Why the ‘world's largest fund company you've probably never heard of’ only allows access to its funds through hand-picked advisers

A few days ago, I posted about active, passive and Dimensional funds.

Dimensional Fund Advisors (DFA) are known for being “the world’s largest fund company you have probably never heard of”…

Insiders know them for their Nobel prize-winning research and evidence-based approach to maximising expected returns.

One follower asked, “Why can Dimensional funds only be accessed through a financial adviser?”

The answer deserves a blog of its own.

Dimensional Fund Advisors is one of the top mutual fund providers with $517 billion assets under management.

You can access Dimensional funds as a large institution or through a small and carefully selected group of financial professionals.

But why do they limit access to their funds? Why not let everyone in given their size, reputation and performance?

It’s all part of a unique and brilliant business model ensuring everyone gets much better results.

The question is “How?”

The short answer provided by Quora is:

“By marketing to advisors, DFA gains access to high-net-worth* individuals who will be disciplined, long-term investors, with great behavioral guardrails in the form of the most professional and qualified advisors to keep them calm in market turbulence. This ends up being a win for everyone involved.

Advisors get great funds and can attract clients/grow their business with exclusive access to a scientifically proven better investment model. DFA gets a hand-picked team of the most qualified, ethical and motivated advisors to educate clients about the superior nature of their offering, and investors get low-cost, evidence-based investments with a shot at outperforming their benchmarks over the long term.”

Grounding their investment approach upon academia and science, the Nobel prize-winning research gives investors the opportunity to maximise their returns over other investment strategies – in many ways.

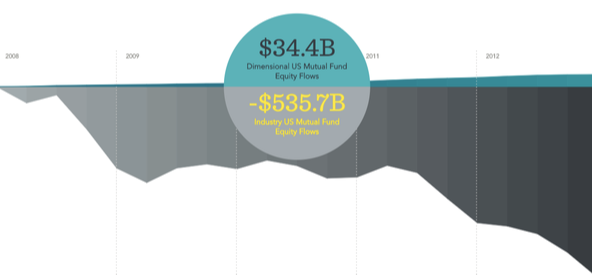

Quora’s post goes on to explain the Dimensional chart below – it tells a powerful story.

During the Great Recession, Dimensional saw net inflows to their equity (stock) funds when, on the whole, stocks saw massive outflows.

As you can imagine, outflows are bad in a downturn.

They’re bad for everyone.

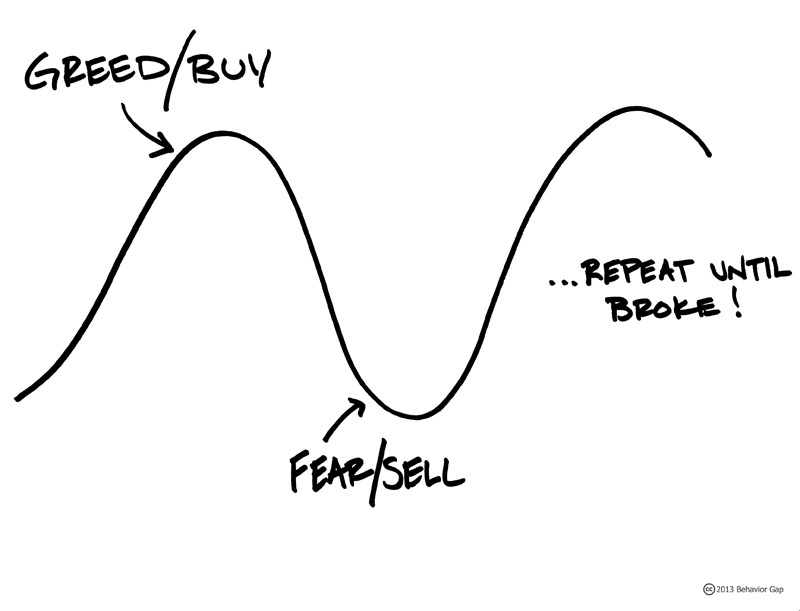

Investors who scurried between 2008-2012 sold low and missed the rebound, which is a bad strategy for building wealth.

Why did Dimensional see inflows of $34.4 billion during these years?

Possibly because investors (with the help of their advisers) were persuaded to stay the course despite volatility.

Possibly because after 2008, investors began questioning active investing.

Either way, they’re probably pleased with their decision.

Adapted from Quora’s post, here’s a more detailed explanation of the benefits of distributing Dimensional funds only through a handful of the most carefully selected professional advisers:

Benefits to investors:

- Potential for outperformance: DFA give you some of the benefits of a passive approach: low cost relative to other mutual funds, massive diversification, and low turnover (which means lower taxes and transaction costs). They also give you a shot at marginal outperformance by “tilting” the portfolio holdings toward different factors (market/size/price) that can potentially lead to better performance.

- More disciplined investors: A common mantra among evidence-based investment converts is “the replacement of speculation with education”. Statistics show it matters who you’re invested with. When you’re in a mutual fund full of speculators, you can get hurt by the other shareholders selling in a panic. When there are net redemptions in a fund (more people are selling than buying), it forces the managers to sell holdings at inopportune times, which can create portfolio imbalances, transaction costs, and taxes that leave you footing the bill. Knowing that just about everyone else in these funds also has an adviser helping them stay on track should set investors at ease about their fund neighbours.

- A steady hand at the tiller: Investing with DFA requires a carefully selected adviser. These advisers can help you pick the right investment plan for your wider life goals, and help you stick with that plan through the years of boom and bust. Numerous studies (Vanguard Adviser Alpha) have proven this makes all of the difference in reaching your destination.

- Transparency and peace of mind: Traditional mutual funds pay retrocessions (backhanders) to the firms who distribute them. They also advertise widely and entertain sales people extravagantly (just look at sailing regattas and cricket matches). DFA funds pay no backhander because they use fee-only advisers who are fiduciaries. This not only keeps costs much lower but ensures clients benefit from truly independent and unconflicted advice.

- No drudgery: DFA views their funds as precision instruments, like medical devices, to be used by trained professionals. Most investors don’t want to be deeply involved in the inner workings of modern portfolio theory, asset allocation, the efficient market hypothesis and rebalancing models but they want to know that someone else is. The DFA funds model removes this drudgery and anxiety that affects so many investors to enable them to focus on life, not money.

The emotional benefits are that clients should feel substantially relieved, more confident, empowered and good about both their wealth and wider life moving forward.

Benefits to advisers:

- An evidence-based approach: DFA has a highly compelling approach, rooted in academic theory from multiple Nobel Laureates. This kind of evidence-based approach makes sense to clients and gives the data necessary to support a firm-wide investment philosophy, even if it takes a little time to always work out.

- A good track record: Everybody knows by now that most actively managed funds just fail miserably to meet, let alone beat, their benchmarks. DFA funds has a good, long-term track record of outperforming their benchmarks after expenses.

- Potential for outperformance: The right type of adviser (fee-only fiduciary) can add a lot of value to your clients, but it may be hard to measure. How do you measure the benefit of not selling because the market dips when their neighbour down the street jumped into Saxo-Bank and sold their investments in a panic? While that may not be measurable, performance is.

One benefit of investing with DFA funds is that their tilts toward value, small, and profitable stocks have led to long-term outperformance when compared to a typical index fund. DFA provides a highly credible option for clients who might otherwise choose a DIY option in quality vanilla index funds such as Vanguard.

- Freed up to focus on planning: Instead of spending all their time focussing on picking new funds or making a case for your investment portfolio to your clients, outsourcing management to trustworthy experts saves a lot of time and enables the emergence of actual financial planning. This involves cashflows, financial plans and addressing important life issues rather than selling investment ideas because they pay commission.

Benefits to DFA:

- Deep training for people who care: Before gaining access to DFA funds, fee-based advisers must attend a two-day deep dive called the Foundations Conference. This teaches the academic approach underlying DFA’s strategy. This training effectively creates a very knowledgeable “marketing team” of advisers ready to educate clients about DFA mutual funds. Thoroughly vetting and training advisers also creates stickiness that a 30-minute webinar, or (God forbid) a 30-second commercial, never could.

- Less marketing spend: It’s insane how competitive marketing investment products has become. Just visit Yahoo Finance, watch a golf tournament, or turn on any major event and you’re bombarded with very similar messaging about how one firm or another can “help you reach your goals”. It all blends together after a while. DFA doesn’t even play that game - by focussing on marketing to advisers and institutions they can narrowly focus on high-value prospects.

- Relationships with high-value clients: Through advisers, Dimensional can get access to loyal clients who, in aggregate, can pour many hundreds of millions into their funds instead of individual investors with substantially smaller investment pots.

- More disciplined investors: For mutual fund managers, major outflows create problems. They require the managers to sell holdings to meet redemptions, which can create tax implications for other investors in the funds. Having a disciplined set of investors who are consistently supplying new capital to the funds allows the managers to be proactive rather than reactive, which can benefit everyone.

The points above demonstrate why such a successful experience exists between DFA funds, their advisers and underlying investors.

This symbiotic relationship allows evidence-based firms to create portfolios tailored to the appropriate level of risk for each client’s life objectives.

Successful client experiences happen with DFA funds because the adviser is working on the same side of the table as you, the client.

They align their business with your own goals.

And ultimately stack the odds in your favour.

I suspect this model is the future of investment but knowing all too well the conflicts (such as commission) that prevent the 'traditional financial services industry' from offering ‘best advice’ – it may take a while.

However, as Dave Butler, their CEO says:

"The global train has left the station".

I, for one, agree.

This growing movement should favorably impact the wealth and well-being of generations.

Note:

A major downside of DFA’s approach is that typically their funds have been limited to those with a lot of money to invest - at least $500,000, with minimums often as high as $1m or more.

One way to access DFA funds at a lower minimum is to get started with £250,000 (or equivalent) through the AES Smart Account™

Get in touch if you’d like to know more.