How the ground-breaking technology of Dimensional Funds is the future of investing

Science has changed every aspect of our lives...

Including how we communicate, travel, shop and even invest.

And the technology keeps improving.

In the financial world, those who don't keep up, often fall behind.

And sell their clients short.

Here's why.

Before computers...

There was no way people could possibly understand what drives the markets.

New technology allowed researchers to dive deep into the data to analyse the behaviour of security prices.

One such researcher was Eugene Fama.

He developed a new framework to study financial markets, along with Kenneth French, and has been honoured with a Nobel Prize in Economic Sciences for his work.

Their research underlies all of Dimensional's thinking and helped develop the firm's process.

Widely regarded as the "father of modern finance," Fama has brought an empirical and scientific rigor to the field of investment management.

Transforming the way finance is viewed and conducted, which you may know as evidence-based investing.

Dimensional Fund Advisors is currently the eighth-largest fund company.

It manages assets exclusively for institutional investors and the clients of a select group of fee-based advisers.

Those assets were worth $579 billion as of September 2019.

So why haven’t you heard of them?

The firm does no advertising and is primarily owned by employees and directors.

This helps keep fund expense ratios very low.

Now for the part I really love.

DFA’s board members, directors, and consultants represent a “who’s who” in the world of financial economics, including Eugene Fama and other Nobel Prize-winning laureates, Robert Merton and Myron Scholes.

DFA does not develop or recommend investor portfolios.

Instead, this work is left up to the adviser chosen by the client.

Development of highly efficient portfolio models requires a thorough understanding of Modern Portfolio Theory (MPT).

The principal goal of MPT is to achieve the greatest return for the amount of risk taken (or, conversely, to minimise the risk in a portfolio targeted to achieve a specific return).

Doing so requires combining asset classes in the portfolio to achieve effective diversification.

The only free lunch in investing.

This is accomplished by measuring the correlation between specific asset classes that demonstrate a historically high rate of return and combining the asset classes in such a way that portfolio volatility is minimised.

Global diversification of the portfolio protects investors from a downturn in any single asset class.

Domestic or foreign.

DFA-based portfolios typically contain more than 9,000 securities in 44 countries.

Dimensional adds value over benchmarks and peers through a dynamic and robust investment process that carefully structures and implements portfolios to target higher expected returns.

By evolving with advances in financial science, the firm has delivered impressive long-term results for clients.

Which is why so many institutional clients and big companies use it.

And why it’s a well-kept secret.

But don't just take my word for it.

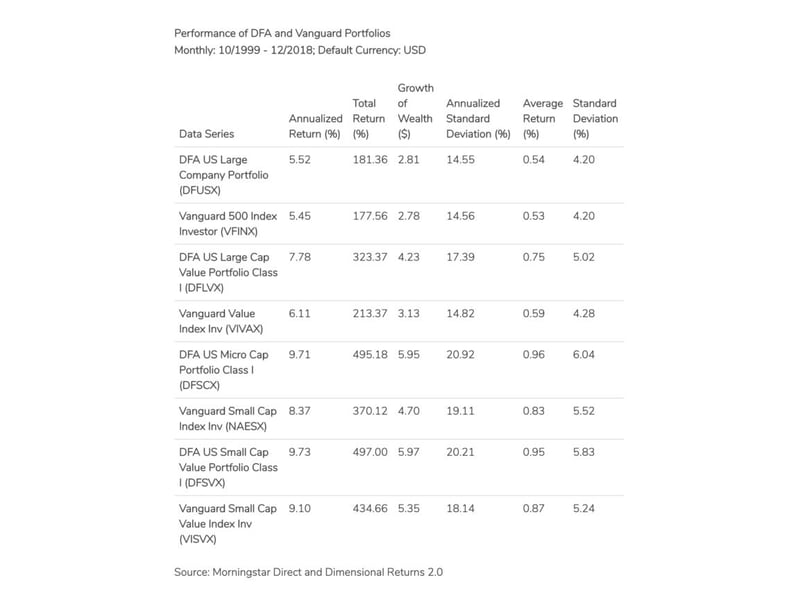

Here's a fascinating comparison of the performance between Vanguard and Dimensional...

As you can see, DFLVX outperformed VIVAX by 1.67% per year.

You will also see that Dimensional outperforms Vanguard across the U.S. Small Cap and U.S. Small Cap Value asset classes as well.

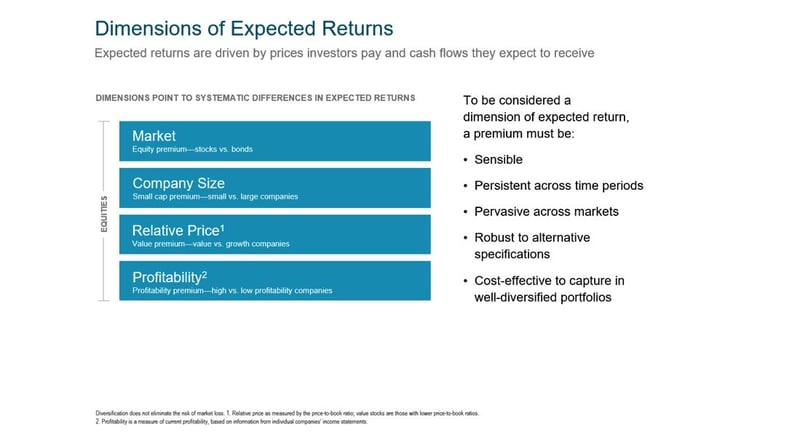

The driving factor behind Dimensional's outperformance comes from their ability to have an exposure that is more sensitive to the market, size, and relative price premiums.

Of course, past performance is no guarantee of future success.

But looking at the evidence helps put things in perspective.

A systematic investment approach is the way forward.

It keeps investors disciplined and patient even through the most challenging times...

Because they believe in the enduring power of the markets.

They believe in their strategies and that their portfolio is working for them no matter what.

It's why during the volatile period of 2008-2012, US mutual funds saw outflows of $535.7 billion and Dimensional saw inflows of $34.4 billion.

Having a strategy you trust is vital to investment success.

It will give you the clarity and confidence needed to control your financial future.

If you're interested in hearing how Dimensional Funds can work for you, give us a call.

The first 15 minutes are on us.