Why a typical offshore financial salesman will break your heart

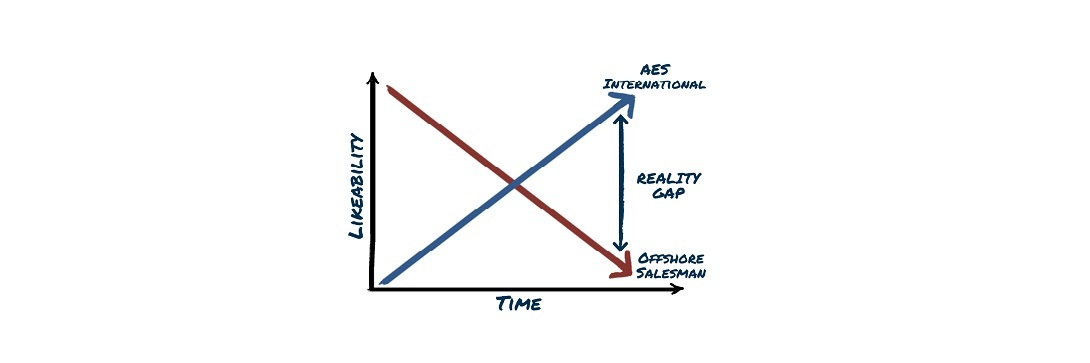

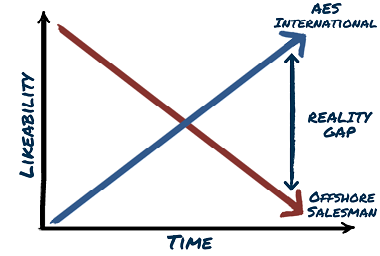

Most expats will at some time meet an outwardly trustworthy, highly attentive, and in most cases charismatic ‘financial adviser’ who offers 'free financial advice and investment guidance'. They will most likely work for an upmarket sounding company, wear sharp suits, drive nice cars, take you to play golf, and invite you out on social events. Wow! What great guys - likeability is initially very high.

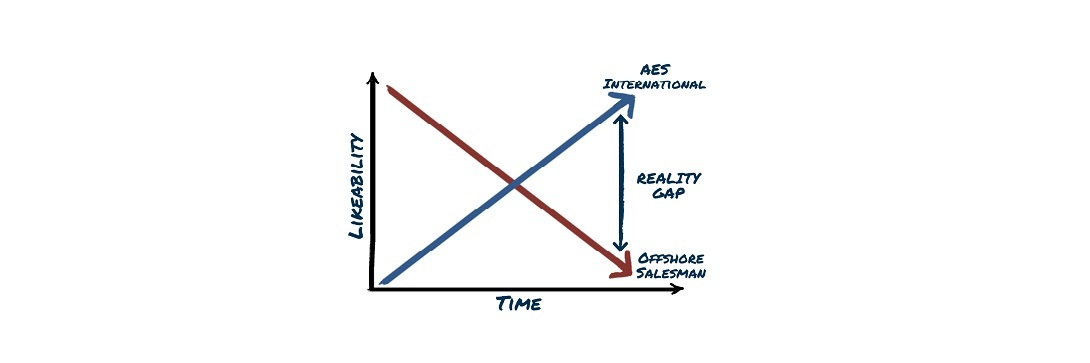

Over time, however, those regular savings plans, pension transfers and offshore bonds just don’t make much money. In a bull market, they might just about keep their heads above water, and regular visits from ‘Mr Nice Guy’ will paper over any cracks. But in a market dip, whoooah! They really tank. When you add time to this equation, the initial hope and comfort that the salesperson’s promises brought fades, and when you fully understand the insider secrets that offshore financial salesmen don’t want you to know, I wager they won't be such a close friend for long.

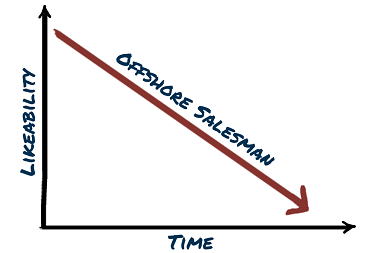

In contrast to an offshore product vendor, a professional financial adviser may initially appear less charismatic and friendly. They probably won't tell you everything you want to hear and will most likely challenge your existing views: you may not have planned well enough for your retirement, invested in the wrong things, not be structured efficiently, and probably not possess a coherent, documented financial plan.

But they will most likely address this directly, tell you a few uncomfortable truths, and then go about helping to remedy the situation. They will be transparent, open and professional (and not clambering to meet you for a coffee every couple of months so they can either churn your investments, get some more money (‘top-ups’) off you or, even better, a few referrals). Over time the results are empirically the polar opposite of the former solution, and as you learn more and grow your assets efficiently, you will grow to love your professional adviser! Why? Because they actually assist you to grow your wealth while the former more than often deplete it!

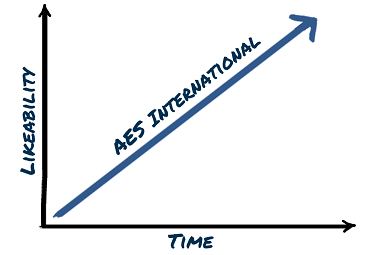

I call the difference between being told what you want to hear from an offshore financial salesperson and being professionally presented with the empirical facts the 'Reality Gap.' This reality gap in international financial advice is the difference between fiction and fact, opaque and transparent, and industry and profession.

Those clients that understand the reality gap and take professional financial advice will in time benefit from a massive difference. The compounding losses of those who fail to properly understand the damage and opportunity cost of sleep walking into the wrong advice is easily measured, and the sooner it is addressed, the better the performance you will get.

I am personally deeply passionate that international clients understand the differences between a real adviser and a salesman that calls himself an ‘adviser’. As such, AES International is happy to empirically demonstrate the difference in numbers and offer a complimentary analysis of any international individuals' existing circumstances and investments.

These are our complimentary services and offers:

-

The transparent disclosure of all the hidden fees you have paid to your adviser but probably didn’t know about;

-

A comparison of your existing investments against their peer group (benchmark) to see if you are invested in the right funds;

-

An analysis of your asset allocation;

-

Our view on what makes sense for you; and

-

0% charge on all transfers to AES International.

If you are worried your investments were set up less than responsibly, we could help you recover and start building your own wealth rather than someone else’s.