![]() Questioning is critical.

Questioning is critical.

The right ones can change your life.

And improve your odds of long-term investment success.

Here are just a few insider secrets.

John spent his life in the Navy, in submarines.

Like many in the military, he retired at 45 and needed 10 years of work to supplement his income before enjoying a well-deserved retirement with his wife.

He did this overseas (just up the road from me in Abu Dhabi)…

And just before returning to his home country, he met a charismatic financial ‘salesperson’ who promised market-beating returns.

Needless to say – his retirement never happened.

To stop the same happening to you, I’ve put together 7 questions you NEED to ask your financial planner.

The answers will give you invaluable insight into what you’re getting yourself into…

And who you’re trusting with your life savings.

After all, “time spent in reconnaissance is seldom wasted”.

1. What are my chances of picking an investment fund that survives and outperforms?

Flip a coin and the odds of getting heads or tails are 50/50…

Which are the same odds as choosing a fund that still exists in 20 years.

Getting good growth is even more difficult.

The market’s pricing power (known as the Efficient Market Hypothesis) works powerfully against those trying to outperform through stock picking or market timing.

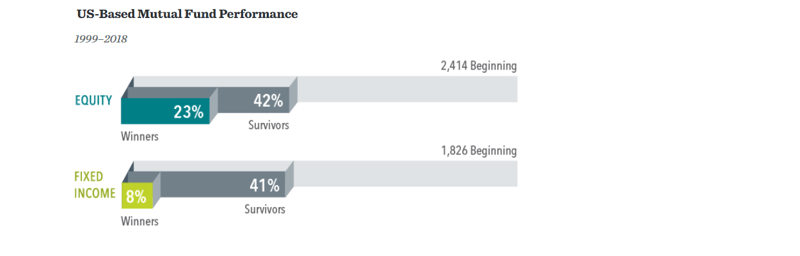

Only 23% of US equity mutual funds and 8% of fixed income funds have survived and outperformed their benchmarks over the past 20 years.

Your financial planner should make this clear:

Time in the market is far more rewarding than timing the market.

2. If I choose a fund because of strong past performance, does it mean it will do well in the future?

Many investors select mutual funds based on past returns.

A star rating system.

Or stuff they read in the press.

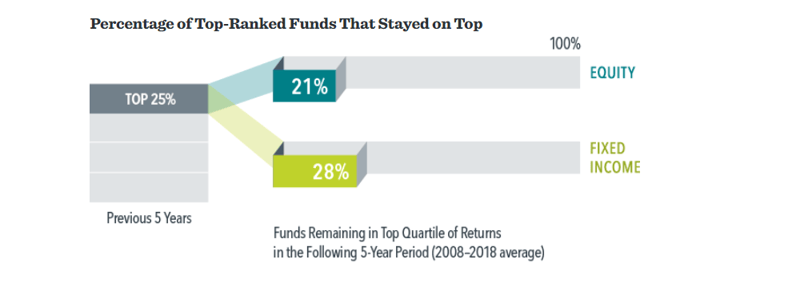

However, academic research shows that most funds in the top quartile (25%) of previous five-year returns did not maintain a top-quartile ranking in the following five years.

In other words…

Past performance offers little insight into a fund’s future returns.

Your planner should encourage you to focus on your personal life goals.

And help block out any noise that may lead to sub-optimal decision making.

3. Do I have to outsmart the market to be a successful investor?

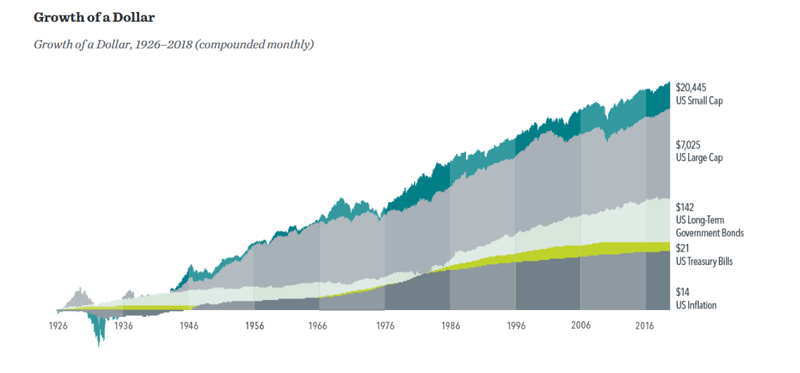

Financial markets have rewarded long-term investors.

People expect a positive return on the capital they invest.

And, historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

Instead of fighting the markets, let them work for you.

Accept the substantial growth they have historically provided.

Because, the increased risk and cost of trying to beat them quite frankly, isn’t worth it.

Your planner should help you access the global market in a cost-efficient way.

So you have the capital to help you live the life you want.

4. Is international investing for me?

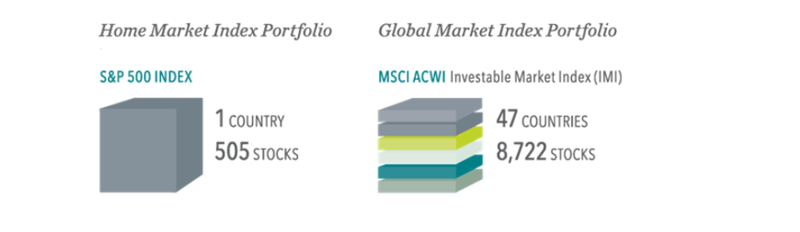

Diversification helps reduce risk.

It’s known as ‘the only free lunch in investing’.

But diversifying only within your home market (for me this is looking at the FTSE 100 - known as home bias) may not be enough.

By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

Not in India.

Not in China.

Not in Brazil.

Not in North America.

Not in Europe.

Not in gold.

Not in underwater teak forests.

Not in storage pods.

Not in car parks, healthcare, tech or any other narrow segments that promise a quick buck (to the salesperson).

But… EVERYWHERE.

Your planner should structure your portfolio this way to help spread your risk…

And ultimately cushion you against any market downfalls.

5. Will making frequent changes to my portfolio help me achieve investment success?

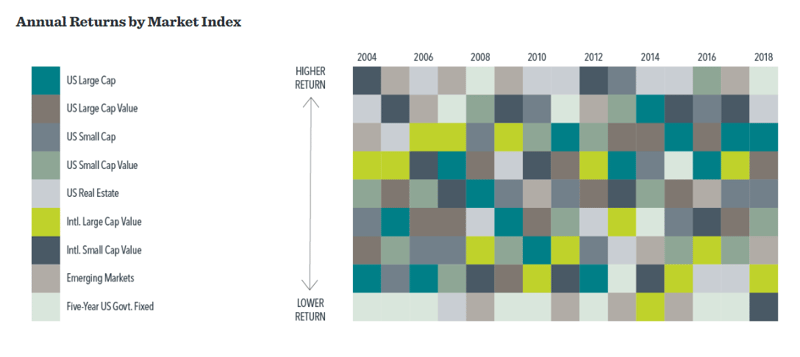

It’s almost impossible to know which market segments will outperform from period to period.

Accordingly, it’s better to avoid market timing calls and other unnecessary changes that can be costly.

Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results.

If you’re feeling uneasy about the markets, your planner should provide peace of mind…

And show you the evidence of how the markets have recovered in the past, even during the toughest times.

6. Can my emotions affect my investment decisions?

People don’t like to hear this but it is a struggle to separate our human emotions from investing.

Markets go up and down.

Reacting to current market conditions may lead to making poor investment decisions.

Traditional financial salespeople are taught to play off our fear and greed to encourage you to buy and sell on a whim.

7. So, what should I be doing to get better results?

A good planner should play many roles.

In the Internet age they no longer have a monopoly on information.

And stock/mutual fund picking isn’t their value add.

I’d suggest it should look more like this:

Ultimately better results mean better feelings.

An end to confusion, frustration and anxiety.

And better clarity, confidence and control over your ideal future.

If you have any doubt about anything, get in touch.

We’d love to put your mind at ease and provide you with the right plan of action…

For you and your goals.