[Estimated reading time: 2 minutes]

Equities have been rising almost uninterrupted in 2017.

In the year to date:

- The S&P has advanced nearly 11%...*

- The Dow has had 34 record finishes...**

- And the FTSE recently enjoyed its best week.***

However, historically August and September are two of the worst months for investors.****

As a result, many news sources are predicting a bumpy ride for the markets.

So, now’s a good time to consider two things:

- The things successful investors focus on, and

- The things they ignore…

Successful investors ignore what they cannot control

The one thing that matters to all investors is the one thing no-one can control…

The markets.

However, there’s always someone willing to have a go!

Take Giles Keating, former head of research at Credit Suisse – he believes he can forecast market movements and is predicting a "nasty correction" ahead.

He may be right, he may be wrong – but successful investors will ignore him.

A Harvard Business Review article dating back to 2009 explains why:

“The future, like any complex problem, has far too many variables to be predicted.

Quantitative models, historical models, even psychic models have all been tried — and have all failed.

Just imagine predicting something far simpler than the future of the stock market; say, chess.

There are an overwhelming 10 to the 120th power possible moves. That’s a 1 followed by 120 zeros…that sum far exceeds the number of atoms in the universe.”

In other words, successful investors don’t try to predict the market or listen to those who believe they can – because it cannot be predicted.

Instead, they get in the market and stay in the market – no matter which way it may be heading.

What do successful investors focus on?

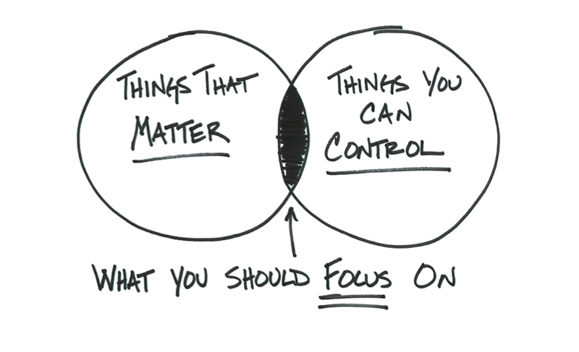

This illustration by Carl Richards explains successful investors should only focus on the things that matter that they can control:

As a successful investor, your own list will be unique, but here are some suggestions for you to get started:

1. Living a happy and productive life;

2. Surrounding yourself with good and positive people;

3. Not letting your long-term plans be derailed by market movements, noise and predictions…

Advice to take away…

If you worry about things you have no control over, you are likely to be a less successful investor, and more likely to experience stress.

- But, if you heed Carl Richards’ advice and only focus on things that matter that you can control;

- And you get in the market, stay in the market and ignore the market;

- You stand the greatest chance of achieving investment success.

Reference List:

*Source: Kollmeyer, B (2017, August 10) Retrieved from

http://www.marketwatch.com/story/dow-industrials-shape-up-for-record-no9-2017-08-07

**Source: Kollmeyer, B (2017, August 7) Retrieved from

http://www.foxbusiness.com/features/2017/08/07/market-snapshot-dow-on-track-for-9th-record-in-row0.html

***Source: Rees, K (2017 August 4) Retrieved from

http://uk.reuters.com/article/uk-britain-stocks-idUKKBN1AK0WP

****Source: Lim, P (2017, August 4) Retrieved from

http://time.com/money/4885699/august-september-worst-month-stock-market/