5 types of recession, when they've happened and the dream scenario we all hope for (plus the nightmare to avoid)

A recession seemed all but inevitable last year.

I wrote about it a few times.

After all, there's always a 100% chance we will have a recession at some point...

But even with everything 2022 threw at us...

A war in Europe.

Surging energy and food prices.

The fed aggressively raising interest rates.

Not to mention stocks and bonds in free fall...

The year came and went, with no recession.

Now, in January, recession fears still abound.

Two-thirds of economists expect one in 2023.

However, not every recession has to be a catastrophe.

Yes, it would of course be painful for those affected by unemployment.

But the losses could be limited and the duration, relatively short.

As I've said before, you should always be ready for A recession rather than trying to get ready for THE recession.

Given what we know from history, you should expect events like this to happen.

Your best choice is to take a long-term view and be in the market (as it often tells a different story).

That said, there's no harm in knowing how different recession 'shapes' can affect your investments.

It could help you catastrophise less and see opportunities more.

The five recession shapes

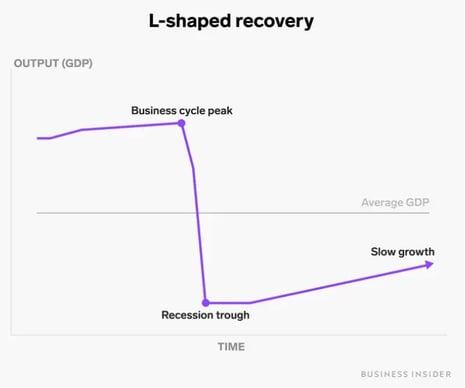

Recovery shapes are used by economists to characterise different types of recessions and their recovery.

The shapes take the form of letters, named after how each recovery looks when charted on a graph (showing the overall health of the economy).

They make it simple for investors to discuss the complexities of an economic downturn, and how long it may take to recover.

All recessions begin the same way, with a significant period of economic decline.

But how they end can happen in different ways.

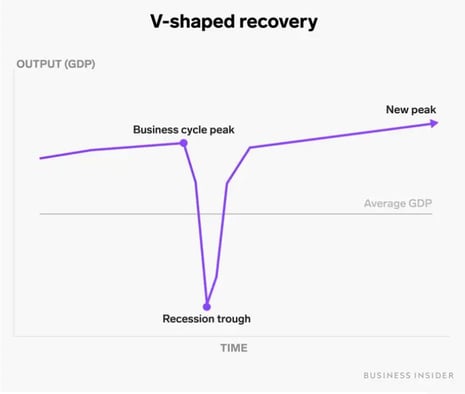

1. V: Blink and you might miss it

This is the lesser of all evils.

The V-shaped recovery is the shortest type of recession.

The dream - if there is such a thing.

In a V-shaped recovery, the economy experiences a sharp decline but then bounces back almost immediately to its pre-recession level.

The period in which the economy remains at a low point (the bottom of the V) is extremely brief.

When has this happened before?

One example could be the recession of 1953, in which the economy achieved a full comeback by the first quarter of 1954, less than a year after it first declined.

It helped that the downturn was fairly mild, but most economists also credit the actions of the Federal Reserve — which spotted the slowdown early on and moderately increased government spending to stimulate the economy — for the swift recovery.

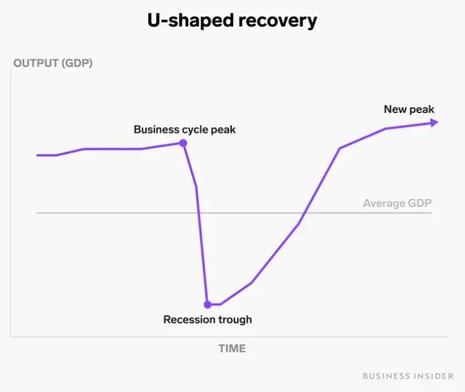

2. U: The next best thing

Slow and steady.

Just like the V-shaped recovery, the economic decline is steep – but the recovery takes a little longer.

The economy spends more time at the trough before improving.

This doesn't necessarily mean that the recession is more severe in terms of the loss in GDP, but it does mean that it lasts longer.

When has this happened before?

The 1973–1975 recession, in which the economy didn't resume pre-recession levels until 1976, is an example of a U-shaped recovery.

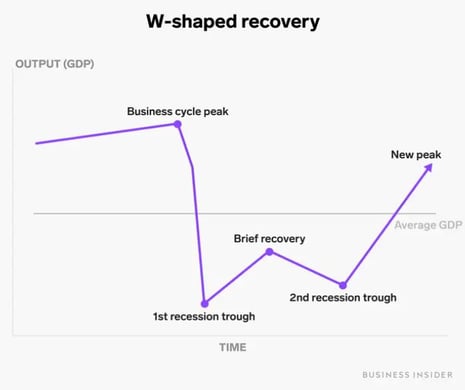

3. W: A double whammy

4. L: A slow hobble

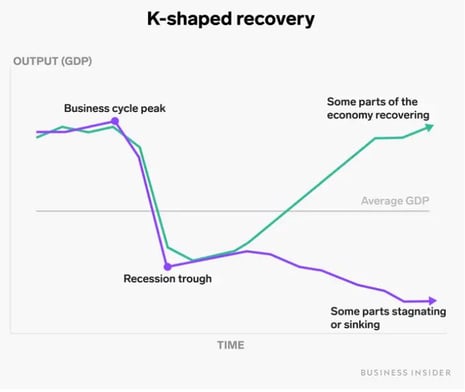

5. K: Two contradictory trends