Three essential steps for successful retirement planning

It was back in 2001, early in my financial advice career, that I came across my first big retirement casualty. Our new client had lost so much money in the technology bubble that her £100,000 plus income in retirement had been virtually destroyed. She hadn't taken the ONE basic step every investor MUST take. Here's the story of what went wrong, and how not to find your retirement in financial ruins.

When I met the client in question, I had just left my job as a financial programme editor on BBC Radio 5 Live. I had been reporting on a host of financial disasters including the Russian financial crisis of 1998 (are we here again?), the Asian financial crisis and of course, that mother of all bubbles and crashes, the technology bubble that climaxed in March 2000. But they felt like very detached abstract issues compared with the stark practical realities of the lady sitting in front of me who was now facing retirement, having lost 70% of her wealth in a few short months. So, what had gone wrong?

She hadn't diversified her investments.

Put like that it sounds glib, perhaps heartless, but it was that simple.

Talking to my new client that day in the boardroom of our London office, I wanted to know how this lady had come to be in this position. Perhaps it was the journalist in me. We talked for a long time and I scribbled notes that I have referred back to time and again throughout my 15-year career in financial services. Understanding a client's motivations and drivers is critical to being able to really help them over the long term.

This is a version of those notes that I wrote that day, which I hope can help you think again about what investments you are in and why you are in them.

-

Mrs X had been working for her company for seven years and it was now part of the FTSE 350. She didn't feel she could sell her shares because it would send the wrong signal to others in the company, not to mention that she had an emotional attachment to the shares because of the profits and wealth they had given her, at least until the technology bubble burst.

-

She had never sold any of her shares, which meant that the profits would be taxed at 40% under the capital gains tax rules [today UK capital gains tax rates are 18% and 28%]. Her tax bill would be millions of pounds, and she didn't want to 'lose' money in paying tax.

-

Having already made millions of pounds in potential (unrealised) profit, she felt the shares were still a good bet to keep. In other words, she was feeling satisfied with her investments. She was certainly not alone in making this common investment mistake.

What did we do?

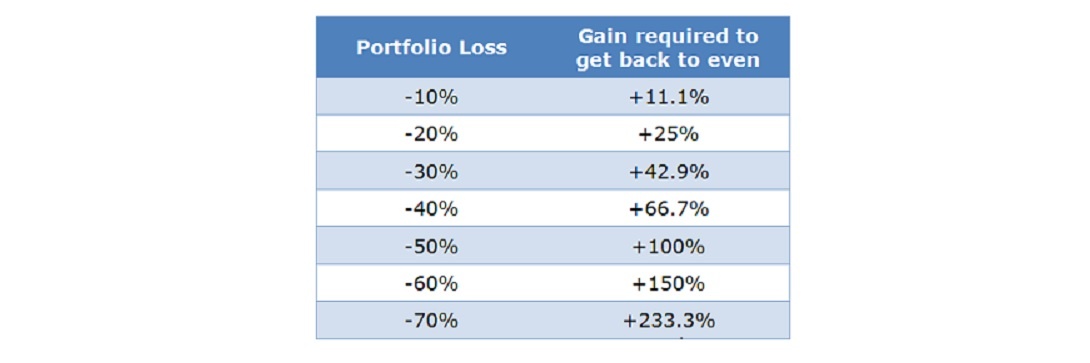

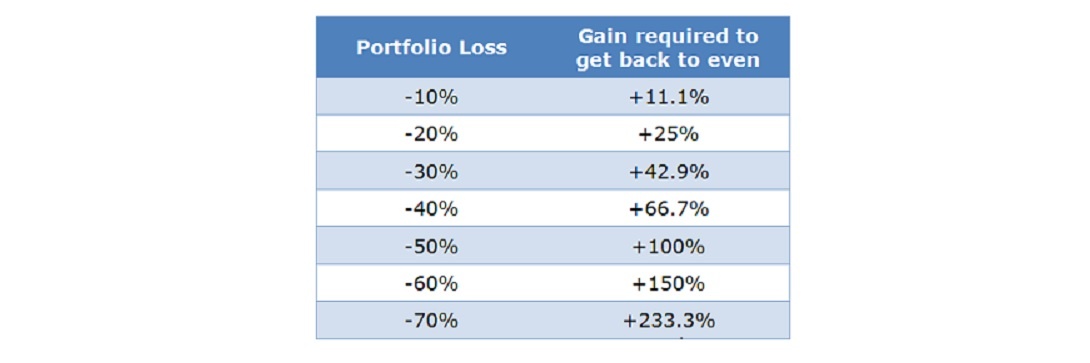

She had three years until retirement to make up the losses, but that was going to be impossible. With a 70% loss in her investment portfolio, she was going to need a 233% investment return to get her investment value back to the pre-stock market crash level. In three years, this was impossible without taking the same risks as she had just unwittingly taken to make millions of pounds of profits in the first place.

And this is worth thinking about. If you have just a few years to retirement or you are saving towards a goal like school fees planning or buying a home, take a look at the table to see what an investment loss could mean for you.

![]()

By the end of the meeting, which was quite emotional, we agreed that she should sell half of the shares she was still holding in her company and move the cash from this sale into a well-balanced and diversified portfolio. In technical jargon, we had agreed to de-risk her portfolio and dramatically reduce the risk of her losing a further massive amount of her retirement capital. We could do this without paying any capital gains tax as well, because the shares were back to a similar level as what she had bought them for five years earlier. In other words, we make the switch for little cost to her.

We agreed to keep the other 50% of the shares and sell down 15% of whatever the share price was every 6 months. This was a disciplined approach to investing, and as her new financial adviser, she gave me permission to hold her to account – to make sure she went through with the plan that we put together on that emotional day in London. You see, part of a financial adviser's job is to work with clients, mentor them, coach them and make sure they are accountable for the lifetime goals they set. And part of the reason why she was sitting there with me was because of a lack of a financial plan, as her last financial adviser never discussed it with her.

The ONE basic step every investor MUST take is to take profits from their investment portfolio in the good times and diversify their holdings. If you would like a X-Ray Review of your investments, please get in touch with us and we'd be happy to help ensure you don't end up like the lady investor whose retirement planning went so very off-course.