“Invest in your mind...

Invest in your health...

Invest in yourself.”

Which one is more important to you?

I found inspiration in this anonymous quote.

Investing is such an interesting concept.

It’s more than just gaining returns.

It’s about changing our lives.

Circumstances.

Making a dream a reality.

Ultimately, whatever our reason, it falls into one of those three categories…

We’re either investing for peace of mind, wellbeing or a personal goal.

Have you thought about that?

1. Investing for peace of mind

Retirement, children’s education or simply growing your wealth.

These are some of the most common reasons to invest.

They are all investing for peace of mind.

Hopeful that, when the time comes, the funds will be available.

Without fear of shortfalls.

Or having to downscale the dream to fit the funds.

Warren Buffet says:

“Do not save what is left after spending, but spend what is left after saving.”

The secret to being a successful investor is consistency.

Changing your view of money is fundamental to this.

It’s not about what you can afford to buy today.

But the power that money holds tomorrow.

It’s a future for your children.

Or a debt-free life.

2. Investing for your wellbeing

Perhaps your job has a fair share of stress.

You want to enjoy an early retirement.

Take a well-deserved holiday.

Or spend a few months at an ashram in Bali.

This is for your wellbeing. Your health.

Investing for more enriching, fulfilling experiences.

That offer a break from the everyday hustle and bustle.

A quote from Aya Layara rings especially true for these types of investments.

He’s a writer, investment advocate and realtor who says:

“When you invest, you are buying a day that you don’t have to work.”

A day when you don’t have to wake up to an alarm clock.

Put on a suit.

Schedule meetings.

Sit in traffic to and from the office.

3. Investing for a personal goal

A dream home with seaside views.

Sports car with a V12 engine.

Your own business.

These are personal goals – totally unique to you.

Investments in yourself.

Which means, they require financial plans that are as individual.

Do you know the book, The Richest Man in Babylon?

It’s a fascinating read that dispenses financial advice through a collection of ancient parables.

A line from it reads:

“A part of all I earn is mine to keep.”

A portion of your earnings and savings should always be for you.

Your dreams.

Rewarding your hard work and consistent dedication.

Reaping the fruits of your labour, so to speak.

So why am I talking about this?

Financial goals differ from person to person.

It may even vary according to location.

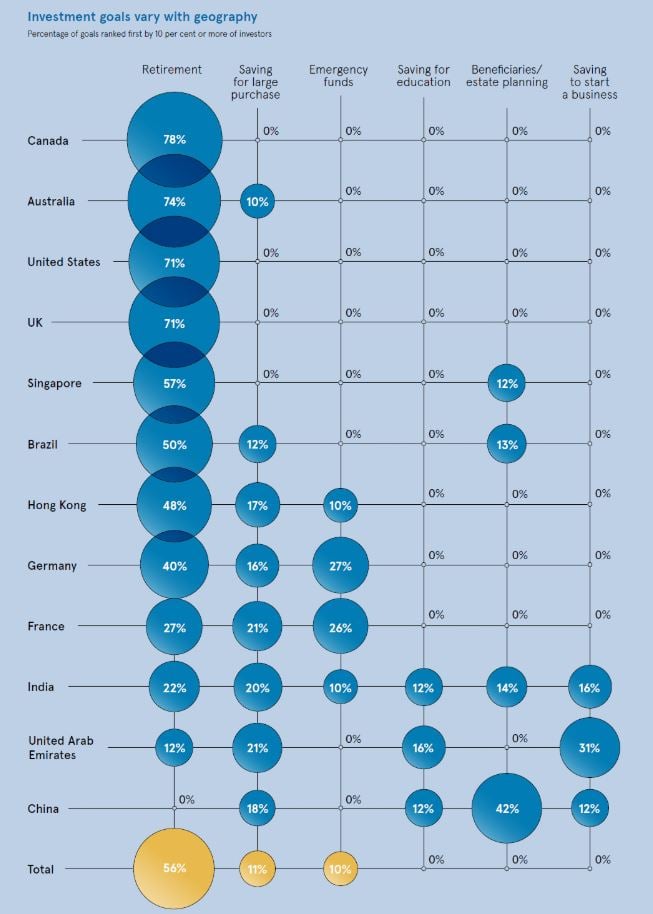

A point that Raconteur makes in their infographic titled ‘What Investors Want’.

Interestingly, Western investors seem to put more of their eggs in the retirement basket.

While Eastern investors gravitate more towards diversification – most notably in India.

Deciding on your goal is the start of any investment journey.

No matter what it is, the most important thing is to start.

Even if it means starting a conversation with us to weigh your options.

Ask for advice.

Get a second opinion.

Book a Discovery Call, at no obligation.

It could be the most valuable 15 minutes you ever have about your financial goals.