[Estimated time to read: 3 minutes : Read while you lounge on the sofa!]

Updated 30th October 2017

Because you take a personal interest in your financial well-being, I know you're not a couch potato!

But!

Being a couch potato investor is far better for your money than choosing an over-active approach to growing your wealth!

But not everyone is happy about me sharing this secret with you...

In fact, a large active fund company recently threatened me with legal action for publicly comparing their active portfolio with the portfolio of a couch potato!

I demonstrated that a couch potato portfolio is easier, cheaper, more effective and delivers better returns...and the fund company got upset!

What is a couch potato portfolio?

The concept of the couch potato portfolio was invented by personal-finance writer Scott Burns.

Mr. Burns came up with a strategy that involved investing half of an investor's assets in an S&P 500 index fund, and half in a fund mirroring the Shearson/Lehman Intermediate Bond Index…

And then doing - nothing!

He was convinced this approach would deliver higher returns than any actively managed portfolio.

Burns originally used the Vanguard 500 Index and the Vanguard Total Bond Fund Index for his strategy.

He also said that anyone with a slightly higher risk tolerance, looking for more aggressive growth for example, could modify their 50/50 asset allocation to 25% in the Vanguard Total Bond Fund Index, and 75% in the Vanguard 500 Index…and still, sit back and do nothing.

Why ignoring your investments makes financial sense

In 2016, $289billion poured into the champion of champion couch potato funds - Vanguard’s.

In fact, so fed up were investors with their poor performing actively managed funds, Vanguard gathered more money from investors last year than the rest of the asset management industry combined!

Why?

Because the way the world invests is changing…

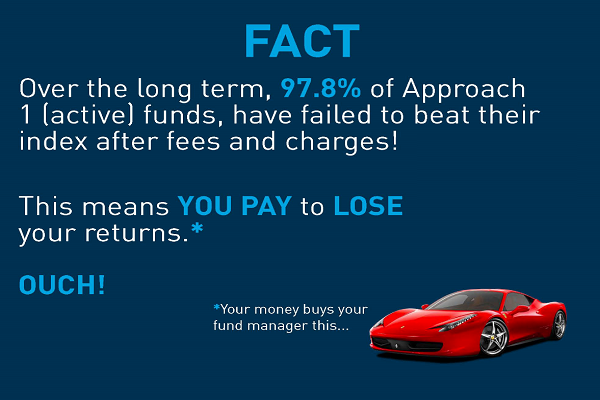

Passive investing strategies – i.e., couch potato style portfolios – are a low cost, high returning, no-brainer alternative to paying a failing fund manager whose performance is beaten by the averages 97.8% of the time.

Passive investing means buying an index fund and then pretty much ignoring it.

It requires minimal time and effort to set up, is usually your least expensive investment option, and returns you more money in the long-run than any other investment strategy – as long as you commit to being lazy and leaving your funds well alone.

Just remember that to enjoy the low fees of passive investing and the high returns, keep in mind how well you’re diversified…

The optimal risk/return trade-off can be achieved by remembering: -

The 3 key rules for couch potato investors...

1. After you’ve set your asset-allocation strategy, your portfolio may require annual rebalancing in order to maintain it. But other than that, leave it alone!

2. Commit to investing regularly and over the long-term – because of dollar cost averaging, and the fact the markets reward long-term investors most handsomely.

3. Avoid complex ETFs that carry high, unnecessary fees – they defeat the object entirely!

Now let’s look at the numbers

After putting his couch-potato strategy to the test, Burns kept half an eye on his returns.

Returns:

The plain 50/50 couch potato portfolio returned 10.37% between 1991 and 2001.

The average balanced fund returned less in the same period (9.45%).

From 1986 to 2001 the sophisticated couch potato strategy returned 12.3%.

The average equity index returned less in the same period (11.85%).

Losses:

In 2001, the average domestic equity fund lost 11.32%.

The 50/50 couch potato only lost 1.80%.

Even the sophisticated portfolio only lost 6.91% - i.e., still less than the average!

Conclusions:

In the periods that Scott Burns measured, both his regular and the more sophisticated strategies offered decent returns, while at the same time, protecting investors from significant losses.

3 reasons why it pays you to be a lazy investor!

1. Diversification

Diversifying your portfolio with both fixed-income and equity securities allows you to limit losses during periods of bearish equity performance.

2. Cost

Funds that mimic indexes have lower fees, because of the passive investment strategy of managers of index funds.

Fewer transactions = fewer expenses for you.

3. Risk

Returns are not at the cost of taking big investment risks.

This couch potato strategy offers sound gains, while allowing investors to sleep soundly (on their sofa) each night!

Positively change the way you invest!

You can cut your costs, increase your returns and reduce the amount of time you have to spend thinking about investing by taking a couch potato approach.

If you want to research these funds yourself then Andrew Hallam’s book The Global Expatriate’s Guide to Investing has country by country suggestions for funds suitable for expats.

Morningstar is another great resource for finding funds.

...let us help...

If you have money saved, invested or in a pension already – let’s look at it together to see if we can cut costs, increase returns and improve your long-term profits .