One cubic foot of gold weighs half a ton.

All the gold in the world fits inside an Olympic swimming pool.

In fact, gold is so rare, that the world pours more steel in an hour than it has poured gold since time began.

The case for gold as an investment asset is also an interesting one.

It’s widely accepted that gold is a safe haven when markets are choppy.

Some also say it helps to maintain purchasing power at times of hyperinflation.

And doom merchants claim gold is the ultimate Armageddon safe haven.

But gold is just metal.

It generates no income whatsoever.

It will only ever be worth what someone is willing to pay for it at any given time.

Warren Buffett explains:

“This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they believe that the buying pool will expand still further. Owners are not inspired by what the asset itself can produce – it will remain lifeless forever – but rather by the belief that others will desire it more avidly in the future...”

I’m often asked whether investing in gold is a good idea...

I want to present evidence to help you make a personal decision about whether to hold this precious metal – or not.

Recent performance of gold is lacklustre

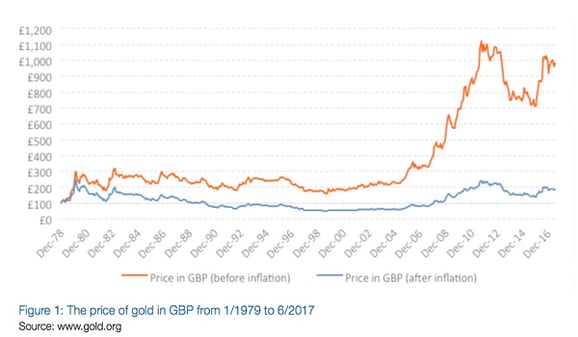

In the UK, the price of gold has floated freely since about 1979.

The following graph from gold.org shows the price of gold before and after inflation in the 30+ years since 1979...

At first glance, the price of gold before inflation may make you think it’s been an incredible investment.

Look at that orange line go up!

The disappointing reality is, after inflation, gold has been a pretty lacklustre performer.

Drawing a line from its high in February 1980, it took until 2011 to get back to that former level of purchasing power.

Is gold worth holding as a hedge or a diversifier?

Many accept that gold is a good hedge against inflation, and a decent diversifier when markets tumble.

So, let’s look at the evidence behind these claims by examining its performance between January 1979 and June 2017.

1. The performance of gold vs equities:

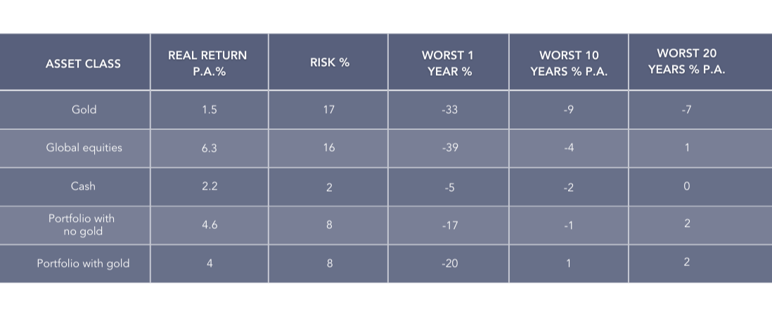

Gold suffered prolonged negative real returns over periods as long as 20 years...

It delivered an annualised annual return circa 5% lower than equities and its volatility was comparable to equities.

As illustrated below, there’s no discernible relationship between gold and equity prices over this period.

This table accounts for the risk and returns characteristics of different assets from 1979 to 2017.

2. Gold is a defensive asset when markets crash

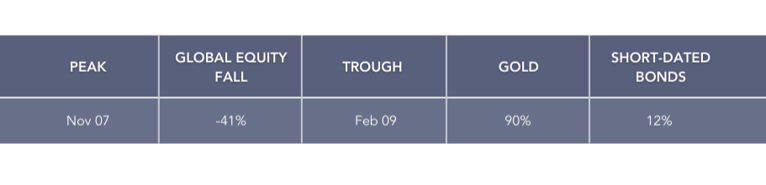

In our timeframe (1979 – 2016) there have been 3 major equity market crashes.

As a defensive asset during the first crash, gold helped a bit.

But no more so than high quality, short-dated bonds.

During the short 1987 crash, gold delivered a negative return of -7% compared to +2.5% for bonds.

During the credit crisis, however, holding gold would have helped.

Take a look...

However, the price of gold plunged circa 35% once the crisis was over.

Fear can drive up the price of gold...

But exploiting that to your advantage isn’t easy!

As Warren Buffett said:

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money, if they become less afraid you lose money, but the gold itself doesn’t produce anything.”

3. Gold is a hedge against inflation

For over 2,000 years, gold has kept up with inflation.

But over a more realistic investor timeframe, the evidence suggests stocks and index-linked gilts provide better opportunities to hedge against inflation.

Global investment management firm GMO analysed the relationship between gold and inflation.

Their data showed inflation for each decade in relation to the gold price was uncorrelated, except for during the 1970s.

Academics Claude Erb and Campbell Harvey drew similar conclusions in their own research paper The Golden Constant.

Should you invest in gold?

At the time of writing, gold’s spot price is £32,139 per kilo...

Making the metal a costly addition to any portfolio.

So, considering all the evidence, should you diversify into gold?

I don’t think so.

Gold comes with equity-like volatility, and whilst it has occasionally provided defensive returns during some market declines, its performance cannot be predicted or exploited.

Over a realistic investment horizon, gold proves to be a poor hedge against inflation.

And never forget gold is just a metal – it generates no income.

It will only ever be worth what someone is willing to pay for it.

Therefore, gold doesn’t provide effective portfolio diversification – nor will it improve your portfolio.

Buy some for its aesthetic value in the form of jewellery maybe, but don’t pack out your portfolio with bullion.