The two most important things affluent investors can do for success

There's always a reason to be concerned.

Markets could be lower in two years; they could be higher.

The question, then, becomes: what is your tolerance for discomfort?

What are you going to do if the market goes down 10%?

Or 20%?

There's a great story on Wall Street involving Joseph Kennedy Sr. and a shoeshine boy.

The father of the 35th U.S. President began building his family fortune in the stock market and through commodities trading.

He also did well to secure the distribution rights for Scotch whisky ahead of prohibition — Kennedy Sr., a man of foresight.

As the legend goes, one day in 1929, Joe Kennedy is getting his shoes shined.

The shoeshine boy began to give stock tips as he polished Kennedy's oxfords.

At that moment, it struck Joe that he needed to leave the market.

He reasoned, famously, if shoeshine boys have an opinion on stocks, the market is clearly, dangerously popular.

Supposedly, he pulled out not long before the stock market crash, which led to what we know today as the Great Depression.

Some might argue he made the right decision.

But what if he remained invested?

What would his fortune have looked like today?

Financial siren songs come in many differing forms.

Sometimes shoe-shiners.

Sometimes a taxi driver's stock tip.

Sometimes global events and the media.

Almost daily, high-net-worth investors are reaching out for guidance.

“Should I be worried about the latest market bubble?”

“Is now a good time to buy gold as an inflation hedge?”

No one likes doubt and uncertainty.

These emotions incite us to take action.

To do something.

To change something.

To control something.

But the thing about investing is, it’s almost certainly about uncertainty.

And this is where investors genuinely prove their mettle.

We don’t know what will happen in the markets an hour, day, month or year from now.

I've read quite a few life-changing investment books.

One of them is Rescue Your Money by Ric Edelman.

It’s a great read for anyone wanting to know how to invest in uncertain times.

In it, he mentions how a long-term focus is vital to achieving your investment goals.

“You must maintain a long-term focus for one simple reason: It’s the only way you can be certain you’ll capture the profits that investments offer – and avoid taking the full brunt of occasional downturns.”

When there’s market volatility, do you continue to invest systematically and consistently?

Or are you prone to reacting?

Fidelity did a study in 2020.

It focussed on investors who stayed with the same investment from 2008 through 2017.

Over this time, their investments grew by a 147%.

That's twice the average 74% return for those who fled their investments during the fourth quarter of 2008.

While others were selling in panic in 2008 and 2009, these investors were buying.

They inevitably bought more shares with each dollar.

When those shares rose, so did their investments.

Another reason to stay patient and disciplined is that the stock market’s gain only occurs over very short periods.

During years of market crashes, the market will often recover all or most of its losses during a brief period.

So, if you react to the market’s volatility by constantly buying and selling, you could lose out on the year’s gains or sustain bigger losses.

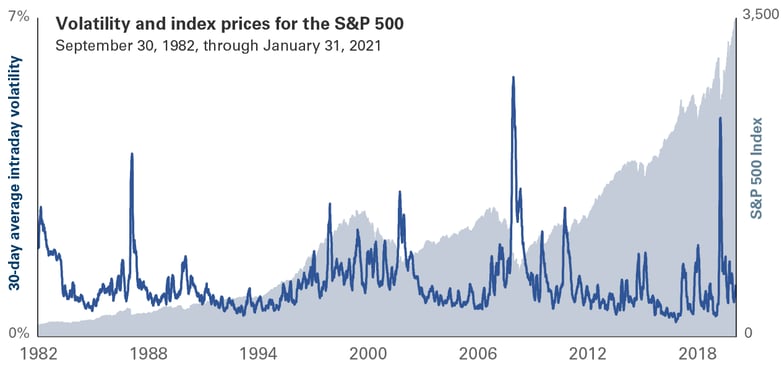

To illustrate this, let’s look at the S&P 500.

In 2007, the year’s entire gains occurred in just 1 week.

In 2014, 93% of gains occurred within 11 weeks.

In 2011, 8% of the year’s loss was recovered in only 24 days.

Between 2011 and 2020, there were 2,517 trading days.

In the past decade alone, the S&P 500 had a total return of 225%.

Now imagine if you stayed invested during this period.

It’s common for the stock market to jump in short bursts and long periods of stagnation to follow.

Can you predict when these short bursts will happen?

No.

Neither can I.

Neither can your financial planner.

The two most important things a high-net-worth investor can do to build on their wealth is:

- Build a globally diversified portfolio

- Do nothing

In 2007, the behaviour of elite goal-keepers was examined.

286 penalty kicks were analysed.

It was discovered that although goalies almost always jump left or right, the optimal strategy to achieve better results is actually to stay in the goal’s centre.

In other words, do nothing at all.

Something that applies to investors too.

Do you understand the benefits of staying disciplined and patient?

There’ll always be uncertainty.

Markets, economies and politics are always changing.

There’s nothing you can do about it.

But one thing is undeniable and that’s the evidence proving a long-term, disciplined and patient investment approach is key to achieving your financial goals.

When the market's volatility and the media’s headlines encourage you to sell, remember the only way to make those losses concrete is to cash out.

Staying invested and riding out the storm is not only the rational thing to do but the right thing to do.

I hope this provided the clarity and confidence you need to control the way you view and react to what’s happening in the markets.

If not, give us a call.