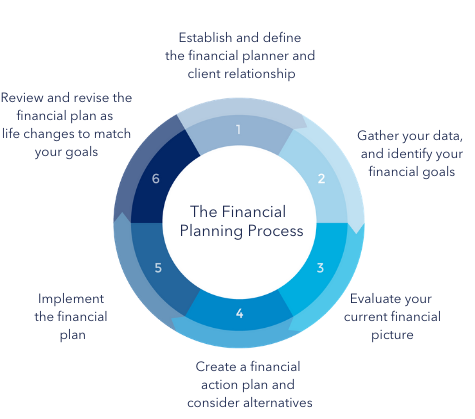

Comprehensive financial planning

As an international senior professional, comprehensive financial planning involves a few additional areas.

There are the 6 key considerations that go into comprehensive financial planning for expats and international executives like you:

1) Cash flow planning or cash management

One of the best routes to strong budgeting - and ultimately to stress reduction - is to prepare a cash flow plan.

It will help inform your spending and savings decisions - and importantly, flag up future problems before they arise.

Your cash flow plan will take into account your income, assets, outgoings, and other present-day information, and predict your future cash-flow in order to predict how much money you’ll have coming in and going out at any given point in your life.

Your forecast will help you plainly see expenditure, so you can better plan.

The aim of cash management like this is to help you feel more confident about your finances, and have sufficient disposable income to enjoy throughout life – i.e., so you balance spending today - and then saving for growth for your future income needs.

An additional benefit is that many cash-flow forecasts created by professional financial planners will help you spot potential shortfalls or issues before they occur.

If your plan anticipates future difficulties, such as not having enough to retire on, you’ll have plenty of warning to make alternative arrangements – like cutting spending and investing more today, so you can retire sooner and on a better income.

A strong side benefit of having a solid cash flow plan is that you demonstrate effective budgeting - which may give others confidence in your financial management, thus potentially helping you secure loans, funding, mortgages or overdrafts.

When we create a cash flow plan for you, we factor in extensive data. For example, we plan for the worst, plan for multiple different scenarios, consider fixed and variable costs and returns on investment…

And then we create your financial road-map for your future prosperity.

2) Family and protection

Are you part of the sandwich generation? In other words, those who are financially responsible for both younger and older family members? Over 1 million Britons are.

If you have a single or dual financial responsibility as an expat, it’s critical to consider how your loved ones would cope if you were to suffer an incapacitating illness or even die.

There are very few countries in the world with as generous a social support system as the UK’s. And fewer still where foreign residents are eligible for financial support in times of hardship.

As a result, you need to think not just about growing your wealth, but also about protecting your family with insurance.

There’s a range of insurances and protections available that can help cover your family and give you the peace of mind that your loved ones will remain looked after, no matter what.

In some scenarios, protecting before investing may even make the most sense. Your financial plan will help you determine your priorities, and how best to meet obligations and challenges to ensure your loved ones’ security is protected.

3) Estate planning

Having worked hard to build wealth and security for yourself and your family, the last thing you want is for an over-eager taxman to come along and rob your beneficiaries of what’s rightfully theirs when you pass away.

The fundamentals of estate planning and wealth protection or preservation need to be included in any financial plan – no matter how much or little you believe you’ll have to leave behind.

Inheritance taxes are only one part of the problem – as an expat your estate may be at risk of unfavourable laws of succession in the country in which you now live – or hold assets. Dubai is a classic example where the laws of succession are unfavourable for most expats.

A solid financial plan focuses on protecting your wealth for today, tomorrow and your future generations.

When we, as financial planners work with you on your financial plan, we will look at estate, gift, and generation-skipping transfer taxes (as well as the income taxation of trusts, estates, and beneficiaries) for example.

We’ll cover strategies for making of present and future interests, the effective use of assets providing death benefits (e.g., life insurance, commercial annuities, qualified retirement benefits etc.) The use of family businesses and investment entities as estate planning tools, the use of non-charitable actuarial techniques (e.g., qualified personal residence trusts and private annuities) in estate planning, valuation planning and estate freezing techniques.

We can even consult on post death estate planning issues and about providing liquidity in an estate.

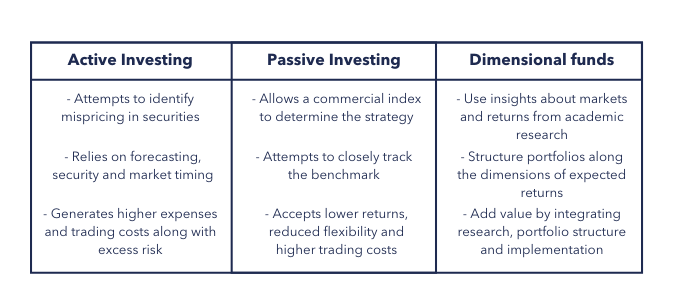

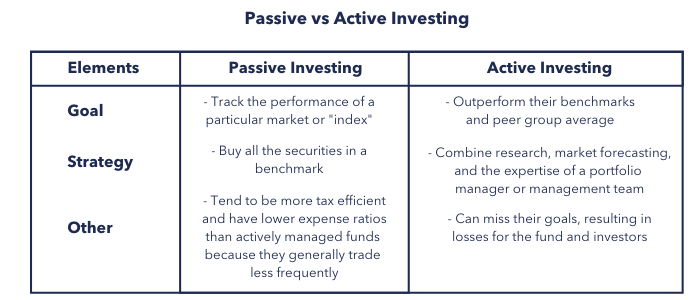

4) Investment planning

Investment planning is the process of matching your financial goals and objectives with your financial resources, and it’s a core component of financial planning.

As a process, investment planning begins when you’re clear on your financial goals and objectives - it helps you match your financial resources to your financial objectives.

There are quite literally thousands of different investment paths you can take as an expat…by helping you set out clear and measurable goals, your financial planner can match the most suitable mixture of investments to each specific goal in the most efficient way.

5) Retirement planning

Retirement is one of the most important life events many of us will ever experience. From both a personal and financial perspective, realising a comfortable retirement is an extensive process that takes sensible planning and years of persistence.

Even once it is reached, managing your retirement is an ongoing responsibility that lasts throughout your life.

While all of us would like to retire comfortably, the complexity and time required to build a successful retirement plan can make the whole process seem daunting.

However, retirement planning can often be done with fewer headaches (and financial pain) than you might think – what it takes is some homework, an attainable savings and investment plan, and a long-term commitment.

6) Offshore banking

Offshore banking is suited to high earning professionals with around £250,000 to invest. It is an important step to take when managing wealth.

Arguably, opening an offshore bank account is the most important step for any expatriate to take when managing wealth.

Keeping your money in a country other than the one in which you live means if anything happens, you know your money is being held securely in another location.

Keeping your money outside your old home country too will help you avoid paying taxes unnecessarily.

Another benefit of having an offshore bank account is that if you move countries again, you won’t have to move your money from one country to the next – because that is a major inconvenience.

As an expat, by banking offshore, you can have all your assets arranged in one place.

Expat financial planning requires a lot of time and effort but with the right financial planner it can be the aspect that helps you reach your financial goals faster.

.png?width=600&name=Copy%20of%20Untitled%20(1).png)