ve known people with much less who live happy and satisfied.

And I’ve known ultra-wealthy people who suffer from depression.

Money certainly does not buy you happiness.

But you still need enough of it so that you stop worrying about the lack of it.

I asked this question to a group of middle-aged friends.

(That’s mid 40s).

One of them replied,

“I need enough to buy a good retirement home with enough left over to provide annual income for the rest of my life.”

Another friend wanted enough to send their son to University in America, buy a large family home, and to have some left to invest to be able to fund household expenses, without any active source of income.

One friend opted for this rule of thumb:

“Looking ahead from now, I think I would need 40x of annual expenses as my liquid net worth when I retire, plus 50% extra for expensive pursuits like foreign holidays etc., and zero financial liabilities.”

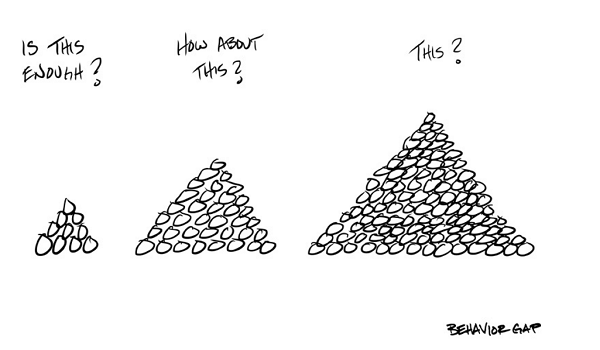

One thing is sure.

There is no one right answer to the question my daughter asked.

But one can certainly arrive at an approximate number using a formula like above.

But there are other variables.

Current age and life expectancy (the longer you will live, the more you will need).

Current annual household expenses (higher it is now, higher you will need in the future to maintain your lifestyle).

Number of dependents…expected inflation in household expenses…current and future financial liabilities.

Even the answer that you get from using these variables would be an approximation.

But it would give you a number to aim for.

Your magic number.

Imagine entering the London Marathon only to find they have made a key change.

There is no finish line…

How will you train?

You couldn’t.

How will you know if you’d won?

You wouldn’t.

You need finish lines.

Answering my daughter’s money question will help you know where that finish line could be for you.

Life is too short to save and invest everything for the future, and not spend in the present.

But you must strike a balance.

My advice to my daughter?

1. Start early.

2. Spend less than you earn.

3. Invest well (passively managed index funds) to avoid being part of the 95% club.

What about you?

How much would you need to feel financially secure?