My grandfather had a lot of money.

But he lost a lot within the stock market.

Growing up with this story – I always thought of investment as a gamble.

More like speculating than a sure thing.

That’s one reason I am so interested in sharing the secret of a much more successful experience…

Now. What does this phrase mean to you…

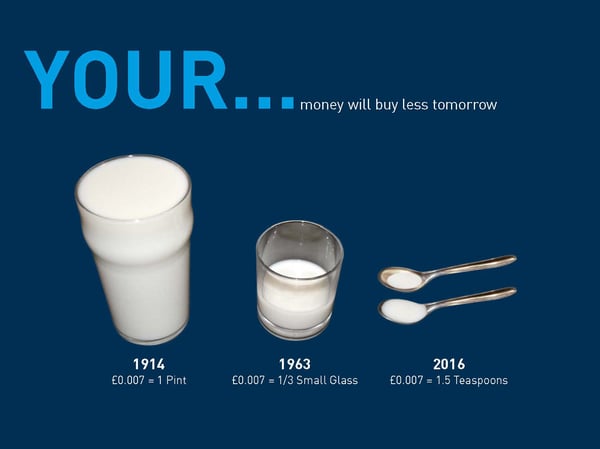

“The invisible enemy to money in your bank account”

Most people I speak to understand this to be inflation.

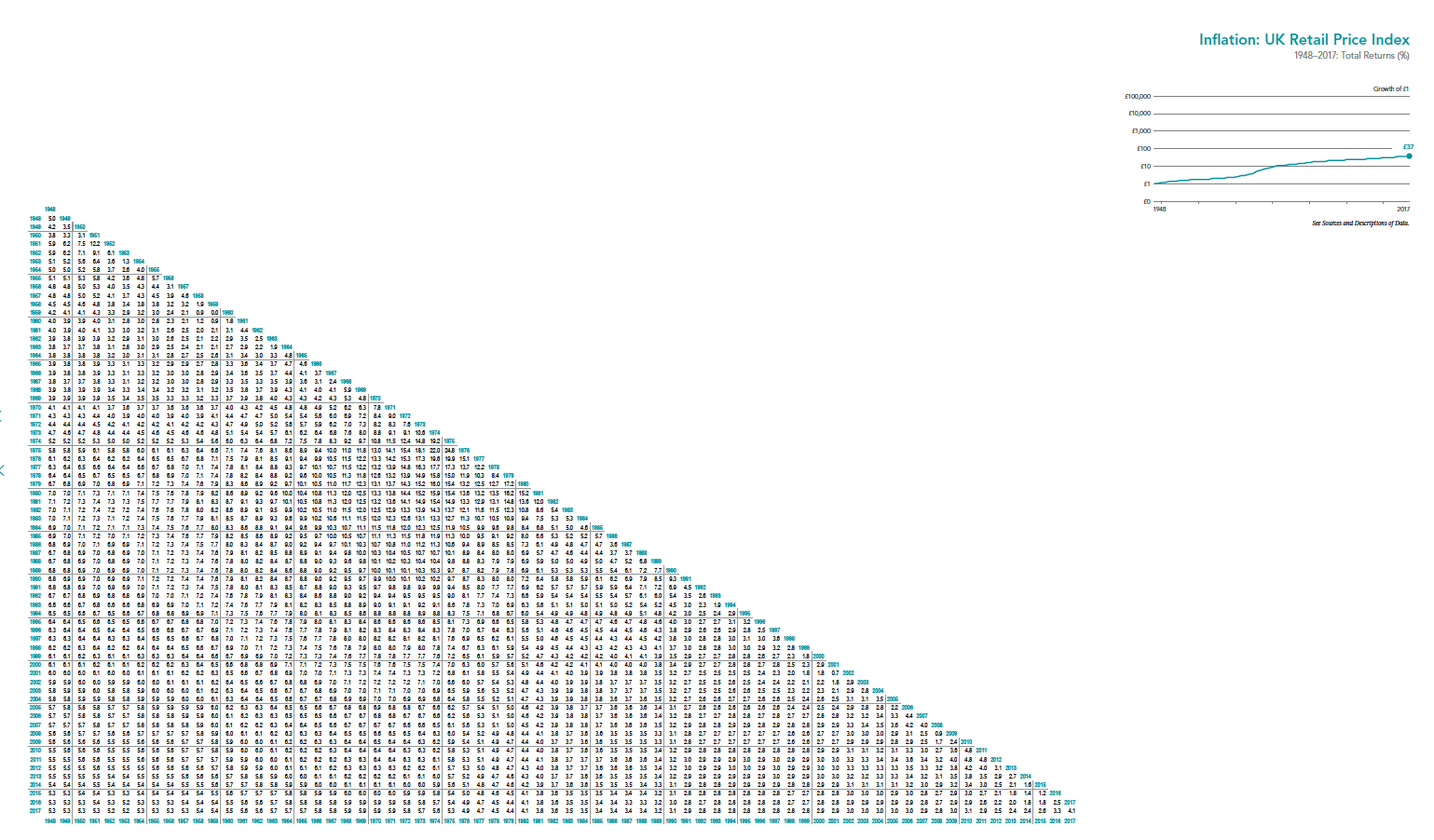

In the UK we track inflation through the UK retail price index.

It shows just how fast the value of your money is being eroded.

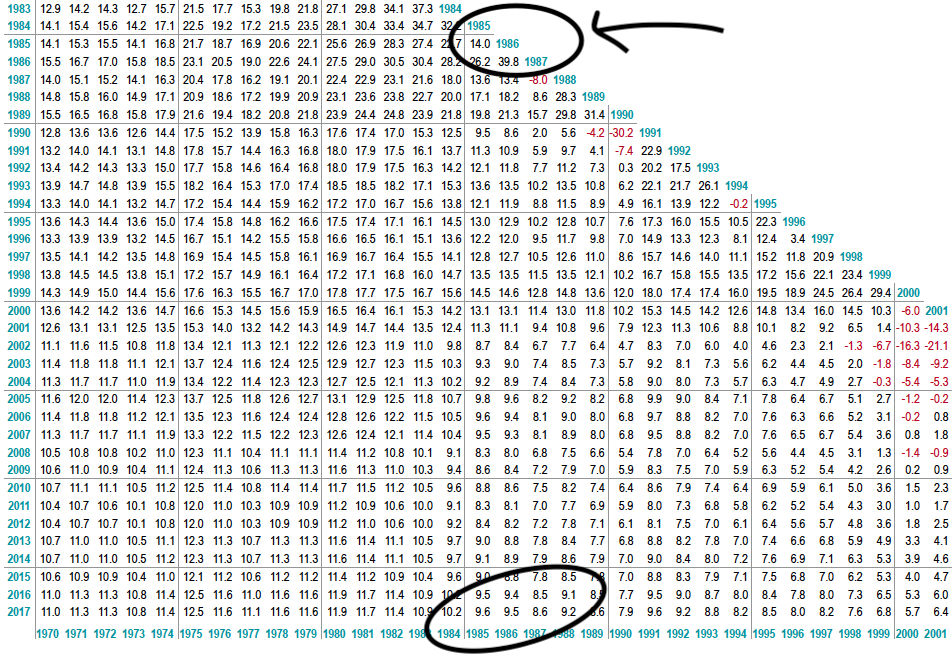

I have a fantastic chart that shows the annualised long-term rate of inflation.

Sadly, it's too big to show clearly in a blog.

See...

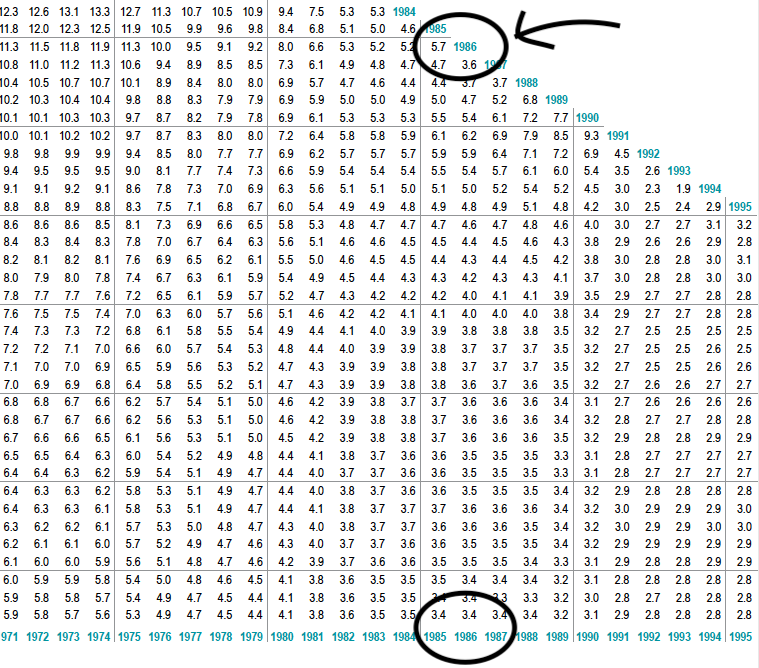

Now, I'm going to start by picking a year that means something to me.

It’s 1986 (when my childhood was marred by Maradona’s hand of God).

On the chart above – I find the year along the top (X axis).

Running my finger to the bottom of the chart then gives me my annualised figures.

What's the average annual rate of inflation since 1986?

3.4% per year.

What does that mean?

It means if we leave your money in the bank as a client then you're going backwards by 3.4% per year.

So, it's imperative you at least do something.

I like to think of this as taking your first step onto the risk ladder in terms of protecting your future capital requirements.

Now, there is no such thing as a risk-free return.

So, if you want to invest…

… you need to make an initial investment management decision.

Probably the best asset class to get a ‘safe’ return from is something like a UK one-month Treasury Bond – a quality short term fixed income investment, not a lot of risk, very little yield, and its volatility is extremely low.

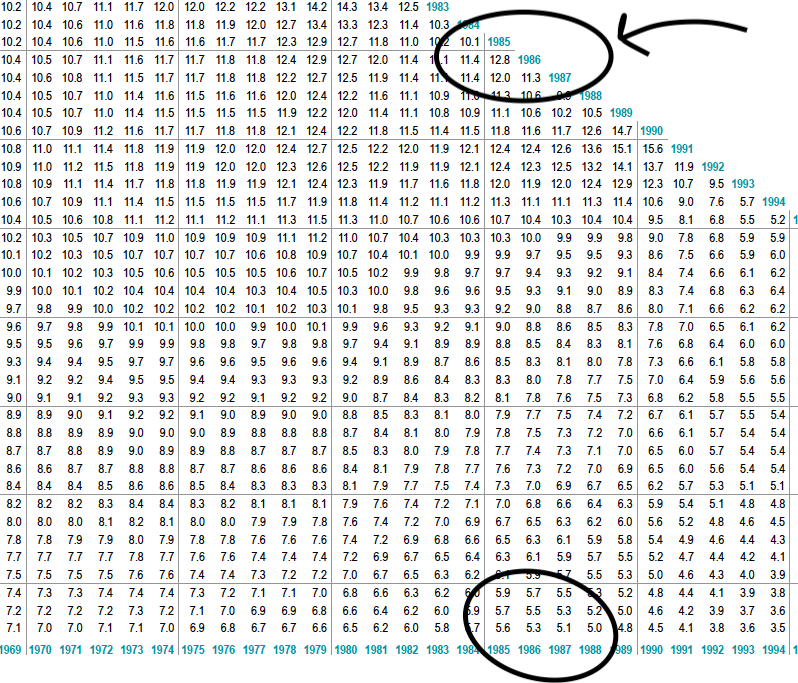

I have another chart too large to share.

But we'll go to 1986 again.

Let’s see - 5.3% per year.

Let’s see - 5.3% per year.

Is that a big number against the annual inflation rate since then of 3.4%?

No.

But it at least shows us the opportunity to mitigate against inflation is enhanced by using ‘fixed income’ or bonds.

Now a financial planner will normally give you a cashflow plan to show you what return you actually need to get on your money to live the life you want to lead, free of worry.

Thinking about your goal in terms of a return:

Is it enough if we get you 1.9% per year over time?

Would that be enough to help you reach your future goal and objectives?

No?

So that probably means we need to introduce the primary driver of strong returns.

Equities.

Evidence-based investing firms such as AES take a globally diversified approach to capture these returns (following the old rule about not keeping all your eggs in one basket)

We would start off with thinking about something like the MSCI World Index as a good indicator of likely returns.

And that market rate return since 1986?

9.5% annualised performance.

So now we are getting closer to our goal.

Living the life you want, free of worry.

Not quite there, but getting closer.

As it turns out, a huge amount of academic, Nobel Prize-winning research has been carried out to help investors decide exactly which equities give the strongest returns.

The 3 main factors are:

1. Value (the true value of the company)

2. Size (its size)

3. Price (its share price)

For example, excluding less valuable firms from the MSCI gives rise to a premium.

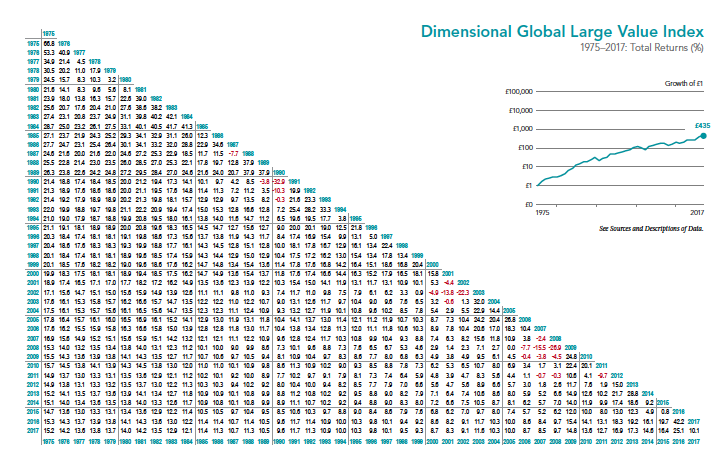

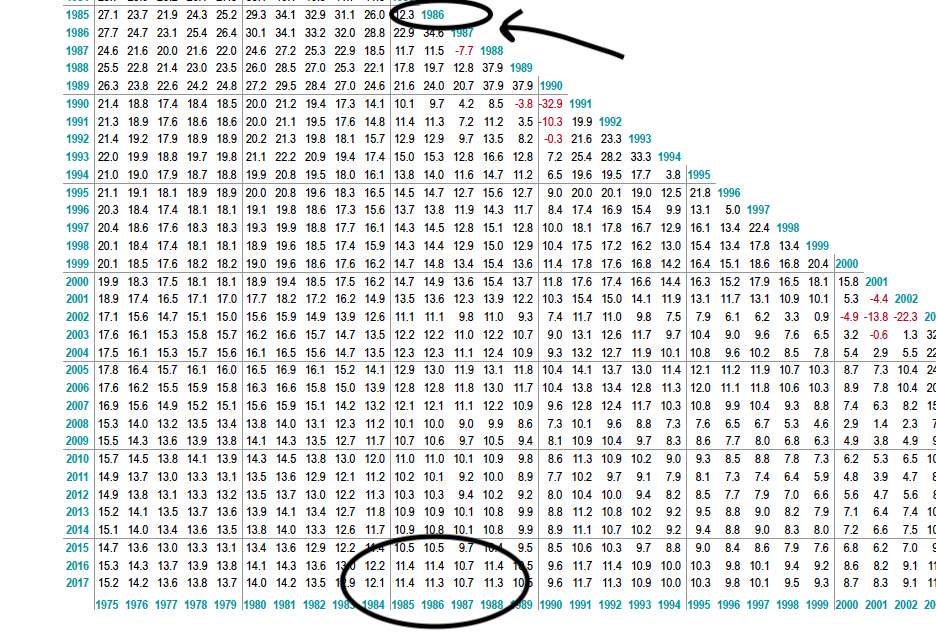

The table below shows us this value premium within the Dimensional Global Large Value Index.

Go again to 1986 and the annualised return is 11.3%.

I haven’t included the charts due to lack of space, but the size’s premium is 11.1% and the value premium is 12.2%.

Can we say anything more about these absolute numbers?

Not really.

In any particular year, we don't know what the premium is going to be.

But we know that there is a link between time and the relationship these numbers have with each other.

And here it is…

It turns out that after any decent period of time, equities will outperform bonds.

We expect this, because we are taking more risk and expect to be rewarded for taking that risk.

With these tables and factors we have what you could think of as an ingredients list.

The role of a professional adviser is: -

1. firstly to help work out what you need; then

2. to mix these ingredients into a recipe that helps you achieve your goals and objectives in a safe (risk controlled) manner; and

3. to adjust things as life gets in the way.

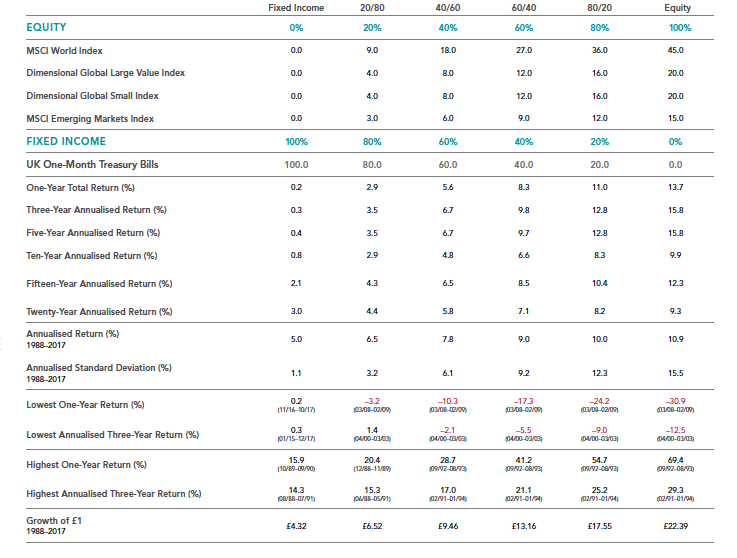

It takes many ingredients to set-up a portfolio ranging from 100% fixed income to 100% equities.

As you look through these ratios we see something really interesting.

You see dovetailing between the magic number on your cashflow plan and the required fixed income/equity mix.

For example, if a client needs an annualised return of 8% in order to have the retirement they are dreaming of, how do we construct an appropriate portfolio from the available ingredients?

We take that number and measure it against the expected returns of the portfolios that we are utilising.

Index statistics as at 31 December 2017, in British Pound Sterling.

Looking at the picture above - which portfolio do we need to return an annualised average of 8%?

Probably 60% global equities and 40% fixed income.

Since 1988 the world has served up a 9% annualised return to a portfolio with that mix.

But what risk matches that return?

To understand this, we need to look at the lowest return year (2008) since 1986 and look you, our client, in the eye and say,

Mr Client, I'm comfortable putting you in this portfolio so long as you look me straight in the eye and tell me that next year, if the portfolio drops by 21%, the worst ever year this portfolio has had – you too will be comfortable.

If the answer is anything other than yes, then the equity element of the portfolio needs to be reduced.

You need to be made aware that you may miss that perfect retirement goal and need to adjust your plans accordingly.

Likewise, if higher returns are experienced and you outperform your cashflow plan then the annual review process should dial down the equity exposure to say a 20-80 ratio.

Why?

To ensure that you are getting the return you want, but for less risk.

Let’s re-cap my example of 1986:

Inflation -3.4%

1 month bonds 5.3%

MSCI World 9.5%

Large-Cap 11.3%

60:40 Blended portfolio 9%

Why is this relevant?

Ask the typical person with money doing nothing in the bank, whether investing is like gambling or a “scientific process”.

Like myself, I think on average you'd see the majority likening it to gambling.

Most people ‘think' every year is wildly different than previous years.

But the evidence shows that if you have time on your side, and if you are disciplined and think of investing in capital markets as much more of a thorough and robust investment process – then it is a sure thing.

Yes I said it, a sure thing.

Look at any of the charts above and you see two colours.

Red for negative.

Black for positive.

And it's likely a whopping red number in 2008.

I can understand why 2008 felt like a volatile year.

But, big red years are always followed by bigger black years.

Most the charts after rolling 3,4 or 5-year periods are back to black.

In fact, at no point in the history of the world market would you have lost money to inflation over any 10-year period.

So…...

It is these numbers, this evidence and this process which are the building blocks for a powerful conversation about transforming your future in a good way.

Turning your back on sales spin, forecasting, fear and complexity.

I hope this explains how we construct portfolios.

And why it's important to invest in the stock market properly.

A little bit of knowledge can lead to a successful experience.