I recently overhead a client ask:

“Am I going to be okay?”

Like many of our clients, he was a ‘HENRY.’

High Earning Not Yet ‘Rich’.

OR at least not rich enough to have no money cares in the world.

He worries about having enough to see him through retirement and set his children up for their futures.

I wasn’t surprised to hear this…

Let’s face it.

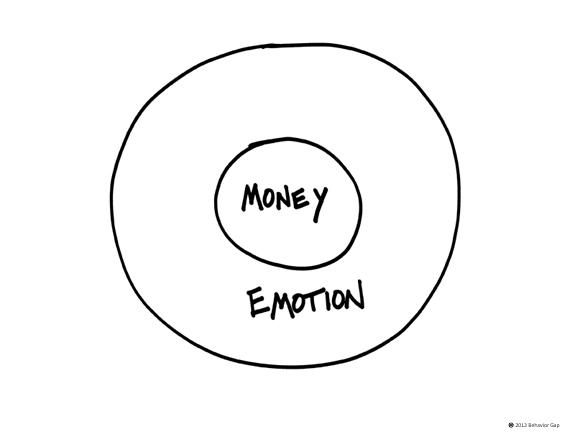

We all have anxiety around money.

It's surrounded by frustration, complexity and confusion.

Regardless of how much we earn…

There’ll always be something we worry about.

Houses.

Children’s education.

Leaving a legacy.

I’m married with three kids.

I want to make sure that they’ll be okay even without me in the picture.

I want to know I’m saving enough to give them a head start in life.

And despite being a professional investor…

I still worry.

Because money = feelings/emotion.

Earning and growing money is one thing.

Preserving it is totally different.

Something many wealthy (and even powerful) people have got wrong.

So how can you be sure you and your family will be okay?

It comes down to three things.

#1. Clarity

What do you want your life to be like?

The best planners know you should have clear life goals BEFORE investing.

Knowing exactly what you’re investing for helps decide what you're investing in…

But make sure your financial planner is a fiduciary who acts in your best interests and not their own.

One with experience in dealing with people like you.

Investing your money according to a clear investment philosophy.

In an un-conflicted and transparent way.

This clarity will give you the peace of mind knowing that you won’t have hidden charges eating away at your returns.

You can learn about the 4 different types of financial advisers…

What sets a fiduciary apart from other financial advisers…

How financial salespeople are paid to mis-sell investments…

And how one client lost £66,000 on hidden commissions.

Take time to read these as your financial ‘adviser’ (planner or salesperson) can either be your greatest asset…

Or your biggest mistake.

#2. Confidence

Will you have all the resources you need?

With clarity, comes peace of mind.

Peace of mind brings confidence.

As a confident and well-informed investor, you’ll have faith in your portfolio.

And understand how it’s working for you and your goals.

This means you’ll be able to leave it alone…

And instead of wasting time worrying or panicking about what’s happening in the markets…

You’ll spend time doing things you love.

You won’t speculate or be affected by swings in the market.

Nor will you feel compelled to act when there’s fear mongering in the media.

Because you’ll know that time in the market is far more powerful than timing the market.

And that even if the market drops today, like it did in 2020…

It will recover.

Staying invested through the ups and downs will reward you over the long term.

Because, as we know from Warren Buffett…

Compounding needs time to work its magic.

If you’d like to read more on these, we’ve written a blog on the power of compounding…

Why timing the market is a complete waste of time…

And why you should stop panicking about the markets.

If you’re an advised investor and any of this is news to you…

You’re welcome to get a second opinion.

Your adviser should always take time to explain these concepts to you in a way that’s simple to understand.

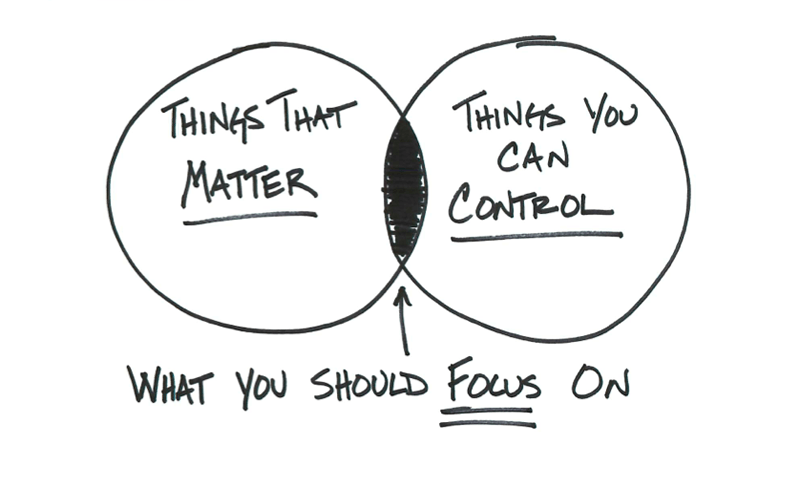

#3. Control

Are you prepared for life’s surprises?

Your investment experience all comes down to accepting what you can control.

And the things you can’t.

(Like the markets for example).

As much as we don’t want to admit it, we are all prone to biases.

These can affect our decision making.

A financial adviser should act as your behavioural coach and help you recognise the common forms of emotional bias we all exhibit...

They may be uncomfortable to hear.

But rather that, than to be told a bunch of comforting lies.

Your adviser should remind you that investing is a marathon, not a sprint.

Remaining disciplined, patient and head-strong are THE most important traits for investment success.

They’re also key for having a stress-free life.

For more information on behavioural biases, you can read this blog.

We’ve also spoken in more detail about the things you can control regarding your investments…

And the 7 roles of a financial adviser.

Sit back, relax and enjoy your life

I cannot stress enough that the best thing you can do for your investments…

Is do nothing at all.

Simple, but not always easy.

If you’ve done your due diligence by hiring the right type of financial planner…

They should have recommended you invest for the long-term in a globally diversified portfolio.

One which uses low-cost investments such as ETFs, an asset allocation that’s in line with your risk tolerance and above all, avoids trades that attempt to predict what’s hot…

(And has covered all your bases regarding estate planning, taxes and insurance).

After that, take time to appreciate the now.

Your future is already being taken care of.

Use your time to take the kids out, your dog for a walk or partner out for dinner.

Rest assured, you’re going to be okay.

If ever you’re feeling uncertain, anxious or fearful, give us a call.

We’ll try our best to put things in perspective.