We took inspiration for this blog from a question sent by a reader.

Let’s be honest, it’s what we’re all thinking.

It’s one of THE most important questions high-performance executives ask themselves when it comes to financial planning.

So is hiring a financial planner worth it?

My answer might surprise you.

A friend of mine is a top banker and considers himself a sophisticated investor.

He often asks me if I believe hiring a planner would enable him to earn more (net of all fees) than if he avoided any advice and invested on his own.

The answer is, of course, it depends.

But on what exactly?

To my mind, there are 7 key factors.

I cover 4 of them in this blog, and the rest in part 2.

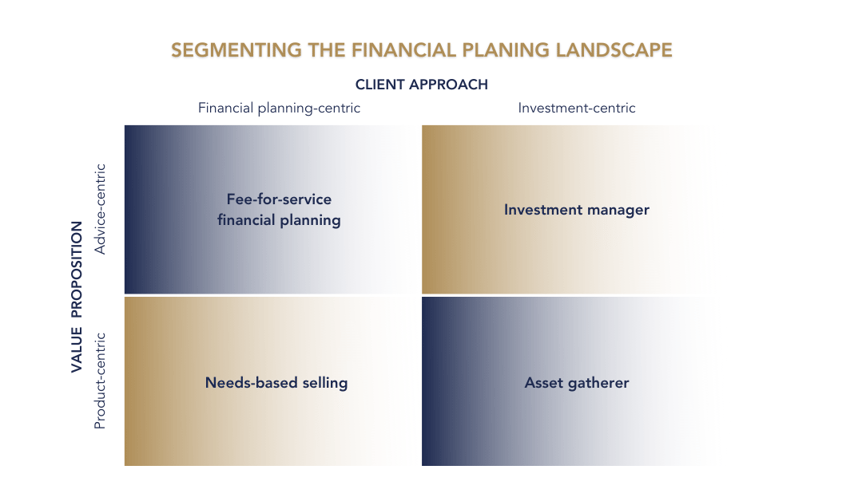

1. The type of financial planner

I often explain not all ‘advisers’ are created equal.

Some vend investments, structured products in banks, discretionary investments from well-heeled ‘names’ and other expensive investments...

Or trade ideas that ultimately don’t work.

Much of the traditional money management business has been an abject failure across the board.

Especially for the high-net-worth investors who need bespoke plans for their complex financial situations.

They're prone to poor investor behaviour that make dreadful performance even worse.

For example, buying and selling too often, at the wrong times and into the wrong instruments...

Chasing returns via managers, sectors and trades that have been 'trending'...

Only to be disappointed when mean reversion inevitably sets in.

Inflated expectations make matters worse because investors expect outperformance as a matter of course...

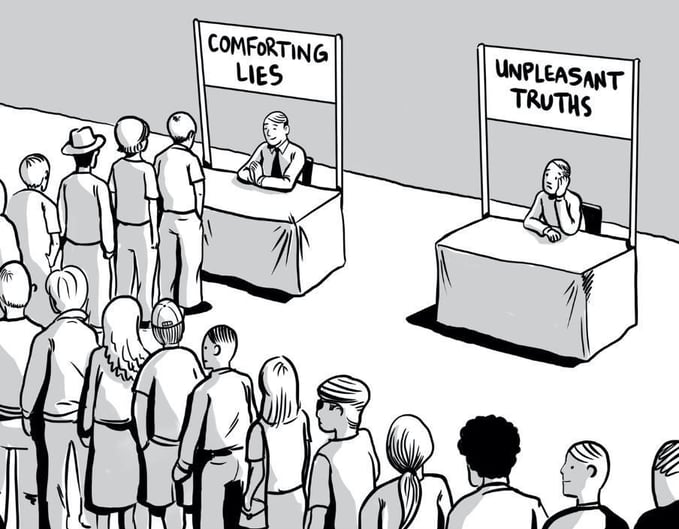

And fund managers tell everyone to expect it, implicitly and explicitly.

After all, that’s what makes the sale.

In my experience, many ‘advisers’ and their clients wrongly think their primary function is to pick good investment vehicles.

This isn’t to say they aren’t nice human beings...

They’re just not necessarily looking out for your best interests.

You may think they're providing unbiased financial advice, but they're actually brokers making money through hidden charges.

However, a viable alternative does exist.

A rare few are fiduciaries who are highly qualified and charge fees.

This tiny subset is legally required to put your interests ahead of their own.

Why does this matter?

Because senior international professionals are prone to choosing the wrong type of ‘adviser’ who do far more damage than good.

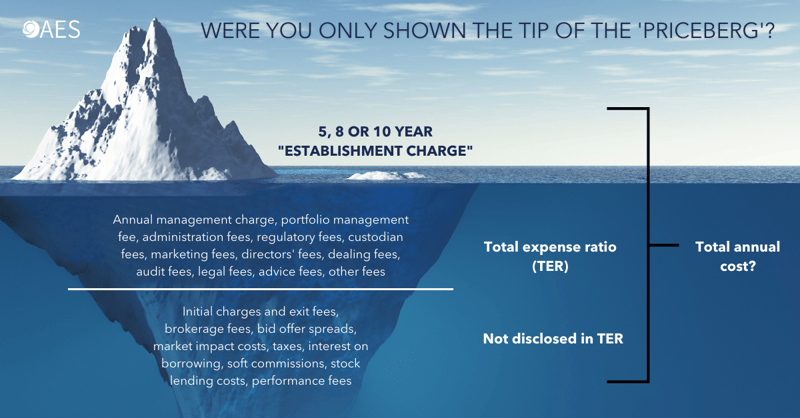

2. The type and level of fees

We’re used to paying more for better products.

But, with investing, the less you pay, the more you get to keep for yourself.

A fee-based planner should focus on this, showing you the substantial savings and value-added benefits it brings.

That is a counter-intuitive message, and people find it very difficult to fully understand.

Put another way…

Chances are, you are probably paying MORE than you think. It’s highly likely you could pay far less AND get better returns, products and services than you currently are.

This is where the value comes from.

Assuming you agree that fee-based fiduciary planner is better than a product salesperson it should be easier to quantify how much an adviser is charging for their services…

But internationally, it isn’t.

It’s not just the fee you pay, but the total annual charge which represents the real hurdle any adviser’s services will have to overcome to make your engagement worthwhile.

For this reason, it’s critical that you fully understand how you're being charged.

If an adviser is charging a percentage of assets annually, a recurring subscription fee, or a per engagement or hourly fee, it’s easier to come up with an annual dollar outlay for the advice.

But it’s the bottom part of the ‘priceberg’ and total annual cost that matters.

Being charged in any other way, such as being put in commission-based products, could mean that your total outlay may be even more opaque.

There’s no single right way to pay for financial planning but weighing up the cost of any advice as well as the total cost of the solutions you get is a good start.

My advice?

Always keep the total all-in costs involved with investment and financial advice below a maximum of 2% p.a.

A sensible breakdown for this may broadly comprise anything up to:

- 0.5% for investment advice and management

- 0.5% for advanced financial planning

- 0.5% for underlying fund costs

- 0.5% for custody, dealing and administration fees

People generally don’t understand how much they pay (in total) for investment and aren’t used to getting any tangible advice.

For example, a typical mutual fund may have an annual management charge of 1.5% but cost over 2%.

With product charges, advice and administrations costs; things add up and eat away at your returns.

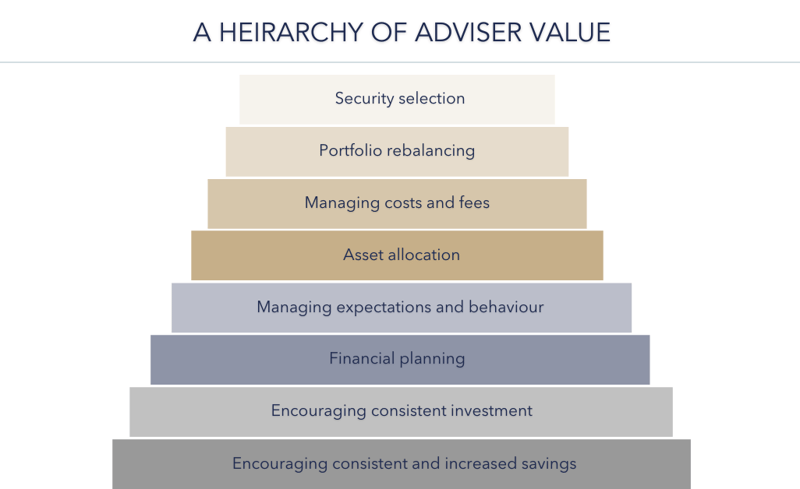

3. The breadth of advice on offer

Real financial planners tend to fall into one of three buckets:

- Those whose primary focus is managing a client's investment portfolio

- Those who focus primarily on financial planning

- Those who emphasise both areas (comprehensive planners)

While the wrong type of adviser can be detrimental to your financial health...

The right ones can bring you closer to your ideal future.

According to Vanguard, financial planners can increase their clients' investment returns by 3 percentage points or more.

They've quantified it as:

- Lowering expense ratios: 45 basis points (0.45%) back in your pocket

- Rebalancing portfolios: 35 basis points (0.35%) of increased performance

- Asset allocation: 75 basis points (0.75%) of increased performance

- Withdrawing the right investments in retirement: 70 basis points (0.70%) in savings

- Behavioural coaching: 150 basis points (1.50%) for serving as your practical psychologist

The grand total: 3.75% of added value.

In other words, if your account rises 7%, and the services of a planner increase that to 10%, they've increased your returns by 43%+!

However, Vanguard’s Adviser Alpha Study was limited to investment results.

Other studies showed the right type of planner could also demonstrate their value through the use of smart ‘Beta’ or evidence-based investment philosophies.

Many of these solutions are simply not available to investors on their own.

In their research paper, “Alpha, Beta, and Now...Gamma,” Morningstar’s David Blanchett and Paul Kaplan attempted to quantify how much value planners can add with services other than asset allocation and security selection.

Planning opportunities such as tax mitigation, wealth/asset structuring, life planning through cashflow analysis and behavioural finance provide a greater opportunity to maximise value.

Advice on credit such as Lombard loans, mortgages, employee benefits, insurance and state planning offer even more.

Their research demonstrated that a retirement plan encompassing these “gamma” factors was able to generate an income level at least 20% higher than a retirement plan that didn’t.

On the other hand, the level of fees may be higher to begin with if the adviser is offering advanced financial planning.

This is why it’s so important to understand exactly how and what you’re paying.

4. The planner’s skill level

A financial planner offering a broader range of services, will have more opportunities to add value than one with a narrower focus.

It’s pretty intuitive.

Trouble is, many 'advisers' say they offer a broad range of financial planning services.

But it’s hard to know which ones are truly skilled in a variety of areas…

And which ones are merely telling you what you want to hear.

That concludes part 1 of this series.

You can find part 2 here.

If you have any questions, feel free to talk to a qualified financial planner today to get and keep the life you want.