How to transfer your Shell pension (Shell Overseas Contributory Pension Fund/SOCPF)

If you’re a Shell employee or former employee living overseas, and are nearing retirement, you’re likely considering how best to transfer your Shell pension.

After 18 years of meeting many oil and gas professionals, I've realised almost everyone gets the same thing wrong.

We've worked with dozens of top oil and gas professionals over the years.

Your skill level is high.

You often live and work in 'riskier' countries and uproot your entire family to be with you.

For this, you’re rewarded well, both in salary and the large benefits that have built up over time.

The Shell Overseas Contributory Pension Fund (SOCPF), also known as the Shell Pension, is based in Bermuda and is a good, well-funded, final salary pension scheme for those not working in the UK.

Shell has several offshore pension schemes.

However, the SOCPF is the only scheme that’s transferrable (aside from the UK defined benefit scheme).

It's unique and unlike other UK-based schemes such as the UK Defined Benefit (DB) Pension or Defined Contribution scheme.

It's not surprising then, that you become a target for financial salespeople, when in fact you need a technical specialist.

Because it’s not classified as a UK Defined Benefit Scheme, it’s not under the UK jurisdiction.

This means you don’t need to consult with a FCA regulated Financial Planner to transfer away.

In the UK, advisers must be transparent about how much they are being paid to complete a transfer.

But the same level of transparency does not always exist overseas.

You’re likely to be offered transfer values that are often significant in value - several hundred thousand, to a few million pounds.

Given that insurance bonds can hide hefty hidden commissions, the rewards for some salespeople can be huge.

But not so great for you...

Shell offers advice on companies you can work with. The problem is, their advice can vary hugely.

And problems not only occur from deciding the best pension transfer advice to take...

But also, in choosing the most suitable scheme to transfer to.

We have many Oil and Gas professionals as clients.

We're duty-bound to offer advice which is in the client’s best interest.

AES is the only certified fiduciary in the whole of the Middle East, Asia and Africa.

This means you'll get objective, unbiased and professional advice that's in your best interest.

A real-life, 2022 case study

Earlier this year, Grant* came via our website, looking for a review of his pensions and help on whether to remain or transfer upon his next move.

In our Discovery Call, we learned that Grant had spent 30 years at Shell, 15 of which were overseas.

Because of this, he’d built up entitlement to both the Shell UK DB scheme and the Shell Overseas DB scheme.

We were a good fit for Grant's situation, so we arranged to speak in more-depth, something we call our Compelling Conversation™.

Grant wanted to retire at 55, however Normal Retirement Age (NRA) for each scheme is 60.

Drawing the pension before the NRA would result in an ‘early retirement reduction’ being deducted from the annual income, to reflect the longer time it would need to be paid out.

But Grant's concerns weren't purely for himself.

We asked a series of questions to understand what’s most important to Grant, and he shared his goals and aspirations, including what he’d like to accomplish and what keeps him awake at night.

A major concern was being to leave a greater amount (than simply a spouse’s pension) to his wife and children, upon his death.

Particularly if this happens earlier than expected.

We committed to working towards achieving everything important to Grant and his family.

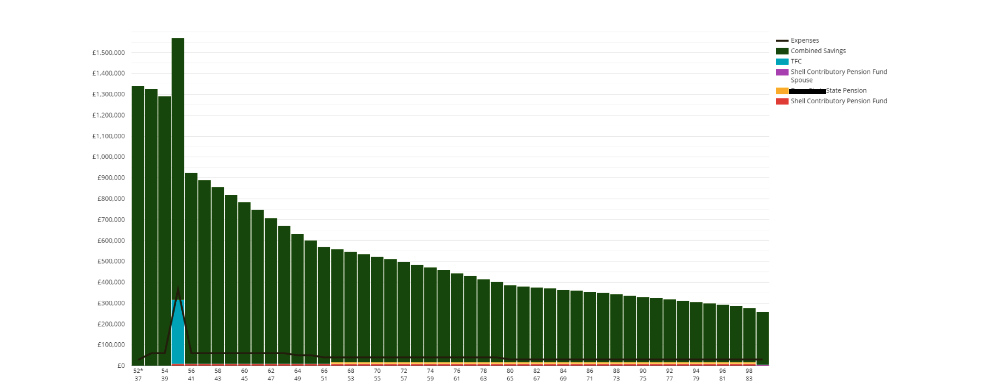

My team and I conducted careful analysis and created a financial plan, which we presented in our Life Strategy Meeting™.

At this point, we estimated that for Grant to be able to achieve his objectives, he was required to transfer his Shell (SOCPF) overseas scheme and take the cash equivalent transfer value.

To achieve the capital value required to provide his wife and daughters with a legacy, he would also have to increase the level of risk he was taking (rather than receiving a guaranteed annual income for life) and also draw down on his UK DB scheme.

To attain the capital value required based on the current assets and assumed inflation rate, he would require an average growth rate of at least 4.50%+.

In summary, we recommended transferring his Shell (SOCPF) overseas pension to a QROPS and taking a pension income from age 55 onwards.

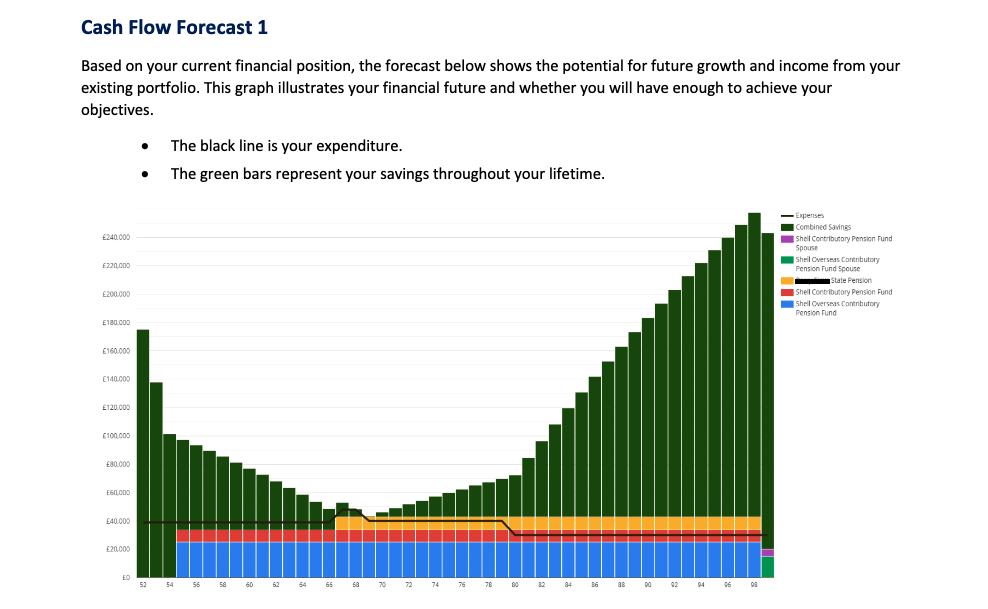

We forecasted the future growth and subsequent cash flow:

This strategy would mean the income was paid completely free of tax to Grant, because the country he retired in does not tax foreign income.

It also allows him to pass on a sizeable pot to his younger wife and children, which will fall outside of the scope of UK Inheritance Tax.

Transferring the overseas scheme benefits (to take advantage of the additional flexibility on offer), allowed Grant to retain his Shell UK DB scheme benefit.

Everything that was important to him.

This provided him with a secure, guaranteed and inflation-proof income from 60, as well as avoiding exposure to the UK Lifetime Allowance (because if he’d transferred the UK scheme, he may have been subject to UK Lifetime Allowance charges).

Now, every case is different.

Most are complex.

But, broadly speaking, there are only 2 options if you’d like to transfer your Shell Pension.

Option 1: Move to a UK scheme

You could consider transferring to a Self-Invested Personal Pension (SIPP). This is a type of UK Personal Pension but with wider investment powers.

This option is most flexible when it comes to drawing funds out, as you benefit from Flexi Access Drawdown (FAD), allowing you to vary the timing and amount of your cash and income to suit your circumstances. However, a SIPP will always be subject to UK legislation and, as such, you are subjecting the money to UK rules and oversight.

You can read more on the technical aspects of a SIPP here.

Option 2: Move to a non-UK scheme

The second option is to transfer to a non-UK scheme, such as a QROPS or QNUPS.

A QROPS is an international pension scheme that can accept pension transfers. The major centres for QROPS are Malta, Gibraltar and the Isle of Man. A QNUPS can be thought of as like a QROPS but with some differences...

Unlike the first option, your pension remains offshore and not subject to UK rules/oversight.

However, there are many schemes to choose from, so caution is needed. There are also limitations on how freely you can access your money.

You can read more on the technical aspects of a ROP, QROPS or QNUPS here.

Which option is best for you?

If you have an overseas pension with Shell and wish to review your options, we can provide a complete analysis of your scheme.

Depending on your current residency as well as your retirement residency destination, and considering your goals and aspirations for your retirement, we can provide you with the right advice for your retirement.

Not only this, but we'll make sure you bypass other expense-laden schemes and get you the very best options that I'd happily recommend to my own oil and gas family.

We not only know the risks senior oil and gas professionals are up against, we know how to fix most messes, and definitely how to prevent you from being mis-sold to in the first place.