I like to think of myself as a rational person, but I’m not.

None of us are, in fact.

As humans, we are irrational and make mental errors.

Psychologists and behavioural researchers have uncovered a wide range of mental errors that derail our thinking and often lead to poor decision making.

There are dozens of them.

I'm going to talk about the 5 most common ones in this blog.

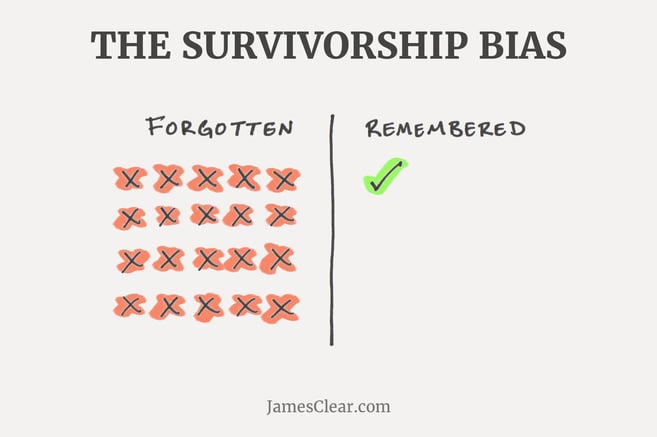

1. Survivorship bias

I often advise against listening to the media.

That’s because headlines and stories are filled with survivorship bias these days.

You see articles with headlines about things like…

Investors making millions from Bitcoin, active fund managers who made their clients super wealthy, people who’ve won the lottery and so on.

This is survivorship bias in action.

The term refers to our tendency to focus on the winners and to try to learn from them while completely forgetting about those who didn’t win, or employed the same strategy unsuccessfully.

2. Loss aversion

I have previously written a blog on this.

It refers to our tendency to strongly prefer avoiding losses over acquiring gains.

Research shows that if someone gives you $10, you’ll experience a small boost in satisfaction.

But if you lose $10, you’ll feel the loss more deeply than you did the gain.

Our tendency to avoid losses causes us to make silly decisions and change our behaviour.

Investors who are loss averse may be risk-averse as well.

Opting for ‘safer’ investments instead of those that could offer potentially higher gains.

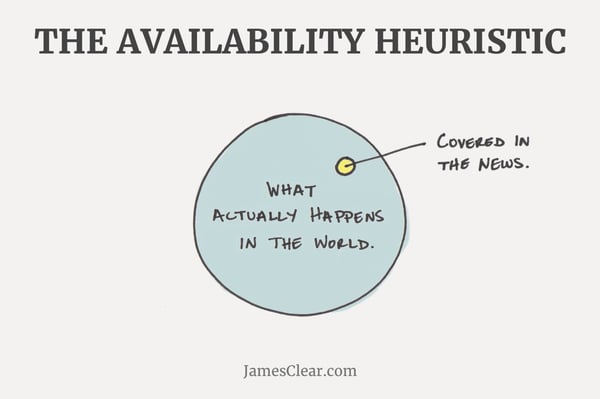

3. The availability heuristic

This common mistake happens when our brains assume that the examples which first come to mind are also the most important.

Research by Steven Pinker at Harvard University has shown that there are more people living in peace right now than ever before.

People are shocked to hear this.

And some refuse to believe them.

If the world is so peaceful, why are we always hearing about wars, violent crimes and destruction?

Enter the availability heuristic.

We also happen to be living in the most reported time in history.

Information on any disaster or crime is more widely available.

(And we all know bad news sells more than good).

Because of this, our brains assume they happen with greater frequency.

We overvalue and overestimate the impact of things we can remember.

And undervalue and underestimate the prevalence of the events we hear nothing about.

4. Anchoring

Living in Dubai, there are jewellery stores around every corner.

With pieces worth millions.

But once you step inside, there are more affordable ones.

Like a watch for $5000.

This is how business owners move the average up.

Many of the premium products that businesses sell are never expected to sell many units themselves.

But they anchor your mindset.

And the mid-range products appear much cheaper than they would on their own.

It’s why I often talk about value rather than price.

A more expensive product may seem like you’ll be getting more value, but how much are these costs affecting your returns?

And are the extra charges delivering real value?

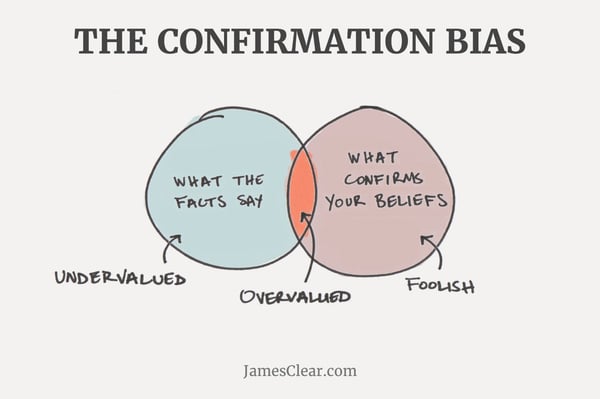

5. Confirmation bias

This is our tendency to search for information that confirms our beliefs while ignoring information that contradicts them.

For example:

Someone believes that buying into a particular fund is a good idea.

So they research and read stories about how great the product is which confirms and supports their current beliefs without considering there are ‘two sides to every story’.

The more you believe you know something…

The more you filter and ignore all information to the contrary.

It’s not natural for us to formulate a hypothesis and then test various ways to prove it wrong.

It’s far more likely that we’ll form one ‘decision’, assume it’s true and look for information to support it.

People don’t want new information they want validation.

Two heads are better than one

Getting a second opinion on anything is important.

But more than that, is an unbiased opinion.

Find a financial planner who will tell you the truth, look after your best interests and ensure that the decisions you make fully support your future goals…

Not their own.

While validation may feel great now, having a dream retirement, the house you’ve always wanted or the means to afford the best education for your children feels even better.